Intro

Discover the factors affecting Medical Insurance Cost, including premiums, deductibles, and copays, to make informed decisions about your healthcare coverage and reduce out-of-pocket expenses.

The cost of medical insurance has become a significant concern for individuals and families around the world. As healthcare costs continue to rise, the need for adequate medical insurance coverage has never been more pressing. However, the increasing cost of medical insurance premiums has made it challenging for many people to afford the coverage they need. In this article, we will delve into the world of medical insurance costs, exploring the factors that influence premiums, the benefits of having medical insurance, and the steps you can take to reduce your medical insurance costs.

The cost of medical insurance is influenced by a variety of factors, including age, health status, lifestyle, and location. Insurance companies use these factors to determine the level of risk associated with insuring an individual or group, and this risk assessment is used to calculate premiums. For example, individuals who are older or have pre-existing medical conditions may be considered higher-risk and therefore face higher premiums. Similarly, individuals who engage in high-risk behaviors such as smoking or extreme sports may also face higher premiums.

As the cost of medical insurance continues to rise, it is essential to understand the benefits of having medical insurance coverage. Medical insurance provides financial protection against unexpected medical expenses, allowing individuals and families to receive the medical care they need without incurring significant debt. Additionally, many medical insurance plans offer preventive care services, such as routine check-ups and screenings, which can help prevent illnesses and detect health problems early on. With the rising cost of healthcare, having medical insurance coverage is crucial for maintaining financial stability and ensuring access to quality medical care.

Understanding Medical Insurance Costs

Understanding medical insurance costs is crucial for making informed decisions about your healthcare coverage. There are several types of medical insurance costs, including premiums, deductibles, copays, and coinsurance. Premiums are the monthly or annual payments made to the insurance company to maintain coverage. Deductibles are the amount of money that must be paid out-of-pocket before the insurance company begins to pay for medical expenses. Copays are the fixed amounts paid for specific medical services, such as doctor visits or prescriptions. Coinsurance is the percentage of medical expenses paid by the insurance company after the deductible has been met.

Factors Influencing Medical Insurance Costs

The cost of medical insurance is influenced by a variety of factors, including: * Age: Older individuals typically face higher premiums due to the increased risk of health problems. * Health status: Individuals with pre-existing medical conditions may face higher premiums or be denied coverage. * Lifestyle: Individuals who engage in high-risk behaviors such as smoking or extreme sports may face higher premiums. * Location: The cost of living and healthcare costs in your area can impact premiums. * Plan type: The type of medical insurance plan you choose, such as an HMO or PPO, can impact premiums.Benefits of Medical Insurance

The benefits of medical insurance are numerous, and having adequate coverage can provide peace of mind and financial protection. Some of the key benefits of medical insurance include:

- Financial protection: Medical insurance provides financial protection against unexpected medical expenses, allowing individuals and families to receive the medical care they need without incurring significant debt.

- Access to quality care: Medical insurance can provide access to quality medical care, including preventive care services, specialist care, and hospitalization.

- Reduced financial risk: Medical insurance can reduce the financial risk associated with unexpected medical expenses, allowing individuals and families to maintain financial stability.

Types of Medical Insurance Plans

There are several types of medical insurance plans available, including: * Health Maintenance Organization (HMO) plans: These plans provide coverage for medical services within a specific network of providers. * Preferred Provider Organization (PPO) plans: These plans provide coverage for medical services both in-network and out-of-network, with higher copays and coinsurance for out-of-network services. * Point of Service (POS) plans: These plans provide coverage for medical services both in-network and out-of-network, with the option to choose a primary care physician. * Indemnity plans: These plans provide reimbursement for medical expenses, regardless of the provider or network.Reducing Medical Insurance Costs

Reducing medical insurance costs is a top priority for many individuals and families. There are several steps you can take to reduce your medical insurance costs, including:

- Shopping around: Compare premiums and coverage options from different insurance companies to find the best rate.

- Choosing a higher deductible: Higher deductibles can lower premiums, but be sure you can afford the out-of-pocket expenses.

- Selecting a catastrophic plan: Catastrophic plans provide limited coverage at a lower premium, but may not provide the comprehensive coverage you need.

- Taking advantage of tax-advantaged accounts: Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can help you save for medical expenses on a tax-free basis.

Strategies for Reducing Medical Expenses

In addition to reducing medical insurance costs, there are several strategies for reducing medical expenses, including: * Preventive care: Routine check-ups and screenings can help prevent illnesses and detect health problems early on. * Generic medications: Generic medications can be significantly cheaper than brand-name medications. * Medical billing advocacy: Medical billing advocates can help you navigate the complex medical billing process and negotiate lower rates. * Telemedicine: Telemedicine services can provide convenient and cost-effective access to medical care.Medical Insurance and Employer-Sponsored Plans

Medical insurance and employer-sponsored plans are an essential part of many employees' benefits packages. Employer-sponsored plans can provide comprehensive coverage at a lower cost than individual plans, and may also offer additional benefits such as dental and vision coverage. However, employer-sponsored plans may also have limitations, such as limited provider networks and higher copays.

