Intro

Get protected with Emergency Health Care Insurance Plan, covering urgent medical needs, hospital stays, and critical care, ensuring financial security and peace of mind during unexpected health crises.

Having a reliable emergency health care insurance plan is crucial in today's unpredictable world. Medical emergencies can arise at any moment, and the financial burden of unexpected healthcare expenses can be overwhelming. A well-structured emergency health care insurance plan can provide individuals and families with the necessary financial protection and peace of mind. In this article, we will delve into the importance of emergency health care insurance plans, their benefits, and the key factors to consider when selecting a plan.

The rising costs of healthcare services, combined with the increasing frequency of medical emergencies, have made it essential for individuals to have a safety net in place. Emergency health care insurance plans are designed to provide coverage for unexpected medical expenses, ensuring that individuals can receive the necessary treatment without worrying about the financial implications. With the ever-increasing costs of medical care, having a reliable emergency health care insurance plan can help alleviate the financial burden and provide access to quality healthcare services.

In recent years, the demand for emergency health care insurance plans has increased significantly, driven by the growing awareness of the importance of financial protection against medical emergencies. As the healthcare landscape continues to evolve, it is crucial for individuals to stay informed about the available options and make informed decisions about their emergency health care insurance plans. By understanding the benefits and limitations of these plans, individuals can make informed choices and ensure that they have the necessary coverage in place to protect themselves and their loved ones.

Benefits of Emergency Health Care Insurance Plans

Emergency health care insurance plans offer numerous benefits, including financial protection, access to quality healthcare services, and peace of mind. Some of the key benefits of these plans include:

- Financial protection against unexpected medical expenses

- Access to a network of healthcare providers and facilities

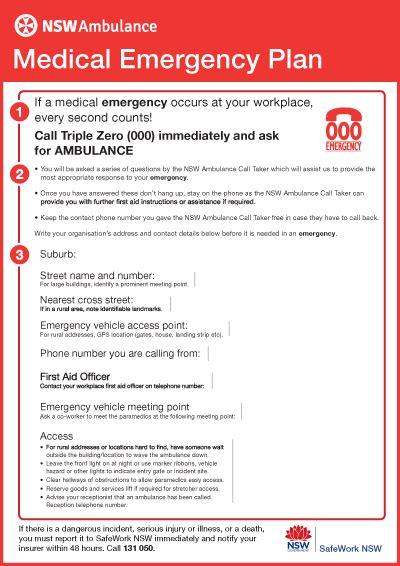

- Coverage for emergency medical services, such as ambulance transportation and emergency room visits

- Optional coverage for additional services, such as prescription medications and rehabilitation therapy

- Peace of mind knowing that you have a safety net in place in case of a medical emergency

Key Factors to Consider

When selecting an emergency health care insurance plan, there are several key factors to consider. These include: * The scope of coverage, including the types of medical services and expenses covered * The deductible and copayment amounts, which can impact the out-of-pocket costs * The network of healthcare providers and facilities, which can affect access to quality care * The optional coverage for additional services, such as prescription medications and rehabilitation therapy * The premium costs, which can vary depending on the plan and providerTypes of Emergency Health Care Insurance Plans

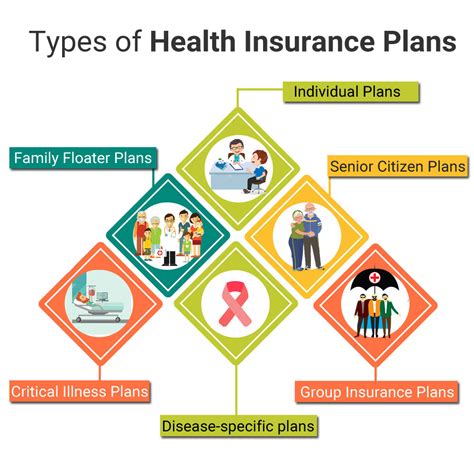

There are several types of emergency health care insurance plans available, each with its own unique features and benefits. Some of the most common types of plans include:

- Individual plans, which provide coverage for a single individual

- Family plans, which provide coverage for multiple family members

- Group plans, which provide coverage for a group of individuals, often through an employer or organization

