Intro

Compare and buy health insurance plans online, securing medical coverage with affordable premiums, flexible deductibles, and comprehensive benefits, protecting against unexpected expenses and ensuring financial stability.

Purchasing health insurance is one of the most crucial decisions you can make to ensure your financial security and well-being. With the rising costs of medical care, having a comprehensive health insurance plan can help protect you and your loved ones from unexpected medical expenses. In this article, we will delve into the world of health insurance, exploring its importance, types, benefits, and how to choose the right plan for your needs.

The importance of health insurance cannot be overstated. Medical emergencies can arise at any time, and without adequate coverage, you may find yourself facing significant financial burdens. Health insurance provides a safety net, allowing you to receive necessary medical care without breaking the bank. Moreover, many health insurance plans offer preventive care services, such as routine check-ups and screenings, which can help detect health issues early on, reducing the risk of costly treatments down the line.

As the healthcare landscape continues to evolve, it's essential to stay informed about the various types of health insurance plans available. From individual and family plans to group and employer-sponsored plans, each type of coverage has its unique features, benefits, and drawbacks. Understanding these differences is vital to making an informed decision when selecting a health insurance plan. In the following sections, we will explore the different types of health insurance plans, their benefits, and how to navigate the complex world of health insurance.

Understanding Health Insurance Plans

When it comes to health insurance plans, there are several types to choose from, each with its own set of benefits and drawbacks. Here are some of the most common types of health insurance plans:

- Individual and family plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan.

- Group plans: These plans are offered by employers to their employees and are often more affordable than individual plans.

- Employer-sponsored plans: These plans are offered by employers to their employees and may include additional benefits, such as dental and vision coverage.

- Medicare and Medicaid: These plans are government-sponsored and provide coverage to eligible individuals, such as seniors and low-income families.

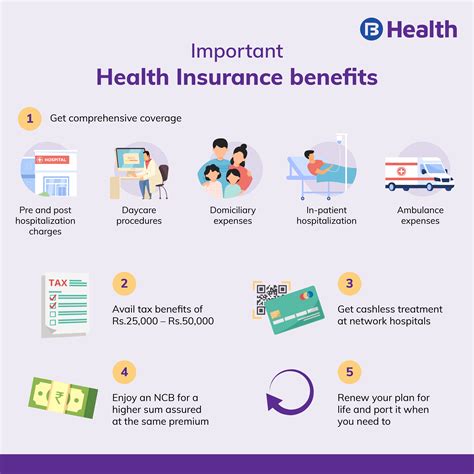

Benefits of Health Insurance Plans

Health insurance plans offer a wide range of benefits, including:

- Financial protection: Health insurance plans provide financial protection against unexpected medical expenses.

- Access to quality care: Health insurance plans provide access to quality medical care, including preventive care services.

- Peace of mind: Health insurance plans provide peace of mind, knowing that you and your loved ones are protected in case of a medical emergency.

- Tax benefits: Health insurance plans may offer tax benefits, such as deductions for premiums paid.

How to Choose the Right Health Insurance Plan

Choosing the right health insurance plan can be a daunting task, but there are several factors to consider when making your decision. Here are some tips to help you choose the right plan:

- Assess your needs: Consider your medical needs, including any pre-existing conditions or ongoing treatments.

- Research plans: Research different health insurance plans, including their benefits, drawbacks, and costs.

- Compare costs: Compare the costs of different plans, including premiums, deductibles, and copays.

- Check the network: Check the network of providers for each plan, including doctors, hospitals, and specialists.

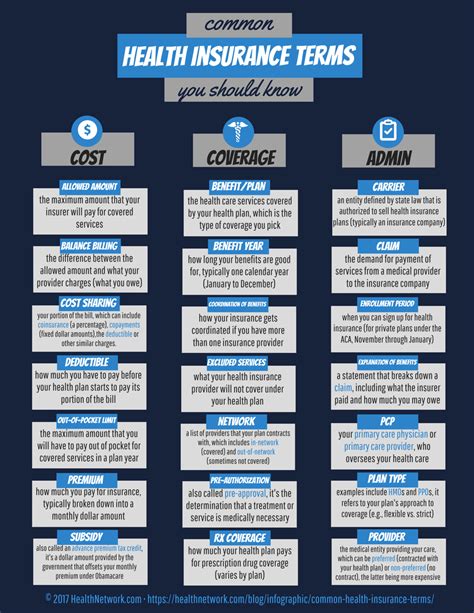

Common Health Insurance Terms

Understanding common health insurance terms is essential to navigating the complex world of health insurance. Here are some common terms to know:

- Premium: The monthly or annual payment for a health insurance plan.

- Deductible: The amount you must pay out-of-pocket before your insurance plan kicks in.

- Copay: The amount you pay for a specific medical service or treatment.

