Intro

Unlock FSA HSA card benefits, including tax-free savings, flexible spending, and healthcare expense management, with our expert guide to maximizing medical reimbursement and insurance advantages.

The world of health savings accounts (HSAs) and flexible spending accounts (FSAs) can be complex, but understanding the benefits of using an FSA HSA card can make a significant difference in managing healthcare expenses. With the rising costs of medical care, it's essential to take advantage of tax-advantaged accounts that can help individuals and families save money. In this article, we'll delve into the benefits of using an FSA HSA card, how it works, and provide practical examples to illustrate its advantages.

As healthcare costs continue to escalate, consumers are looking for ways to reduce their expenses. One effective way to do this is by utilizing tax-advantaged accounts such as FSAs and HSAs. These accounts allow individuals to set aside pre-tax dollars for qualified medical expenses, resulting in significant savings. An FSA HSA card is a payment method that enables users to access their FSA or HSA funds to pay for eligible medical expenses, making it a convenient and efficient way to manage healthcare costs.

The importance of understanding FSA HSA card benefits cannot be overstated. By leveraging these benefits, individuals can reduce their out-of-pocket expenses, lower their taxable income, and make the most of their healthcare dollars. In the following sections, we'll explore the benefits, working mechanisms, and steps involved in using an FSA HSA card, providing readers with a comprehensive understanding of this valuable tool.

FSA HSA Card Benefits

The benefits of using an FSA HSA card are numerous. Some of the most significant advantages include:

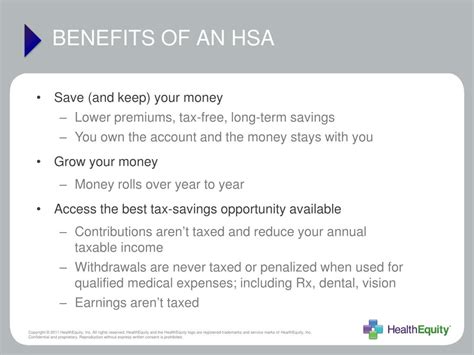

- Tax savings: Contributions to FSAs and HSAs are made with pre-tax dollars, reducing taxable income and lowering tax liability.

- Convenience: FSA HSA cards provide a convenient way to pay for qualified medical expenses, eliminating the need for reimbursement forms and paperwork.

- Flexibility: FSA HSA cards can be used to pay for a wide range of eligible medical expenses, including doctor visits, prescriptions, and medical equipment.

How FSA HSA Cards Work

FSA HSA cards are linked to an individual's FSA or HSA account, allowing them to access their funds to pay for qualified medical expenses. The process is straightforward:

- Contributions are made to the FSA or HSA account.

- The FSA HSA card is used to pay for eligible medical expenses.

- The card is swiped or inserted, and the funds are deducted from the FSA or HSA account.

Eligible Medical Expenses

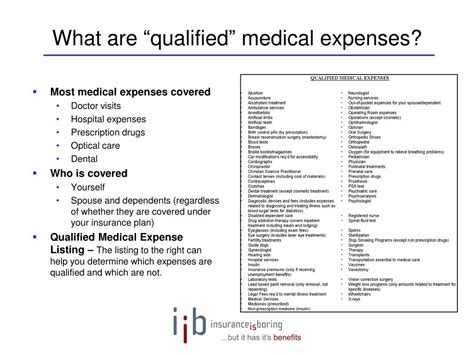

FSA HSA cards can be used to pay for a wide range of eligible medical expenses, including:

- Doctor visits and copays

- Prescriptions and medication

- Medical equipment and supplies

- Dental and vision care

- Chiropractic and acupuncture services

FSA HSA Card Limitations

While FSA HSA cards offer numerous benefits, there are some limitations to be aware of:

- Contribution limits: FSAs and HSAs have annual contribution limits, which can impact the amount of funds available for medical expenses.

- Eligible expenses: Not all medical expenses are eligible for reimbursement, so it's essential to review the list of qualified expenses before using the FSA HSA card.

- Account fees: Some FSA and HSA accounts may have fees associated with them, such as maintenance fees or investment fees.

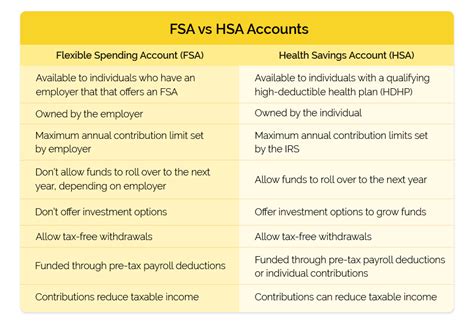

FSA vs. HSA: What's the Difference?

FSAs and HSAs are both tax-advantaged accounts, but they have distinct differences:

- FSA: A flexible spending account is a use-it-or-lose-it account, meaning that any unused funds at the end of the plan year are forfeited.

- HSA: A health savings account is a savings account that allows individuals to roll over unused funds from year to year, providing a long-term savings option.

How to Choose Between FSA and HSA

When deciding between an FSA and an HSA, consider the following factors:

- Contribution limits: HSAs have higher contribution limits than FSAs.

- Eligibility: HSAs are only available to individuals with a high-deductible health plan (HDHP).

- Portability: HSAs are portable, meaning that the account can be taken with you if you change jobs or retire.

Maximizing FSA HSA Card Benefits

To maximize the benefits of an FSA HSA card, follow these tips:

- Contribute as much as possible: Take advantage of the tax savings by contributing the maximum allowed amount to your FSA or HSA.

- Keep receipts: Keep track of receipts and documentation for eligible medical expenses to ensure that you can substantiate your claims.

- Use the card wisely: Only use the FSA HSA card for eligible medical expenses to avoid penalties and fees.

FSA HSA Card Best Practices

To get the most out of your FSA HSA card, follow these best practices:

- Review the account terms: Understand the account fees, contribution limits, and eligible expenses before using the card.

- Monitor account activity: Regularly check your account activity to ensure that there are no errors or discrepancies.

- Plan ahead: Consider your expected medical expenses for the year and plan your contributions accordingly.

What is the difference between an FSA and an HSA?

+FSAs and HSAs are both tax-advantaged accounts, but they have distinct differences. FSAs are use-it-or-lose-it accounts, while HSAs allow individuals to roll over unused funds from year to year.

How do I choose between an FSA and an HSA?

+When deciding between an FSA and an HSA, consider factors such as contribution limits, eligibility, and portability. HSAs have higher contribution limits and are portable, but are only available to individuals with a high-deductible health plan (HDHP).

Can I use my FSA HSA card for non-medical expenses?

+No, FSA HSA cards can only be used for eligible medical expenses. Using the card for non-medical expenses can result in penalties and fees.

In conclusion, an FSA HSA card is a valuable tool for managing healthcare expenses and reducing out-of-pocket costs. By understanding the benefits, working mechanisms, and limitations of FSA HSA cards, individuals can make informed decisions about their healthcare spending and maximize their savings. We invite you to share your thoughts and experiences with FSA HSA cards in the comments below. If you found this article helpful, please share it with others who may benefit from this information. Take the first step towards taking control of your healthcare expenses and start using an FSA HSA card today!