- Short-term plans, which provide temporary coverage for a limited period

- Long-term plans, which provide ongoing coverage for an extended period

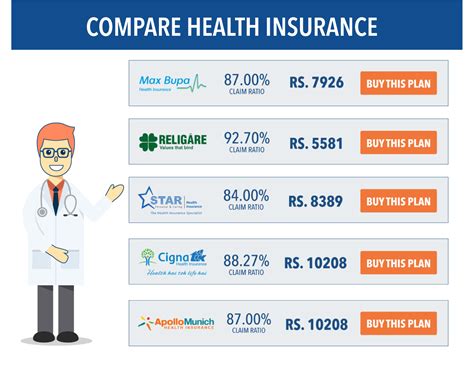

How to Choose the Right Plan

Choosing the right emergency health care insurance plan can be a daunting task, especially with the numerous options available. To make an informed decision, individuals should consider their specific needs and circumstances, including their health status, budget, and lifestyle. Some tips for choosing the right plan include: * Assessing your health status and medical needs * Evaluating your budget and financial situation * Researching different plan options and providers * Comparing the scope of coverage, deductible and copayment amounts, and premium costs * Reading reviews and seeking recommendations from friends, family, or healthcare professionalsEmergency Health Care Insurance Plan Providers

There are numerous emergency health care insurance plan providers available, each with its own unique features and benefits. Some of the most well-known providers include:

- Blue Cross Blue Shield

- UnitedHealthcare

- Aetna

- Cigna

- Humana When selecting a provider, individuals should consider factors such as the scope of coverage, network of healthcare providers, and premium costs. It is also essential to research the provider's reputation, customer service, and claims processing procedures.

Common Mistakes to Avoid

When selecting an emergency health care insurance plan, there are several common mistakes to avoid. These include: * Not carefully reviewing the plan's scope of coverage and limitations * Not understanding the deductible and copayment amounts * Not researching the provider's reputation and customer service * Not comparing premium costs and plan options * Not considering additional coverage options, such as prescription medications and rehabilitation therapyEmergency Health Care Insurance Plan Costs

The costs of emergency health care insurance plans can vary significantly depending on the provider, plan, and individual circumstances. Some of the key factors that impact the costs include:

- Age and health status

- Location and network of healthcare providers

- Scope of coverage and limitations

- Deductible and copayment amounts

- Premium costs and payment options

Ways to Reduce Costs

There are several ways to reduce the costs of emergency health care insurance plans, including: * Shopping around and comparing premium costs and plan options * Considering high-deductible plans with lower premium costs * Taking advantage of tax-advantaged savings options, such as health savings accounts (HSAs) * Negotiating with providers and healthcare facilities * Maintaining a healthy lifestyle and preventing medical conditionsConclusion and Final Thoughts

In conclusion, having a reliable emergency health care insurance plan is essential in today's unpredictable world. By understanding the benefits and limitations of these plans, individuals can make informed decisions and ensure that they have the necessary coverage in place to protect themselves and their loved ones. When selecting a plan, it is crucial to consider factors such as the scope of coverage, network of healthcare providers, and premium costs. By avoiding common mistakes and taking steps to reduce costs, individuals can find an affordable and comprehensive emergency health care insurance plan that meets their unique needs and circumstances.

We invite you to share your thoughts and experiences with emergency health care insurance plans in the comments section below. Your input can help others make informed decisions and find the right plan for their needs. Additionally, if you found this article informative and helpful, please consider sharing it with your friends and family on social media.

What is an emergency health care insurance plan?

+An emergency health care insurance plan is a type of insurance that provides coverage for unexpected medical expenses, such as emergency room visits, hospital stays, and surgical procedures.

How do I choose the right emergency health care insurance plan?

+To choose the right emergency health care insurance plan, consider factors such as the scope of coverage, network of healthcare providers, and premium costs. It is also essential to research the provider's reputation, customer service, and claims processing procedures.

What are the benefits of having an emergency health care insurance plan?

+The benefits of having an emergency health care insurance plan include financial protection against unexpected medical expenses, access to quality healthcare services, and peace of mind knowing that you have a safety net in place in case of a medical emergency.