Intro

Discover the top 5 California health plans, featuring affordable medical insurance options, including HMO, PPO, and EPO plans, with benefits like preventive care, hospital coverage, and prescription drug coverage, to suit individual and family needs.

California, known for its diverse population and vast geographical expanse, offers a wide range of health insurance plans to cater to the varied needs of its residents. With the Affordable Care Act (ACA) in place, Californians have access to numerous health plans, each with its unique features, benefits, and drawbacks. In this article, we will delve into the top 5 California health plans, exploring their characteristics, advantages, and what sets them apart from the rest.

The importance of selecting the right health plan cannot be overstated. A suitable health plan not only provides financial protection against unforeseen medical expenses but also ensures access to quality healthcare services. With so many options available, it can be daunting to navigate the complex world of health insurance. Therefore, it is crucial to understand the key aspects of each plan, including coverage, network, out-of-pocket costs, and additional benefits.

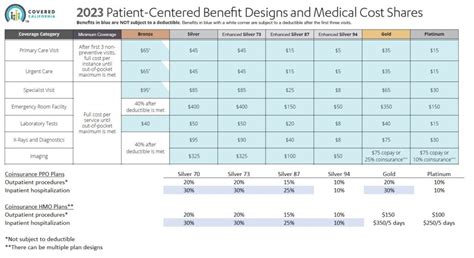

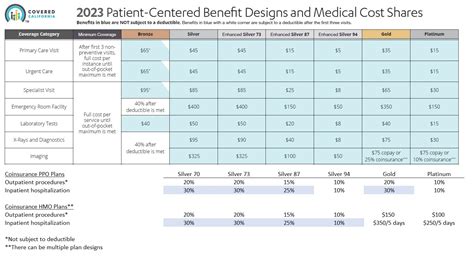

California's health insurance marketplace, Covered California, offers a variety of plans from multiple insurance providers. These plans are categorized into different metal tiers, including Bronze, Silver, Gold, and Platinum, each representing a distinct level of coverage and cost-sharing. Understanding these tiers and the plans within them is essential for making an informed decision.

Introduction to California Health Plans

California health plans are designed to provide comprehensive coverage to residents, including essential health benefits, preventive care, and access to a network of healthcare providers. The top 5 California health plans have been selected based on factors such as network size, plan flexibility, customer satisfaction, and overall value. These plans cater to different needs and preferences, ensuring that Californians can find a plan that suits their lifestyle and budget.

Top 5 California Health Plans

The top 5 California health plans are:

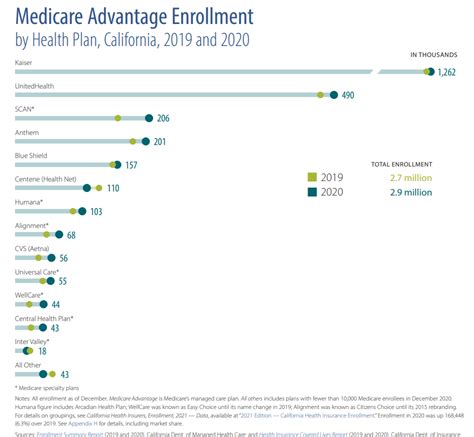

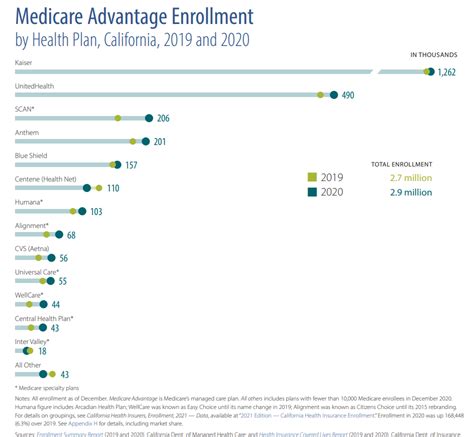

- Kaiser Permanente

- Blue Shield of California

- Anthem Blue Cross

- Health Net

- UnitedHealthcare

Each of these plans has its unique features, advantages, and disadvantages. For instance, Kaiser Permanente is known for its integrated care model, which provides seamless coordination between healthcare providers and services. Blue Shield of California, on the other hand, offers a wide range of plan options, including PPO and HMO plans, to cater to different needs and preferences.

