Intro

Discover affordable Cheap Medical Insurance Options, including low-cost health plans, affordable healthcare coverage, and budget-friendly medical insurance quotes, to save on premiums and get quality care.

The cost of healthcare in many countries has skyrocketed, making it challenging for individuals and families to afford medical insurance. However, having health insurance is crucial to protect against unexpected medical expenses that can lead to financial ruin. Fortunately, there are cheap medical insurance options available that can provide adequate coverage without breaking the bank. In this article, we will explore the importance of medical insurance, the different types of affordable health insurance plans, and tips on how to find the best cheap medical insurance options.

Medical insurance is essential to ensure that individuals and families can access quality healthcare services without incurring significant expenses. Without health insurance, a single hospital visit or medical procedure can lead to financial devastation. Moreover, medical insurance provides peace of mind, knowing that you are protected against unexpected medical expenses. With the rising cost of healthcare, it is more important than ever to have affordable health insurance. Cheap medical insurance options can provide the necessary protection without straining your finances.

The increasing cost of healthcare has led to a growing demand for affordable health insurance plans. Insurance companies have responded by offering a range of cheap medical insurance options that cater to different needs and budgets. From catastrophic health plans to short-term health insurance, there are various affordable health insurance options available. These plans may have lower premiums, but they often come with higher deductibles, copays, and coinsurance. Nevertheless, they can provide essential protection against unexpected medical expenses, making them an attractive option for individuals and families on a tight budget.

Cheap Medical Insurance Options

There are several cheap medical insurance options available, including catastrophic health plans, short-term health insurance, and Medicaid. Catastrophic health plans are designed for young adults and those who cannot afford other types of health insurance. These plans have lower premiums, but they often come with higher deductibles and limited coverage. Short-term health insurance, on the other hand, provides temporary coverage for a specified period, usually up to 12 months. Medicaid is a government-sponsored health insurance program that provides coverage to low-income individuals and families.

Types of Affordable Health Insurance Plans

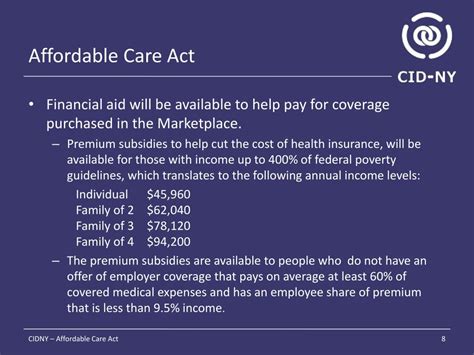

Some of the most popular cheap medical insurance options include: * Catastrophic health plans: These plans are designed for young adults and those who cannot afford other types of health insurance. * Short-term health insurance: This type of insurance provides temporary coverage for a specified period, usually up to 12 months. * Medicaid: This is a government-sponsored health insurance program that provides coverage to low-income individuals and families. * Affordable Care Act (ACA) plans: These plans are also known as Obamacare plans and offer subsidized health insurance to individuals and families who meet certain income requirements. * Employer-sponsored health insurance: Many employers offer health insurance as a benefit to their employees, which can be an affordable option for those who are eligible.Affordable Care Act (ACA) Plans

ACA plans, also known as Obamacare plans, offer subsidized health insurance to individuals and families who meet certain income requirements. These plans are designed to provide affordable health insurance to those who cannot afford other types of health insurance. ACA plans are available through the health insurance marketplace and offer a range of benefits, including free preventive care, mental health services, and prescription drug coverage. To be eligible for an ACA plan, individuals and families must meet certain income requirements, which vary depending on the state and family size.

Benefits of ACA Plans

Some of the benefits of ACA plans include: * Free preventive care: ACA plans cover a range of preventive services, including annual physicals, vaccinations, and cancer screenings. * Mental health services: ACA plans cover mental health services, including counseling and therapy. * Prescription drug coverage: ACA plans cover prescription medications, including generic and brand-name drugs. * No pre-existing condition exclusions: ACA plans cannot deny coverage based on pre-existing medical conditions. * Tax credits: Eligible individuals and families may qualify for tax credits to help lower their premiums.Short-Term Health Insurance

Short-term health insurance provides temporary coverage for a specified period, usually up to 12 months. These plans are designed for individuals and families who are between jobs, waiting for employer-sponsored health insurance to kick in, or need temporary coverage. Short-term health insurance plans are often less expensive than major medical plans, but they may not provide the same level of coverage. Short-term plans may not cover pre-existing medical conditions, and they often come with higher deductibles and copays.

Pros and Cons of Short-Term Health Insurance

Some of the pros and cons of short-term health insurance include: * Pros: + Lower premiums: Short-term health insurance plans are often less expensive than major medical plans. + Temporary coverage: Short-term plans provide temporary coverage for a specified period. + Quick enrollment: Short-term plans often have a quick enrollment process, and coverage can start as soon as the next day. * Cons: + Limited coverage: Short-term plans may not provide the same level of coverage as major medical plans. + Pre-existing condition exclusions: Short-term plans may not cover pre-existing medical conditions. + Higher deductibles and copays: Short-term plans often come with higher deductibles and copays.Catastrophic Health Plans

