Kaiser Permanente is one of the largest and most reputable health insurance providers in the United States. With a strong presence in several states, including California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, and Washington, Kaiser Permanente offers a wide range of health insurance plans to individuals, families, and groups. In this article, we will delve into the world of Kaiser Permanente insurance, exploring its benefits, working mechanisms, and key information that you need to know.

The importance of having health insurance cannot be overstated. With the rising costs of medical care, having a reliable health insurance plan can provide peace of mind and financial protection in the event of unexpected medical expenses. Kaiser Permanente insurance is a popular choice among many Americans, thanks to its comprehensive coverage, affordable premiums, and excellent customer service. Whether you are looking for individual, family, or group health insurance, Kaiser Permanente has a plan that can meet your unique needs and budget.

Kaiser Permanente's commitment to providing high-quality, affordable healthcare has earned it numerous accolades and recognition. From its innovative approach to healthcare delivery to its emphasis on preventive care, Kaiser Permanente is dedicated to helping its members achieve optimal health and wellness. With a strong network of hospitals, medical offices, and healthcare professionals, Kaiser Permanente members can access a wide range of medical services, including primary care, specialty care, and emergency care. In the following sections, we will explore the benefits, working mechanisms, and key information about Kaiser Permanente insurance, helping you make informed decisions about your health insurance needs.

Benefits of Kaiser Permanente Insurance

Kaiser Permanente insurance offers numerous benefits to its members, including comprehensive coverage, affordable premiums, and excellent customer service. Some of the key benefits of Kaiser Permanente insurance include:

* Comprehensive coverage: Kaiser Permanente insurance plans cover a wide range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care.

* Affordable premiums: Kaiser Permanente offers competitive premiums, making it an affordable option for individuals, families, and groups.

* Excellent customer service: Kaiser Permanente is known for its excellent customer service, with a dedicated team of representatives available to answer questions and provide support.

* Preventive care: Kaiser Permanente emphasizes preventive care, with many plans covering routine check-ups, screenings, and vaccinations.

* Network of healthcare professionals: Kaiser Permanente has a strong network of hospitals, medical offices, and healthcare professionals, providing members with access to high-quality medical care.

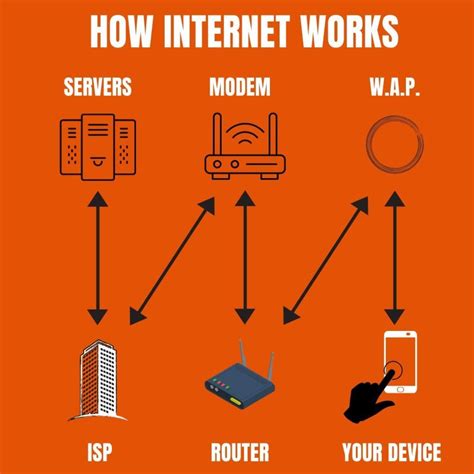

How Kaiser Permanente Insurance Works

Kaiser Permanente insurance works by providing members with access to a network of healthcare professionals and medical facilities. Here's an overview of how it works:

* Members choose a primary care physician (PCP) from Kaiser Permanente's network of healthcare professionals.

* The PCP coordinates the member's medical care, providing routine check-ups, referrals to specialists, and preventive care.

* Members can access medical services, including doctor visits, hospital stays, and prescription medications, through Kaiser Permanente's network of healthcare professionals and medical facilities.

* Kaiser Permanente offers a range of health insurance plans, including HMO, PPO, and Medicare Advantage plans, to meet the unique needs and budgets of its members.

Kaiser Permanente Insurance Plans

Kaiser Permanente offers a range of health insurance plans to individuals, families, and groups. Some of the most popular plans include:

* HMO (Health Maintenance Organization) plans: These plans provide comprehensive coverage, including doctor visits, hospital stays, and prescription medications, through Kaiser Permanente's network of healthcare professionals and medical facilities.

* PPO (Preferred Provider Organization) plans: These plans offer more flexibility, allowing members to access medical services from both in-network and out-of-network healthcare professionals and medical facilities.