Kaiser Permanente

Kaiser Permanente is one of the most popular health plans in California, known for its high-quality care and integrated services. With a large network of healthcare providers and facilities, Kaiser Permanente offers comprehensive coverage, including medical, dental, and vision care. Its integrated care model ensures that patients receive coordinated care, reducing the risk of medical errors and improving health outcomes.Benefits and Drawbacks of Each Plan

Each of the top 5 California health plans has its benefits and drawbacks. For example:

- Kaiser Permanente: Benefits include integrated care, high-quality services, and comprehensive coverage. Drawbacks include limited network flexibility and higher costs.

- Blue Shield of California: Benefits include a wide range of plan options, large network, and competitive pricing. Drawbacks include varying quality of care and limited coverage in some areas.

- Anthem Blue Cross: Benefits include large network, comprehensive coverage, and flexible plan options. Drawbacks include higher costs and varying quality of care.

- Health Net: Benefits include affordable pricing, comprehensive coverage, and flexible plan options. Drawbacks include limited network and varying quality of care.

- UnitedHealthcare: Benefits include large network, comprehensive coverage, and flexible plan options. Drawbacks include higher costs and varying quality of care.

Plan Comparison

Comparing the top 5 California health plans can be challenging, given the numerous factors to consider. However, some key aspects to compare include: * Network size and quality * Plan flexibility and options * Out-of-pocket costs and deductibles * Additional benefits and services * Customer satisfaction and ratingsNetwork and Provider Options

The network and provider options are crucial aspects to consider when selecting a health plan. A larger network with high-quality providers ensures better access to care and improved health outcomes. The top 5 California health plans have extensive networks, with some plans offering more flexibility than others. For instance, Kaiser Permanente's integrated care model provides seamless coordination between healthcare providers and services, while Blue Shield of California's large network offers more flexibility in choosing healthcare providers.

Out-of-Pocket Costs and Deductibles

Out-of-pocket costs and deductibles are significant factors to consider when selecting a health plan. These costs can add up quickly, especially for those with chronic conditions or frequent medical needs. The top 5 California health plans have varying out-of-pocket costs and deductibles, with some plans offering more affordable options than others. For example, Health Net's affordable pricing and comprehensive coverage make it an attractive option for those on a budget.Additional Benefits and Services

In addition to medical coverage, the top 5 California health plans offer various additional benefits and services, including:

- Dental and vision care

- Mental health and substance abuse services

- Wellness programs and fitness discounts

- Telehealth services and online support

- Chronic disease management and case management

These additional benefits and services can enhance the overall value of a health plan, providing comprehensive care and support to members.

Customer Satisfaction and Ratings

Customer satisfaction and ratings are essential factors to consider when selecting a health plan. The top 5 California health plans have varying customer satisfaction ratings, with some plans receiving higher ratings than others. For instance, Kaiser Permanente is consistently rated high for its customer satisfaction, while Blue Shield of California's ratings vary depending on the plan and location.Conclusion and Next Steps

In conclusion, selecting the right health plan is a crucial decision that requires careful consideration of various factors, including coverage, network, out-of-pocket costs, and additional benefits. The top 5 California health plans offer a range of options to cater to different needs and preferences. By understanding the benefits and drawbacks of each plan, Californians can make informed decisions and choose a plan that suits their lifestyle and budget.

We invite you to share your thoughts and experiences with California health plans in the comments below. If you have any questions or need further guidance, please do not hesitate to reach out. Additionally, you can share this article with others who may be interested in learning more about California health plans.

What are the top 5 California health plans?

+The top 5 California health plans are Kaiser Permanente, Blue Shield of California, Anthem Blue Cross, Health Net, and UnitedHealthcare.

How do I choose the right health plan for my needs?

+To choose the right health plan, consider factors such as coverage, network, out-of-pocket costs, and additional benefits. It is also essential to research and compare different plans to find the one that suits your lifestyle and budget.

What is the difference between HMO and PPO plans?

+HMO (Health Maintenance Organization) plans require members to receive care from a specific network of providers, while PPO (Preferred Provider Organization) plans offer more flexibility in choosing healthcare providers. HMO plans often have lower costs, while PPO plans may have higher costs but offer greater flexibility.

Can I change my health plan during the year?

+Typically, you can only change your health plan during the annual open enrollment period or if you experience a qualifying life event, such as losing your job or getting married. It is essential to review your plan and make any necessary changes during this time to ensure you have the right coverage for your needs.

How do I enroll in a California health plan?

+To enroll in a California health plan, you can visit the Covered California website or contact a licensed insurance agent. You can also enroll through the insurance provider's website or by phone. Be sure to review the plan details and ask any questions you may have before enrolling.