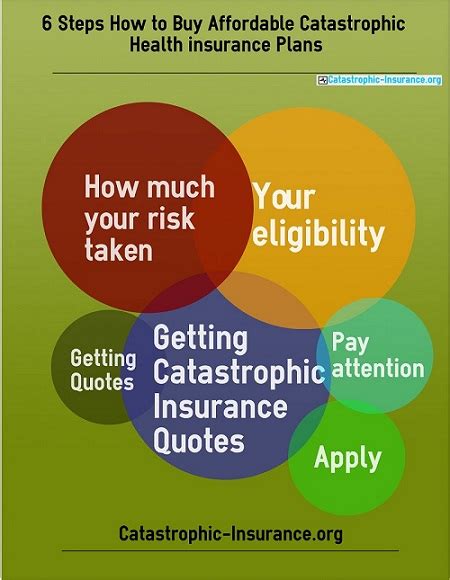

Catastrophic health plans are designed for young adults and those who cannot afford other types of health insurance. These plans have lower premiums, but they often come with higher deductibles and limited coverage. Catastrophic health plans are designed to provide protection against catastrophic medical expenses, such as hospitalizations and surgeries. To be eligible for a catastrophic health plan, individuals must be under the age of 30 or qualify for a hardship exemption.

Benefits of Catastrophic Health Plans

Some of the benefits of catastrophic health plans include: * Lower premiums: Catastrophic health plans have lower premiums than major medical plans. * Protection against catastrophic medical expenses: Catastrophic health plans provide protection against catastrophic medical expenses, such as hospitalizations and surgeries. * Limited coverage: Catastrophic health plans may not provide the same level of coverage as major medical plans, but they can provide essential protection against unexpected medical expenses.Medicaid

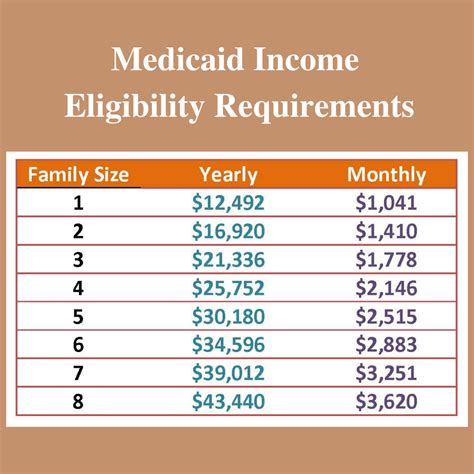

Medicaid is a government-sponsored health insurance program that provides coverage to low-income individuals and families. Medicaid is jointly funded by the federal and state governments and is administered by the states. To be eligible for Medicaid, individuals and families must meet certain income requirements, which vary depending on the state and family size. Medicaid provides comprehensive coverage, including doctor visits, hospitalizations, and prescription medications.

Benefits of Medicaid

Some of the benefits of Medicaid include: * Comprehensive coverage: Medicaid provides comprehensive coverage, including doctor visits, hospitalizations, and prescription medications. * Low or no premiums: Medicaid has low or no premiums, making it an affordable option for low-income individuals and families. * No pre-existing condition exclusions: Medicaid cannot deny coverage based on pre-existing medical conditions. * Tax-free benefits: Medicaid benefits are tax-free, which means that recipients do not have to pay taxes on their benefits.Tips for Finding Cheap Medical Insurance Options

Finding cheap medical insurance options requires research and comparison shopping. Here are some tips for finding affordable health insurance:

- Compare prices: Compare prices from different insurance companies to find the best rates.

- Consider a high-deductible plan: High-deductible plans often have lower premiums, but they may come with higher out-of-pocket costs.

- Look for discounts: Some insurance companies offer discounts for students, military personnel, and non-smokers.

- Check for subsidies: Eligible individuals and families may qualify for subsidies to help lower their premiums.

- Read reviews: Read reviews from other policyholders to get an idea of the insurance company's reputation and customer service.

What is the difference between a catastrophic health plan and a major medical plan?

+A catastrophic health plan is designed to provide protection against catastrophic medical expenses, such as hospitalizations and surgeries, while a major medical plan provides comprehensive coverage, including doctor visits, hospitalizations, and prescription medications.

Can I qualify for Medicaid if I am not a U.S. citizen?

+Some non-citizens may qualify for Medicaid, but eligibility varies depending on the state and individual circumstances. It is best to check with your state's Medicaid office to determine eligibility.

How can I find affordable health insurance if I am self-employed?

+Self-employed individuals can find affordable health insurance through the health insurance marketplace or by purchasing a private plan directly from an insurance company. It is also a good idea to compare prices and consider a high-deductible plan to lower premiums.

Can I purchase health insurance at any time, or are there specific enrollment periods?

+There are specific enrollment periods for health insurance, including the annual open enrollment period and special enrollment periods for qualifying life events, such as losing job-based coverage or getting married. It is best to check with your insurance company or the health insurance marketplace to determine enrollment periods.

What is the difference between a short-term health insurance plan and a major medical plan?

+A short-term health insurance plan provides temporary coverage for a specified period, usually up to 12 months, while a major medical plan provides comprehensive coverage, including doctor visits, hospitalizations, and prescription medications, for an extended period.

In conclusion, finding cheap medical insurance options requires research and comparison shopping. By understanding the different types of affordable health insurance plans, including catastrophic health plans, short-term health insurance, and Medicaid, individuals and families can make informed decisions about their health insurance needs. Remember to compare prices, consider a high-deductible plan, and look for discounts to find the best rates. With the right health insurance plan, individuals and families can protect themselves against unexpected medical expenses and enjoy peace of mind knowing that they are covered. We encourage readers to share their experiences and tips for finding affordable health insurance in the comments below.