Advantages and Disadvantages of Employer-Sponsored Plans

The advantages of employer-sponsored plans include: * Lower premiums: Employer-sponsored plans can provide lower premiums due to the group rate. * Comprehensive coverage: Employer-sponsored plans often provide comprehensive coverage, including preventive care services and specialist care. * Convenience: Employer-sponsored plans can be convenient, with premiums often deducted directly from payroll. The disadvantages of employer-sponsored plans include: * Limited provider networks: Employer-sponsored plans may have limited provider networks, which can limit access to care. * Higher copays: Employer-sponsored plans may have higher copays and coinsurance, which can increase out-of-pocket expenses.Medical Insurance and Individual Plans

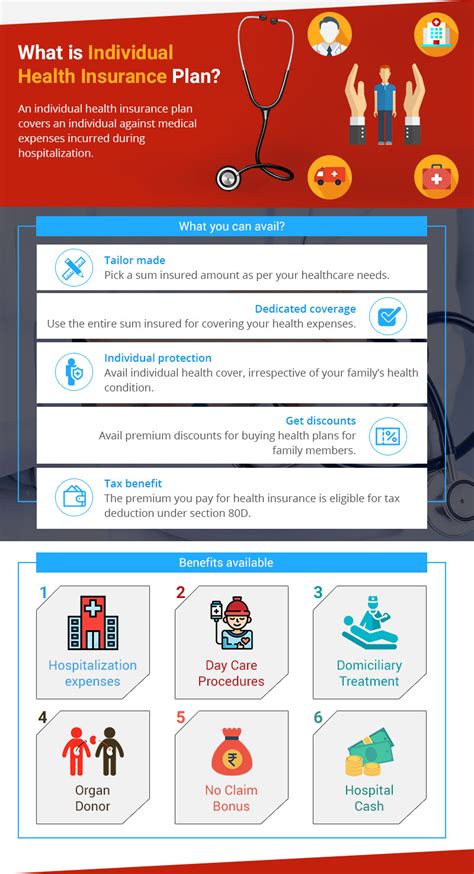

Medical insurance and individual plans are an essential part of many individuals' and families' healthcare coverage. Individual plans can provide comprehensive coverage, including preventive care services and specialist care, and may also offer additional benefits such as dental and vision coverage. However, individual plans may also have higher premiums and limited provider networks.

Advantages and Disadvantages of Individual Plans

The advantages of individual plans include: * Flexibility: Individual plans can provide flexibility, with the option to choose from a variety of providers and plans. * Comprehensive coverage: Individual plans can provide comprehensive coverage, including preventive care services and specialist care. * Portability: Individual plans are portable, meaning you can take them with you if you change jobs or move. The disadvantages of individual plans include: * Higher premiums: Individual plans can have higher premiums due to the individual rate. * Limited provider networks: Individual plans may have limited provider networks, which can limit access to care.Medical Insurance and Government Programs

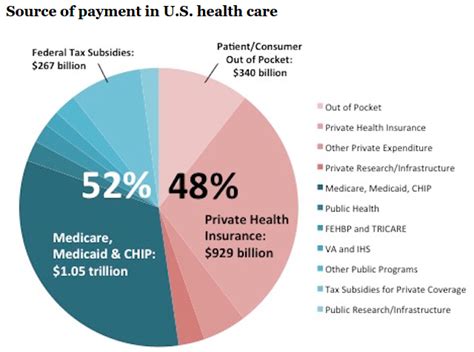

Medical insurance and government programs are an essential part of many individuals' and families' healthcare coverage. Government programs such as Medicare and Medicaid provide comprehensive coverage to eligible individuals, and may also offer additional benefits such as dental and vision coverage. However, government programs may also have limitations, such as limited provider networks and higher copays.

Advantages and Disadvantages of Government Programs

The advantages of government programs include: * Comprehensive coverage: Government programs can provide comprehensive coverage, including preventive care services and specialist care. * Lower premiums: Government programs can provide lower premiums due to the government subsidy. * Convenience: Government programs can be convenient, with premiums often deducted directly from Social Security benefits. The disadvantages of government programs include: * Limited provider networks: Government programs may have limited provider networks, which can limit access to care. * Higher copays: Government programs may have higher copays and coinsurance, which can increase out-of-pocket expenses.As we conclude our discussion on medical insurance costs, it is essential to remember that having adequate medical insurance coverage is crucial for maintaining financial stability and ensuring access to quality medical care. By understanding the factors that influence medical insurance costs, the benefits of having medical insurance, and the steps you can take to reduce your medical insurance costs, you can make informed decisions about your healthcare coverage. We invite you to share your thoughts and experiences with medical insurance costs, and to ask any questions you may have about this complex and often confusing topic.

What is the average cost of medical insurance?

+The average cost of medical insurance varies depending on factors such as age, health status, and location. However, the average premium for an individual plan can range from $300 to $600 per month, while the average premium for a family plan can range from $1,000 to $2,000 per month.

What are the benefits of having medical insurance?

+The benefits of having medical insurance include financial protection against unexpected medical expenses, access to quality medical care, and reduced financial risk. Medical insurance can also provide peace of mind and financial stability, allowing individuals and families to receive the medical care they need without incurring significant debt.

How can I reduce my medical insurance costs?

+There are several steps you can take to reduce your medical insurance costs, including shopping around for quotes, choosing a higher deductible, selecting a catastrophic plan, and taking advantage of tax-advantaged accounts such as Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs).