Intro

Discover affordable health insurance plans with comprehensive coverage, low premiums, and flexible options, including individual, family, and group plans, to suit your needs and budget, ensuring quality healthcare at an affordable cost.

The cost of healthcare in the United States is a significant concern for many individuals and families. With the rising costs of medical care, it's essential to have a health insurance plan that provides adequate coverage without breaking the bank. Affordable health insurance plans are designed to make healthcare more accessible and affordable for everyone. In this article, we'll delve into the world of affordable health insurance plans, exploring the benefits, types of plans, and how to find the best option for your needs.

Having a health insurance plan can provide peace of mind, knowing that you're protected against unexpected medical expenses. Without insurance, a single hospital visit or medical procedure can lead to financial ruin. Affordable health insurance plans can help you avoid this situation, providing coverage for routine check-ups, prescription medications, and emergency care. Moreover, many affordable health insurance plans offer additional benefits, such as dental and vision coverage, mental health services, and wellness programs.

The importance of affordable health insurance plans cannot be overstated. With the increasing costs of healthcare, it's crucial to have a plan that fits your budget and provides comprehensive coverage. Affordable health insurance plans can help you stay healthy, avoid financial hardship, and enjoy peace of mind. Whether you're an individual, family, or business owner, there are various affordable health insurance plans available to suit your needs. In the following sections, we'll explore the different types of plans, their benefits, and how to find the best option for your situation.

Affordable Health Insurance Plans: Types and Benefits

There are various types of affordable health insurance plans, each with its unique benefits and features. Some of the most common types of plans include:

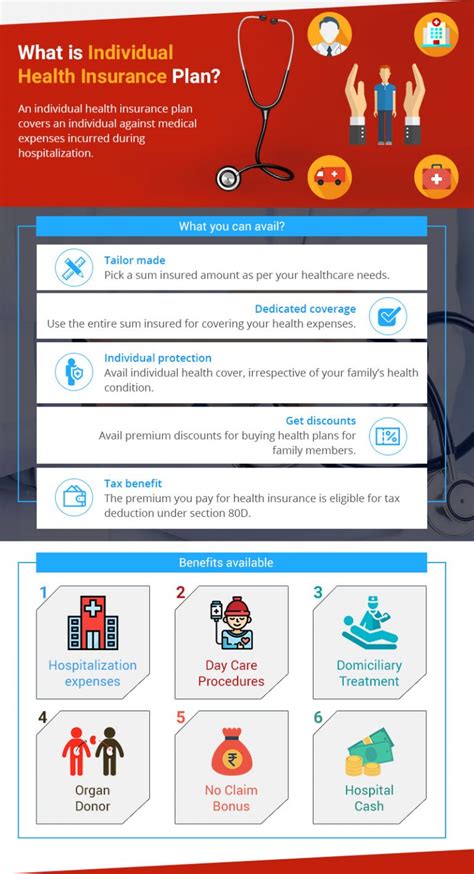

- Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan. They offer a range of benefits, including medical, dental, and vision coverage.

- Group Plans: These plans are designed for businesses and organizations, providing coverage for employees and their families.

- Medicaid and CHIP: These plans are designed for low-income individuals and families, providing comprehensive coverage at little to no cost.

- Short-Term Plans: These plans are designed for temporary coverage, providing benefits for a limited period (usually up to 12 months).

When choosing an affordable health insurance plan, it's essential to consider the benefits and features that matter most to you. Some of the key benefits to look for include:

- Comprehensive coverage: Look for plans that cover a wide range of medical services, including doctor visits, hospital stays, and prescription medications.

- Affordable premiums: Consider plans with lower premiums, but be aware that these plans may have higher deductibles or copays.

- Low out-of-pocket costs: Look for plans with low deductibles, copays, and coinsurance to minimize your out-of-pocket expenses.

- Additional benefits: Consider plans that offer additional benefits, such as dental and vision coverage, mental health services, and wellness programs.

How to Find Affordable Health Insurance Plans

Finding an affordable health insurance plan can be a daunting task, but there are several steps you can take to simplify the process. Here are some tips to help you find the best plan for your needs:

- Research and compare plans: Use online tools and resources to research and compare different plans, considering factors such as premiums, deductibles, and coverage.

