Intro

Discover top-rated health plans, including Medicare, Medicaid, and private insurance options, to find the best coverage for your needs, with benefits like preventive care, prescriptions, and more.

The world of health insurance can be overwhelming, with numerous options available to individuals and families. Choosing the right health plan is crucial, as it can significantly impact one's financial and physical well-being. In this article, we will delve into the top 5 health plans, exploring their benefits, drawbacks, and key features. Whether you're a young adult, a family, or an individual with pre-existing conditions, this article aims to provide you with the necessary information to make an informed decision.

With the rising costs of healthcare, having a comprehensive health plan is more important than ever. A good health plan can provide financial protection, access to quality care, and peace of mind. However, with so many options available, it can be challenging to navigate the complex world of health insurance. In this article, we will break down the top 5 health plans, discussing their pros and cons, and helping you determine which plan is best suited for your needs.

The importance of choosing the right health plan cannot be overstated. A good health plan can help you avoid financial ruin in the event of a medical emergency, while a bad plan can leave you with significant out-of-pocket expenses. Furthermore, a comprehensive health plan can provide access to preventive care, specialist services, and life-saving treatments. As we explore the top 5 health plans, we will examine the key features, benefits, and drawbacks of each plan, helping you make an informed decision about your health insurance needs.

Introduction to Health Plans

Health plans are designed to provide financial protection and access to quality care. There are various types of health plans available, including individual, family, and group plans. Each plan has its unique features, benefits, and drawbacks, making it essential to carefully evaluate your options before making a decision. In this section, we will provide an overview of the different types of health plans, discussing their key features and benefits.

Types of Health Plans

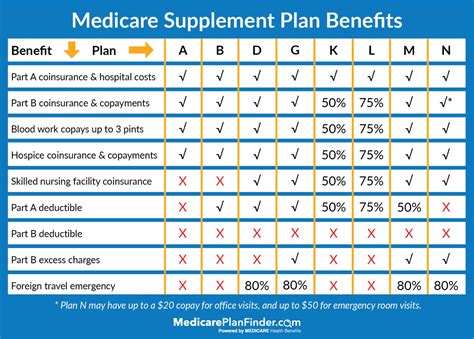

There are several types of health plans available, including: * Individual plans: Designed for single individuals, these plans provide coverage for one person. * Family plans: Designed for families, these plans provide coverage for multiple individuals. * Group plans: Designed for employers, these plans provide coverage for employees and their dependents. * Medicare plans: Designed for seniors and individuals with disabilities, these plans provide coverage for medical expenses. * Medicaid plans: Designed for low-income individuals and families, these plans provide coverage for medical expenses.Top 5 Health Plans

In this section, we will examine the top 5 health plans, discussing their benefits, drawbacks, and key features. We will explore the following plans:

- UnitedHealthcare

- Kaiser Permanente

- Blue Cross Blue Shield

- Aetna

- Cigna

UnitedHealthcare

UnitedHealthcare is one of the largest health insurance providers in the United States. They offer a wide range of plans, including individual, family, and group plans. UnitedHealthcare plans are known for their comprehensive coverage, including preventive care, specialist services, and hospital stays.UnitedHealthcare Benefits and Drawbacks

The benefits of UnitedHealthcare plans include:

- Comprehensive coverage

- Access to a large network of providers

- Competitive pricing The drawbacks of UnitedHealthcare plans include:

- High deductibles

- Limited coverage for certain services

- Complex plan options

Kaiser Permanente

Kaiser Permanente is a non-profit health insurance provider that offers a range of plans, including individual, family, and group plans. Kaiser Permanente plans are known for their emphasis on preventive care and their integrated healthcare system.Kaiser Permanente Benefits and Drawbacks

The benefits of Kaiser Permanente plans include:

- Emphasis on preventive care

- Integrated healthcare system

- Competitive pricing The drawbacks of Kaiser Permanente plans include:

- Limited network of providers

- High out-of-pocket expenses

- Complex plan options

Blue Cross Blue Shield

Blue Cross Blue Shield is a national health insurance provider that offers a range of plans, including individual, family, and group plans. Blue Cross Blue Shield plans are known for their comprehensive coverage and their large network of providers.Blue Cross Blue Shield Benefits and Drawbacks

The benefits of Blue Cross Blue Shield plans include:

- Comprehensive coverage

- Large network of providers

- Competitive pricing The drawbacks of Blue Cross Blue Shield plans include:

- High deductibles

- Limited coverage for certain services

- Complex plan options

Aetna

Aetna is a national health insurance provider that offers a range of plans, including individual, family, and group plans. Aetna plans are known for their comprehensive coverage and their emphasis on wellness programs.Aetna Benefits and Drawbacks

The benefits of Aetna plans include:

- Comprehensive coverage

- Emphasis on wellness programs

- Competitive pricing The drawbacks of Aetna plans include:

- High out-of-pocket expenses

- Limited coverage for certain services

- Complex plan options

Cigna

Cigna is a national health insurance provider that offers a range of plans, including individual, family, and group plans. Cigna plans are known for their comprehensive coverage and their global network of providers.Cigna Benefits and Drawbacks

The benefits of Cigna plans include:

- Comprehensive coverage

- Global network of providers

- Competitive pricing The drawbacks of Cigna plans include:

- High deductibles

- Limited coverage for certain services

- Complex plan options

Conclusion and Final Thoughts

In conclusion, choosing the right health plan is a critical decision that can have a significant impact on one's financial and physical well-being. The top 5 health plans discussed in this article offer a range of benefits and drawbacks, making it essential to carefully evaluate your options before making a decision. By considering your individual needs, budget, and preferences, you can select a health plan that provides comprehensive coverage, access to quality care, and financial protection.

We invite you to share your thoughts and experiences with health plans in the comments section below. Have you had a positive or negative experience with a health plan? What factors do you consider when selecting a health plan? Your input can help others make informed decisions about their health insurance needs.

What is the difference between a deductible and a copayment?

+A deductible is the amount you pay out-of-pocket before your health plan begins to cover expenses, while a copayment is a fixed amount you pay for a specific service or treatment.

Can I change my health plan at any time?

+Typically, you can only change your health plan during the annual open enrollment period or if you experience a qualifying life event, such as a change in employment or marriage.

What is the difference between an HMO and a PPO?

+An HMO (Health Maintenance Organization) requires you to receive care from a specific network of providers, while a PPO (Preferred Provider Organization) allows you to see any healthcare provider, although you may pay more for out-of-network care.