* Medicare Advantage plans: These plans are designed for seniors and individuals with disabilities, providing comprehensive coverage, including doctor visits, hospital stays, and prescription medications, through Kaiser Permanente's network of healthcare professionals and medical facilities.

Kaiser Permanente Insurance Costs

The cost of Kaiser Permanente insurance varies depending on the plan, age, health status, and location. Here are some factors that can affect the cost of Kaiser Permanente insurance:

* Age: Premiums tend to increase with age, with older adults paying more for health insurance.

* Health status: Members with pre-existing medical conditions may pay more for health insurance.

* Location: Premiums can vary depending on the location, with urban areas tend to have higher premiums than rural areas.

* Plan: The type of plan chosen can affect the cost, with HMO plans tend to be more affordable than PPO plans.

Kaiser Permanente Insurance Enrollment

Enrolling in Kaiser Permanente insurance is a straightforward process. Here are the steps to follow:

* Research plans: Compare Kaiser Permanente insurance plans to find the one that best meets your needs and budget.

* Check eligibility: Ensure you are eligible for Kaiser Permanente insurance, including meeting the age, health status, and location requirements.

* Apply: Submit an application for Kaiser Permanente insurance, either online, by phone, or in-person.

* Provide documentation: Provide required documentation, including proof of income, age, and health status.

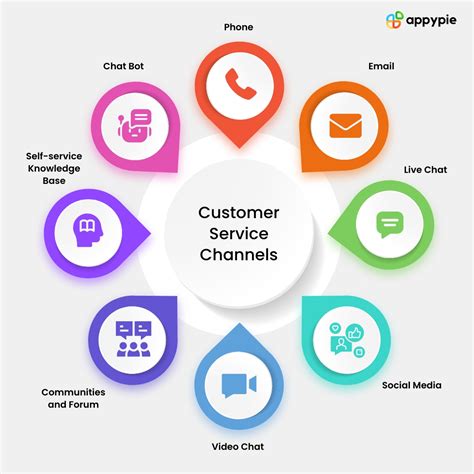

Kaiser Permanente Insurance Customer Service

Kaiser Permanente is known for its excellent customer service, with a dedicated team of representatives available to answer questions and provide support. Here are some ways to contact Kaiser Permanente customer service:

* Phone: Call the Kaiser Permanente customer service phone number to speak with a representative.

* Email: Send an email to Kaiser Permanente customer service to ask questions or request support.

* Online: Visit the Kaiser Permanente website to access online resources, including FAQs, plan information, and contact forms.

Kaiser Permanente Insurance Reviews

Kaiser Permanente insurance has received positive reviews from members, with many praising its comprehensive coverage, affordable premiums, and excellent customer service. Here are some pros and cons of Kaiser Permanente insurance:

* Pros: Comprehensive coverage, affordable premiums, excellent customer service, and a strong network of healthcare professionals and medical facilities.

* Cons: Limited provider network, higher premiums for out-of-network care, and some members have reported difficulty in getting appointments with specialists.

Kaiser Permanente Insurance FAQs

Here are some frequently asked questions about Kaiser Permanente insurance:

What is Kaiser Permanente insurance?

+

Kaiser Permanente insurance is a type of health insurance that provides comprehensive coverage, including doctor visits, hospital stays, and prescription medications, through a network of healthcare professionals and medical facilities.

How do I enroll in Kaiser Permanente insurance?

+

To enroll in Kaiser Permanente insurance, research plans, check eligibility, apply, and provide required documentation.

What are the benefits of Kaiser Permanente insurance?

+

The benefits of Kaiser Permanente insurance include comprehensive coverage, affordable premiums, excellent customer service, and a strong network of healthcare professionals and medical facilities.

In conclusion, Kaiser Permanente insurance is a popular choice among many Americans, thanks to its comprehensive coverage, affordable premiums, and excellent customer service. With a strong network of healthcare professionals and medical facilities, Kaiser Permanente members can access a wide range of medical services, including doctor visits, hospital stays, and prescription medications. Whether you are looking for individual, family, or group health insurance, Kaiser Permanente has a plan that can meet your unique needs and budget. We invite you to share your thoughts and experiences with Kaiser Permanente insurance, and to ask any questions you may have about this topic.