- Consider your budget: Determine how much you can afford to pay each month for premiums, deductibles, and copays.

- Evaluate your health needs: Consider your health needs and the needs of your family, choosing a plan that provides comprehensive coverage for your specific needs.

- Check for subsidies: If you're eligible, apply for subsidies or tax credits to lower your premiums.

- Seek professional advice: Consider consulting with a licensed insurance agent or broker to help you navigate the process and find the best plan for your needs.

Affordable Health Insurance Plans: Tips and Tricks

When shopping for an affordable health insurance plan, there are several tips and tricks to keep in mind. Here are some additional considerations to help you find the best plan:- Look for discounts: Many insurance companies offer discounts for things like being a non-smoker, having a healthy weight, or participating in wellness programs.

- Consider a higher deductible: If you're healthy and don't expect to use your insurance often, consider a plan with a higher deductible to lower your premiums.

- Check for network providers: Make sure your plan includes a network of providers that you're comfortable with, including your primary care physician and any specialists you may need to see.

- Read reviews and ratings: Research the insurance company and plan you're considering, reading reviews and ratings from other customers to get a sense of their reputation and level of service.

Affordable Health Insurance Plans: Common Mistakes to Avoid

When shopping for an affordable health insurance plan, there are several common mistakes to avoid. Here are some pitfalls to watch out for:

- Not reading the fine print: Make sure you understand the terms and conditions of your plan, including any exclusions or limitations.

- Not considering your health needs: Choose a plan that provides comprehensive coverage for your specific health needs, rather than just opting for the cheapest plan available.

- Not checking for network providers: Ensure that your plan includes a network of providers that you're comfortable with, including your primary care physician and any specialists you may need to see.

- Not seeking professional advice: Consider consulting with a licensed insurance agent or broker to help you navigate the process and find the best plan for your needs.

Affordable Health Insurance Plans: Frequently Asked Questions

Here are some frequently asked questions about affordable health insurance plans:- What is the difference between a deductible and a copay?: A deductible is the amount you pay out-of-pocket before your insurance kicks in, while a copay is a fixed amount you pay for each medical service or prescription.

- Can I change my plan after I've enrolled?: In most cases, you can only change your plan during the annual open enrollment period or if you experience a qualifying life event, such as getting married or having a baby.

- How do I know if I'm eligible for subsidies or tax credits?: You can apply for subsidies or tax credits through the health insurance marketplace or by consulting with a licensed insurance agent or broker.

Affordable Health Insurance Plans: Next Steps

Now that you've learned more about affordable health insurance plans, it's time to take the next step. Here are some steps you can take to find and enroll in a plan that meets your needs:

- Research and compare plans: Use online tools and resources to research and compare different plans, considering factors such as premiums, deductibles, and coverage.

- Consult with a licensed insurance agent or broker: Consider consulting with a licensed insurance agent or broker to help you navigate the process and find the best plan for your needs.

- Apply for subsidies or tax credits: If you're eligible, apply for subsidies or tax credits to lower your premiums.

- Enroll in a plan: Once you've found a plan that meets your needs, enroll as soon as possible to ensure you have coverage when you need it.

What is the difference between a PPO and an HMO?

+A PPO (Preferred Provider Organization) is a type of plan that allows you to see any healthcare provider, while an HMO (Health Maintenance Organization) requires you to see providers within a specific network.

Can I keep my current doctor if I switch to a new plan?

+It depends on the plan and the network of providers. Check with your new plan to see if your current doctor is included in the network.

How do I know if I'm eligible for Medicaid or CHIP?

+You can apply for Medicaid or CHIP through your state's Medicaid agency or the health insurance marketplace. Eligibility is based on income and family size.

As you continue on your journey to find an affordable health insurance plan, remember to stay informed, ask questions, and seek professional advice when needed. With the right plan, you can enjoy peace of mind, knowing that you're protected against unexpected medical expenses. Share this article with friends and family who may be searching for affordable health insurance plans, and take the first step towards a healthier, more secure future.