Intro

Discover 5 ways family insurance protects your loved ones, including health, life, and disability coverage, with tips on policy selection and cost savings, ensuring financial security and peace of mind for your familys future.

Family is the backbone of our society, and ensuring their well-being is of utmost importance. One way to provide a sense of security and protection for our loved ones is through family insurance. In today's fast-paced world, where uncertainties lurk around every corner, having a comprehensive insurance plan can be a lifesaver. Not only does it offer financial protection, but it also provides peace of mind, knowing that our family's future is secure. In this article, we will delve into the world of family insurance, exploring its importance, benefits, and the various options available.

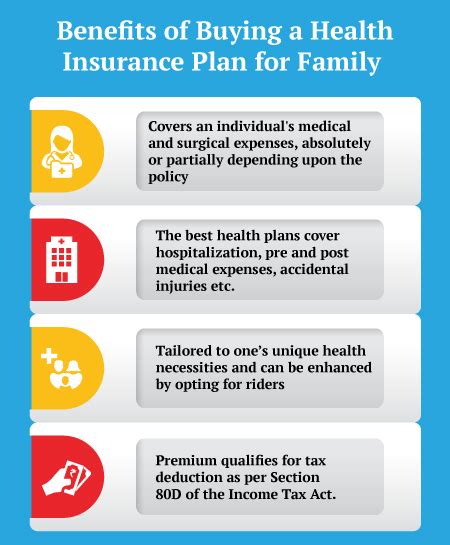

Having a family insurance plan in place can be a game-changer, especially during unexpected events such as illnesses, accidents, or even death. It helps to mitigate the financial burden, ensuring that our loved ones are not left with a significant debt or financial strain. Moreover, family insurance plans often come with additional benefits such as coverage for disabilities, critical illnesses, and even mental health issues. With the rising costs of healthcare and living expenses, having a safety net in place can be a huge relief.

The importance of family insurance cannot be overstated. It provides a sense of security, knowing that our loved ones will be taken care of, regardless of what life throws our way. Moreover, it allows us to plan for the future, whether it's saving for our children's education, retirement, or even a dream vacation. With the numerous options available, it's essential to understand the different types of family insurance plans, their benefits, and how they can be tailored to meet our specific needs. In the following sections, we will explore the various aspects of family insurance, including its benefits, types, and how to choose the right plan.

Benefits of Family Insurance

Types of Family Insurance Plans

Family insurance plans can be broadly categorized into several types, including: * Life insurance plans: These plans provide a lump sum payment to our beneficiaries in the event of our death. * Health insurance plans: These plans provide coverage for medical expenses, including hospitalization, surgeries, and even outpatient treatments. * Disability insurance plans: These plans provide financial protection in the event of disabilities, ensuring that our loved ones are not left with a significant debt or financial strain. * Critical illness insurance plans: These plans provide coverage for critical illnesses such as cancer, heart attacks, and strokes. * Family income benefit plans: These plans provide a regular income to our beneficiaries in the event of our death or disability.How to Choose the Right Family Insurance Plan

Factors to Consider When Choosing a Family Insurance Plan

When choosing a family insurance plan, there are several factors to consider, including: * Premiums: The premiums should be affordable and within our budget. * Coverage: The plan should provide adequate coverage for our specific needs. * Exclusions: It's essential to understand the exclusions and limitations of the plan. * Claim process: The claim process should be straightforward and hassle-free. * Customer service: The insurance provider should have a good reputation for customer service and support.Common Mistakes to Avoid When Buying Family Insurance

Tips for Getting the Most Out of Our Family Insurance Plan

To get the most out of our family insurance plan, here are some tips: * Read and understand the policy terms: It's essential to carefully read and understand the policy terms, including the coverage, exclusions, and premiums. * Keep our policy up to date: Regularly review and update our policy to ensure it remains relevant and adequate. * Make timely claims: Make timely claims to avoid delays and hassles. * Take advantage of additional benefits: Take advantage of additional benefits such as coverage for mental health issues and disabilities. * Consider add-ons: Consider add-ons such as critical illness coverage and disability coverage.Conclusion and Final Thoughts

A Final Word

Family insurance is not just a necessity; it's a responsibility. By taking the time to understand our options and choosing the right plan, we can ensure that our loved ones are protected and secure, no matter what life throws our way. So, take the first step today and explore the world of family insurance. With the right plan in place, we can have peace of mind, knowing that our family's future is secure.What is family insurance, and why is it important?

+Family insurance is a type of insurance that provides financial protection for our loved ones in the event of unexpected events such as illnesses, accidents, or even death. It's essential to have family insurance to ensure that our loved ones are not left with a significant debt or financial strain.

What are the different types of family insurance plans available?

+There are several types of family insurance plans available, including life insurance plans, health insurance plans, disability insurance plans, critical illness insurance plans, and family income benefit plans.

How do I choose the right family insurance plan for my needs?

+To choose the right family insurance plan, it's essential to assess our specific needs and requirements, research different insurance providers and their plans, read reviews, consult an expert, and carefully read and understand the policy terms.

We hope this article has provided you with valuable insights into the world of family insurance. If you have any further questions or would like to share your experiences, please don't hesitate to comment below. Share this article with your friends and family to help them make informed decisions about their family insurance needs. Together, we can create a more secure and protected future for our loved ones.