Intro

Get comprehensive Emergency Medical Insurance Coverage, including urgent care, hospital stays, and medical evacuations, with related benefits like accident insurance and critical illness coverage.

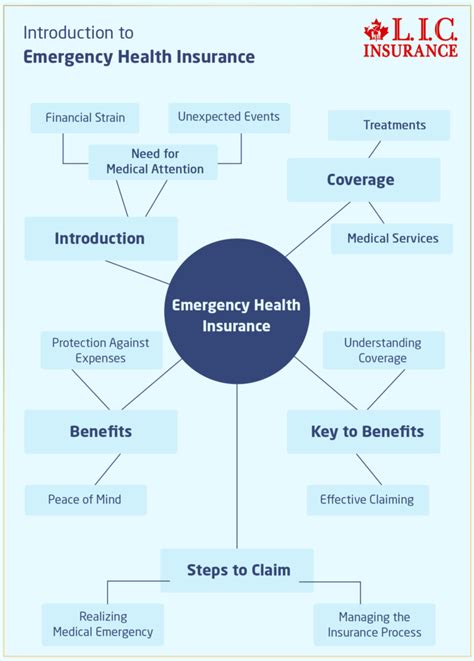

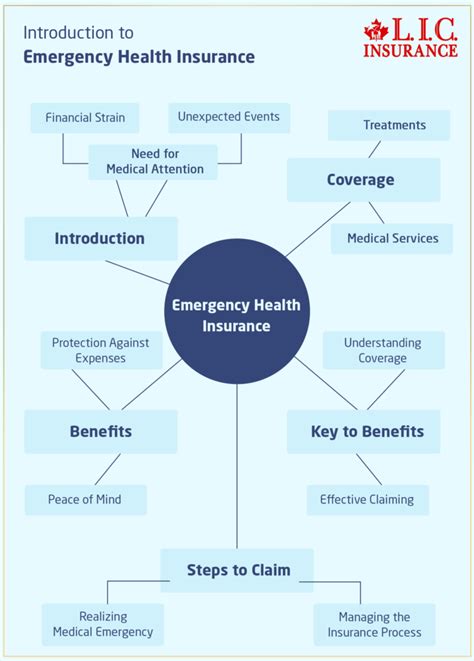

Emergency medical situations can arise at any moment, and the financial burden of receiving immediate care can be overwhelming. This is where emergency medical insurance coverage comes into play, providing individuals with the financial protection they need to receive timely and effective treatment. The importance of having emergency medical insurance coverage cannot be overstated, as it can mean the difference between receiving life-saving treatment and being forced to delay or forgo care due to financial constraints.

In today's fast-paced world, accidents and illnesses can happen to anyone, regardless of their age or health status. Emergency medical insurance coverage is designed to provide individuals with the financial resources they need to cover the costs of emergency medical care, including hospital stays, surgeries, and other treatments. Without this coverage, individuals may be forced to pay out-of-pocket for these expenses, which can lead to financial ruin. Furthermore, emergency medical insurance coverage can also provide individuals with access to a network of healthcare providers and facilities, ensuring that they receive the best possible care in their time of need.

The need for emergency medical insurance coverage is not limited to individuals who are prone to accidents or illnesses. Even healthy individuals can benefit from having this coverage, as emergency medical situations can arise at any moment. For example, a person who is involved in a car accident or suffers a sudden illness may require immediate medical attention, and having emergency medical insurance coverage can ensure that they receive the care they need without incurring significant financial burdens. In addition, emergency medical insurance coverage can also provide individuals with peace of mind, knowing that they are protected in the event of an unexpected medical emergency.

What is Emergency Medical Insurance Coverage?

Types of Emergency Medical Insurance Coverage

There are several types of emergency medical insurance coverage available, including: * Major medical insurance: This type of coverage provides individuals with comprehensive medical coverage, including emergency medical care. * Short-term medical insurance: This type of coverage provides individuals with temporary medical coverage, often for a period of several months. * Travel medical insurance: This type of coverage provides individuals with medical coverage while they are traveling abroad. * Critical illness insurance: This type of coverage provides individuals with a lump sum payment in the event of a critical illness, such as a heart attack or stroke.Benefits of Emergency Medical Insurance Coverage

How to Choose the Right Emergency Medical Insurance Coverage

Choosing the right emergency medical insurance coverage can be a daunting task, especially for individuals who are new to the insurance market. Some of the factors to consider when choosing an emergency medical insurance coverage include: * Coverage limits: Individuals should consider the coverage limits of the policy, including the maximum amount that the insurance provider will pay for medical expenses. * Deductibles: Individuals should consider the deductibles of the policy, including the amount that they must pay out-of-pocket before the insurance provider begins to pay. * Co-payments: Individuals should consider the co-payments of the policy, including the amount that they must pay for each medical service. * Network: Individuals should consider the network of healthcare providers and facilities that are included in the policy, ensuring that they have access to quality care.What to Expect from Emergency Medical Insurance Coverage

Common Misconceptions about Emergency Medical Insurance Coverage

There are several common misconceptions about emergency medical insurance coverage that individuals should be aware of. Some of the most significant misconceptions include: * Emergency medical insurance coverage is only for individuals who are prone to accidents or illnesses. In reality, emergency medical insurance coverage is for anyone who wants to be protected in the event of an unexpected medical emergency. * Emergency medical insurance coverage is too expensive. In reality, the cost of emergency medical insurance coverage can vary depending on the policy and the insurance provider, and there are often affordable options available. * Emergency medical insurance coverage is not necessary for individuals who have comprehensive health insurance. In reality, emergency medical insurance coverage can provide individuals with additional protection and benefits, even if they have comprehensive health insurance.How to File a Claim with Emergency Medical Insurance Coverage

Tips for Getting the Most out of Emergency Medical Insurance Coverage

There are several tips that individuals can follow to get the most out of their emergency medical insurance coverage. Some of the most significant tips include: * Read the policy carefully: Individuals should read the policy carefully, ensuring that they understand the coverage and benefits. * Ask questions: Individuals should ask questions if they are unsure about any aspect of the policy or the claims process. * Keep receipts: Individuals should keep receipts for medical expenses, as these may be required to support a claim.Conclusion and Next Steps

What is emergency medical insurance coverage?

+Emergency medical insurance coverage is a type of insurance that provides individuals with financial protection in the event of an emergency medical situation.

How do I choose the right emergency medical insurance coverage?

+When choosing emergency medical insurance coverage, individuals should consider the coverage limits, deductibles, co-payments, and network of healthcare providers and facilities.

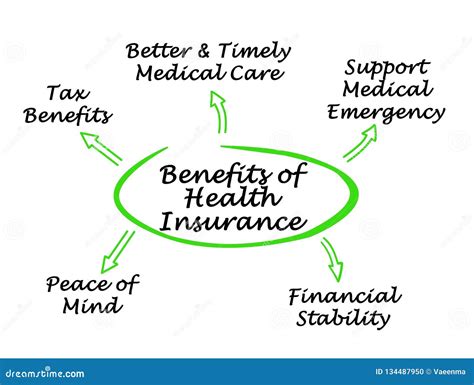

What are the benefits of emergency medical insurance coverage?

+The benefits of emergency medical insurance coverage include financial protection, access to quality care, peace of mind, and flexibility in terms of coverage options.