Intro

Explore Oregon health coverage options, including Medicaid, Medicare, and private plans, to find affordable healthcare solutions, insurance alternatives, and medical benefits that suit your needs.

Oregon has been at the forefront of healthcare reform, offering its residents a wide range of health coverage options. From the Oregon Health Plan to private insurance plans, there are numerous choices available to individuals and families. The importance of having adequate health coverage cannot be overstated, as it provides financial protection against unexpected medical expenses and ensures access to necessary healthcare services. In this article, we will delve into the various health coverage options available in Oregon, exploring their benefits, working mechanisms, and eligibility criteria.

The state's health coverage landscape is complex, with multiple programs and plans catering to different demographics and income levels. Understanding these options is crucial for Oregon residents, as it enables them to make informed decisions about their healthcare. Moreover, the Affordable Care Act (ACA) has significantly expanded health coverage options in Oregon, allowing more people to access affordable healthcare. As we navigate the various health coverage options in Oregon, it is essential to consider factors such as premium costs, deductibles, copays, and provider networks.

In Oregon, health coverage options are not limited to traditional insurance plans. The state has implemented innovative programs, such as the Oregon Health Plan, which provides comprehensive coverage to low-income individuals and families. Additionally, private insurance plans, including those offered through the health insurance marketplace, offer a range of benefits and flexibility. With so many options available, it can be overwhelming to choose the right plan. However, by understanding the different types of health coverage and their corresponding benefits, Oregon residents can make informed decisions that meet their unique needs and budget.

Oregon Health Plan

Eligibility Criteria

To qualify for OHP, individuals must: * Be an Oregon resident * Meet income requirements, which vary depending on family size and income level * Be a U.S. citizen, national, or qualified alien * Not be incarcerated * Not be eligible for other health coverage, such as Medicare or employer-sponsored insurancePrivate Insurance Plans

Types of Private Insurance Plans

There are several types of private insurance plans available in Oregon, including: * Health Maintenance Organization (HMO) plans * Preferred Provider Organization (PPO) plans * Exclusive Provider Organization (EPO) plans * Point of Service (POS) plans Each type of plan has its unique features, benefits, and drawbacks. For example, HMO plans typically require policyholders to receive care from a specific network of providers, while PPO plans offer more flexibility in choosing healthcare providers.Health Insurance Marketplace

Benefits of the Marketplace

The health insurance marketplace offers several benefits, including: * Financial assistance, such as tax credits and subsidies, to help lower premium costs * A range of plan options, allowing consumers to choose the best plan for their needs and budget * Standardized plans, making it easier to compare benefits and costs * Access to essential health benefits, including doctor visits, hospital stays, and prescription medicationsCatastrophic Plans

Benefits of Catastrophic Plans

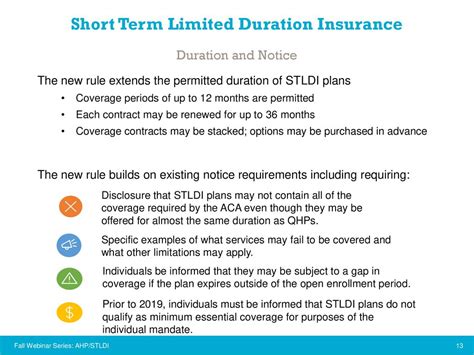

Catastrophic plans offer several benefits, including: * Lower premium costs * Protection against unexpected medical expenses * Access to essential health benefits, including doctor visits and hospital stays * Limited benefits, such as three primary care visits per year, before meeting the deductibleShort-Term Limited-Duration Insurance

Risks of STLDI Plans

STLDI plans pose several risks, including: * Limited benefits and coverage * Pre-existing condition exclusions * Higher premium costs for older adults or those with health conditions * No guarantee of renewalMedicaid Expansion

Benefits of Medicaid Expansion

Medicaid expansion offers several benefits, including: * Comprehensive health coverage * Financial protection against unexpected medical expenses * Access to essential health benefits * Improved health outcomes and reduced mortality ratesWhat is the Oregon Health Plan?

+The Oregon Health Plan is a state-funded program that provides comprehensive health coverage to low-income individuals and families.

How do I apply for the Oregon Health Plan?

+To apply for the Oregon Health Plan, you can visit the Oregon Health Authority website or contact a certified application counselor.

What is the difference between a Health Maintenance Organization (HMO) plan and a Preferred Provider Organization (PPO) plan?

+An HMO plan requires policyholders to receive care from a specific network of providers, while a PPO plan offers more flexibility in choosing healthcare providers.

Can I purchase private insurance plans outside of the health insurance marketplace?

+Yes, you can purchase private insurance plans directly from insurance companies outside of the health insurance marketplace.

What is Medicaid expansion, and how do I apply?

+Medicaid expansion is a program that increases access to health coverage for low-income individuals and families. To apply, you can visit the Oregon Health Authority website or contact a certified application counselor.

As we conclude our exploration of Oregon's health coverage options, it is essential to remember that having adequate health coverage is crucial for maintaining good health and financial stability. With the various options available, including the Oregon Health Plan, private insurance plans, and Medicaid expansion, Oregon residents can choose the best plan for their unique needs and budget. We encourage you to share this article with others, ask questions, and seek guidance from certified application counselors or insurance experts to ensure you make informed decisions about your health coverage. By taking control of your health coverage, you can protect yourself and your loved ones from unexpected medical expenses and ensure access to necessary healthcare services.