Intro

Discover the top 5 NYC health plans, including affordable options, Medicare, and family plans, to find the best medical coverage in New York City, with benefits and providers.

New York City is known for its diverse population and high cost of living, which can make finding affordable healthcare a challenge. However, there are several health plans available in NYC that cater to different needs and budgets. In this article, we will explore the top 5 NYC health plans, their benefits, and what makes them stand out from the rest.

The importance of having a good health plan cannot be overstated. With the rising costs of medical care, having a comprehensive health plan can help protect you from financial ruin in case of an unexpected illness or injury. Moreover, a good health plan can provide you with access to quality care, preventive services, and specialist treatments. Whether you are an individual, family, or business owner, having a reliable health plan is essential for maintaining your physical and financial well-being.

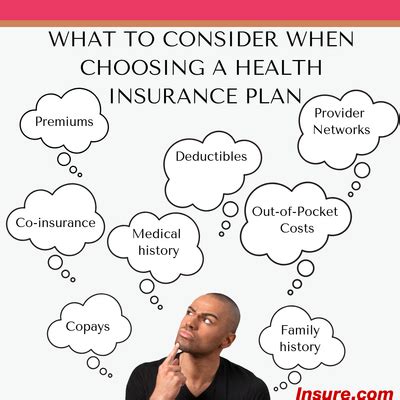

When it comes to choosing a health plan in NYC, there are several factors to consider. These include the network of providers, coverage options, deductibles, copays, and premiums. With so many health plans available, it can be overwhelming to navigate the options and choose the best one for your needs. In this article, we will provide an in-depth analysis of the top 5 NYC health plans, highlighting their features, benefits, and drawbacks.

Overview of NYC Health Plans

Types of Health Plans

There are several types of health plans available in NYC, including: * HMO (Health Maintenance Organization) plans * PPO (Preferred Provider Organization) plans * EPO (Exclusive Provider Organization) plans * POS (Point of Service) plans * Catastrophic plansEach type of plan has its own unique features, benefits, and drawbacks. For example, HMO plans typically require you to receive care from a network of providers, while PPO plans offer more flexibility in choosing your healthcare providers.

Top 5 NYC Health Plans

Benefits and Drawbacks

Each of the top 5 NYC health plans has its own unique benefits and drawbacks. For example: * Empire BlueCross BlueShield offers a large network of providers, but may have higher premiums than some other plans. * UnitedHealthcare offers a range of wellness programs, but may have more restrictive network requirements. * Oxford Health Plans offers affordable premiums, but may have higher deductibles and copays. * Aetna offers innovative care management programs, but may have a smaller network of providers. * Cigna offers international coverage, but may have more complex plan options and higher premiums.Choosing the Right Health Plan

It's also important to consider your individual needs and preferences, such as:

- Do you have a preferred provider or hospital?

- Do you need coverage for specific medical conditions or treatments?

- Do you prioritize preventive care and wellness services?

- Do you need international coverage or travel insurance?

Comparison of Health Plans

Here is a comparison of the top 5 NYC health plans: | Health Plan | Network Size | Coverage Options | Premium Costs | | --- | --- | --- | --- | | Empire BlueCross BlueShield | 100,000+ | HMO, PPO, EPO | $500-$1,500/month | | UnitedHealthcare | 90,000+ | HMO, PPO, POS | $400-$1,200/month | | Oxford Health Plans | 70,000+ | HMO, PPO, EPO | $300-$1,000/month | | Aetna | 60,000+ | HMO, PPO, POS | $400-$1,200/month | | Cigna | 50,000+ | HMO, PPO, EPO | $500-$1,500/month |Conclusion and Next Steps

If you're looking for more information or want to compare health plans in more detail, we encourage you to visit the websites of the top 5 NYC health plans or consult with a licensed health insurance broker. Additionally, you can contact the health plans directly to ask questions or request quotes.

We hope this article has provided you with a comprehensive overview of the top 5 NYC health plans and helped you make a more informed decision about your healthcare coverage. Remember to always prioritize your health and well-being, and don't hesitate to reach out if you have any further questions or concerns.

What is the difference between an HMO and PPO health plan?

+An HMO plan requires you to receive care from a network of providers, while a PPO plan offers more flexibility in choosing your healthcare providers.

How do I choose the right health plan for my needs?

+Consider factors such as network size, coverage options, premium costs, and additional benefits and services. You should also think about your individual needs and preferences, such as your preferred provider or hospital.

Can I switch health plans if I'm not satisfied with my current coverage?

+Yes, you can switch health plans during the annual open enrollment period or if you experience a qualifying life event, such as a change in employment or marriage.

How do I know if a health plan is right for me?

+Consider your individual needs and preferences, such as your health status, budget, and lifestyle. You should also research the health plan's network, coverage options, and customer reviews to ensure it meets your needs.

What is the average cost of a health plan in NYC?

+The average cost of a health plan in NYC can vary depending on factors such as age, health status, and plan type. However, according to recent data, the average monthly premium for an individual health plan in NYC is around $500-$1,000.