Intro

Pay bills online easily with secure payment methods, avoiding late fees and paperwork. Manage utility, credit card, and loan payments effortlessly with online bill pay services, saving time and reducing stress.

Paying bills online has become an essential part of our daily lives, offering a convenient and efficient way to manage our financial obligations. With the advancement of technology, online bill payment has evolved to provide a secure, fast, and reliable means of settling our debts. In today's digital age, it's easier than ever to pay bills online, and this trend is expected to continue as more people adopt digital payment methods. The benefits of paying bills online are numerous, and it's essential to understand how this process works and how it can simplify our lives.

Paying bills online eliminates the need to physically visit a payment center or mail a check, saving time and reducing the risk of late payments. Moreover, online bill payment provides a clear record of transactions, making it easier to track our expenses and stay on top of our finances. With the rise of online banking and digital payment platforms, paying bills online has become a seamless and intuitive process. Whether it's paying utility bills, credit card bills, or loan payments, online bill payment has made it possible to manage our financial obligations with ease.

The importance of paying bills online cannot be overstated, as it offers a convenient and efficient way to manage our finances. By paying bills online, we can avoid late payment fees, reduce the risk of identity theft, and improve our credit score. Additionally, online bill payment provides a secure and reliable means of settling our debts, giving us peace of mind and allowing us to focus on other aspects of our lives. As technology continues to advance, it's likely that paying bills online will become even more streamlined and accessible, making it an essential tool for managing our financial obligations.

Benefits of Paying Bills Online

Some of the key benefits of paying bills online include:

- Convenience: Paying bills online allows us to pay our bills from anywhere, at any time, as long as we have an internet connection.

- Speed: Online bill payment is faster than traditional payment methods, as it eliminates the need to physically visit a payment center or mail a check.

- Security: Online bill payment provides a secure means of settling our debts, reducing the risk of identity theft and late payment fees.

- Record-keeping: Online bill payment provides a clear record of transactions, making it easier to track our expenses and stay on top of our finances.

How to Pay Bills Online

Some of the key steps involved in paying bills online include:

- Gather bill and payment information: We need to gather our bill and payment information, including our account number and payment amount.

- Visit the website of our biller or payment platform: We need to visit the website of our biller or payment platform and log in to our account.

- Enter payment information: Once we're logged in, we can enter our payment information and confirm our payment.

- Confirm payment: Finally, we should receive a confirmation of our payment, which we can use for our records.

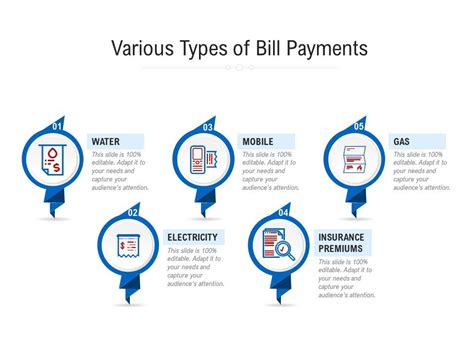

Types of Online Bill Payment

Some of the key types of online bill payment include:

- Online banking: Online banking allows us to pay our bills directly from our bank account.

- Digital payment platforms: Digital payment platforms provide a secure and reliable means of settling our debts.

- Mobile payment apps: Mobile payment apps allow us to pay our bills on-the-go, using our mobile device.

Security Measures for Online Bill Payment

Some of the key security measures for online bill payment include:

- Use a secure internet connection: We should always use a secure internet connection to pay our bills online.

- Avoid using public computers or public Wi-Fi: We should avoid using public computers or public Wi-Fi to pay our bills online.

- Keep antivirus software up-to-date: We should keep our antivirus software up-to-date to protect our personal and financial information.

- Never share login credentials or payment information: We should never share our login credentials or payment information with anyone.

Common Mistakes to Avoid When Paying Bills Online

Some of the key common mistakes to avoid when paying bills online include:

- Not double-checking payment information: We should always double-check our payment information, including our account number and payment amount, to ensure that our payment is processed correctly.

- Paying bills using a public computer or public Wi-Fi: We should never pay our bills using a public computer or public Wi-Fi, as this can put our personal and financial information at risk.

- Not monitoring account activity: We should always monitor our account activity for any suspicious transactions, to ensure that our personal and financial information is secure.

Best Practices for Paying Bills Online

Some of the key best practices for paying bills online include:

- Use a secure internet connection: We should always use a secure internet connection to pay our bills online.

- Keep antivirus software up-to-date: We should keep our antivirus software up-to-date to protect our personal and financial information.

- Never share login credentials or payment information: We should never share our login credentials or payment information with anyone.

- Monitor account activity: We should always monitor our account activity for any suspicious transactions, to ensure that our personal and financial information is secure.

Future of Paying Bills Online

Some of the key trends that are expected to shape the future of paying bills online include:

- Increased use of mobile payment apps: Mobile payment apps are expected to become more popular, providing a secure and convenient means of settling our debts.

- Rise of digital wallets: Digital wallets are expected to become more widely used, providing a secure and convenient means of storing our payment information.

- Improved security measures: Online bill payment is expected to become even more secure, with the use of advanced security measures such as biometric authentication and encryption.

Conclusion and Final Thoughts

We invite you to share your thoughts and experiences with paying bills online. Have you ever paid a bill online? What was your experience like? Do you have any tips or best practices to share with others? Please comment below and let's start a conversation.

What are the benefits of paying bills online?

+Paying bills online provides several benefits, including convenience, speed, and security. It eliminates the need to physically visit a payment center or mail a check, saving time and reducing the risk of late payments. Additionally, online bill payment provides a clear record of transactions, making it easier to track our expenses and stay on top of our finances.

How do I pay my bills online?

+To pay your bills online, you need to gather your bill and payment information, including your account number and payment amount. Next, visit the website of your biller or payment platform and log in to your account. Once you're logged in, enter your payment information and confirm your payment. Finally, you should receive a confirmation of your payment, which you can use for your records.

Is paying bills online secure?

+Yes, paying bills online is secure. Online bill payment provides a secure means of settling our debts, reducing the risk of identity theft and late payment fees. However, it's still important to take certain security measures to protect our personal and financial information, such as using a secure internet connection, keeping antivirus software up-to-date, and never sharing login credentials or payment information with anyone.

What are the common mistakes to avoid when paying bills online?

+Some common mistakes to avoid when paying bills online include not double-checking payment information, paying bills using a public computer or public Wi-Fi, and not monitoring account activity. To avoid these mistakes, always double-check your payment information, use a secure internet connection, and monitor your account activity for any suspicious transactions.

What are the best practices for paying bills online?

+Some best practices for paying bills online include using a secure internet connection, keeping antivirus software up-to-date, never sharing login credentials or payment information with anyone, and monitoring account activity for any suspicious transactions. By following these best practices, you can get the most out of paying bills online and simplify your life.