- Coinsurance: The percentage of medical costs you pay after meeting your deductible.

Health Insurance and Preventive Care

Preventive care is an essential aspect of health insurance, as it helps detect health issues early on, reducing the risk of costly treatments down the line. Here are some preventive care services that may be covered by your health insurance plan:

- Routine check-ups: Regular check-ups with your primary care physician to monitor your health and detect any potential issues.

- Screenings: Screenings for diseases, such as cancer, diabetes, and heart disease.

- Vaccinations: Vaccinations against diseases, such as flu, HPV, and pneumonia.

Health Insurance and Chronic Conditions

Chronic conditions, such as diabetes, heart disease, and asthma, require ongoing treatment and management. Health insurance plans can help cover the costs of treatment, including:

- Medications: Prescription medications to manage chronic conditions.

- Doctor visits: Regular check-ups with your primary care physician or specialist to monitor your condition.

- Hospitalizations: Hospitalizations for complications or exacerbations of chronic conditions.

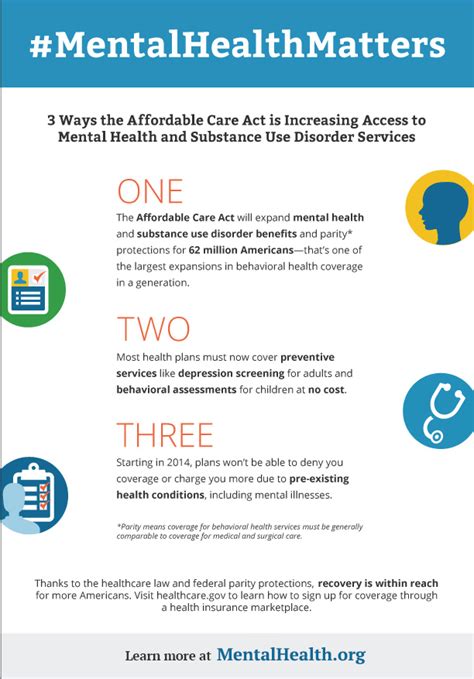

Health Insurance and Mental Health

Mental health is an essential aspect of overall health, and health insurance plans can help cover the costs of mental health treatment, including:

- Therapy: Individual or group therapy sessions with a licensed therapist.

- Medications: Prescription medications to manage mental health conditions, such as depression or anxiety.

- Hospitalizations: Hospitalizations for mental health conditions, such as suicidal ideation or psychosis.

Health Insurance and Substance Abuse

Substance abuse is a serious health issue that requires comprehensive treatment and support. Health insurance plans can help cover the costs of treatment, including:

- Detoxification: Medically supervised detoxification to manage withdrawal symptoms.

- Rehabilitation: Inpatient or outpatient rehabilitation programs to address underlying issues and develop coping skills.

- Counseling: Individual or group counseling sessions to address underlying issues and develop relapse prevention strategies.

Health Insurance and Disability

Disability can have a significant impact on daily life, and health insurance plans can help provide financial protection and support. Here are some ways health insurance plans can help:

- Income replacement: Disability insurance can provide income replacement to help cover living expenses.

- Medical expenses: Health insurance plans can help cover medical expenses related to disability, including doctor visits, hospitalizations, and rehabilitation.

- Support services: Health insurance plans may offer support services, such as home health care or respite care, to help individuals with disabilities.

Health Insurance and Long-Term Care

Long-term care is an essential aspect of health insurance, as it helps provide support and care for individuals who require ongoing assistance with daily activities. Here are some ways health insurance plans can help:

- Home health care: Health insurance plans may offer home health care services, including nursing care, therapy, and assistance with daily activities.

- Adult day care: Health insurance plans may offer adult day care services, including social activities, meals, and transportation.

- Assisted living: Health insurance plans may offer assisted living services, including housing, meals, and assistance with daily activities.

What is the difference between a health insurance plan and a health savings account?

+A health insurance plan provides financial protection against medical expenses, while a health savings account is a tax-advantaged savings account that can be used to pay for medical expenses.

Can I purchase a health insurance plan if I have a pre-existing condition?

+Yes, the Affordable Care Act prohibits health insurance companies from denying coverage based on pre-existing conditions.

How do I choose the right health insurance plan for my needs?

+Consider your medical needs, research different plans, compare costs, and check the network of providers to choose the right plan for your needs.

In conclusion, buying health insurance is a vital decision that requires careful consideration and research. By understanding the different types of health insurance plans, their benefits, and how to choose the right plan, you can make an informed decision and protect yourself and your loved ones from unexpected medical expenses. We encourage you to share your thoughts and experiences with health insurance in the comments below and to share this article with others who may benefit from this information. Take the first step towards securing your health and well-being today by exploring your health insurance options and finding the right plan for your needs.