Intro

Discover affordable Family Health Insurance Plans, covering medical, dental, and vision care, with flexible policy options, deductibles, and copays, ensuring comprehensive protection for your loved ones wellbeing and financial security.

Family health insurance plans are a vital investment for individuals who want to ensure that their loved ones are protected against unexpected medical expenses. With the rising cost of healthcare, having a comprehensive family health insurance plan can provide peace of mind and financial security. In this article, we will delve into the world of family health insurance plans, exploring their importance, benefits, and key features.

Having a family health insurance plan is crucial for several reasons. Firstly, it provides financial protection against unexpected medical expenses, which can be devastating for families who are not prepared. Medical bills can quickly add up, and without insurance, families may be forced to dip into their savings or take on debt to cover these expenses. Secondly, family health insurance plans encourage preventive care, which is essential for maintaining good health and preventing chronic diseases. By covering routine check-ups, screenings, and vaccinations, family health insurance plans can help families stay healthy and avoid costly medical procedures.

Family health insurance plans also offer a range of benefits that can enhance the overall well-being of family members. For example, many plans cover mental health services, which are essential for addressing issues such as anxiety, depression, and stress. Additionally, family health insurance plans may cover alternative therapies, such as acupuncture and chiropractic care, which can be effective in managing chronic pain and other health conditions. With so many benefits to offer, it's no wonder that family health insurance plans are becoming increasingly popular among families who want to prioritize their health and well-being.

Types of Family Health Insurance Plans

There are several types of family health insurance plans available, each with its own unique features and benefits. Some of the most common types of family health insurance plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Point of Service (POS) plans. HMO plans, for example, require policyholders to receive medical care from a network of participating providers, while PPO plans offer more flexibility in terms of provider choice. POS plans, on the other hand, combine elements of HMO and PPO plans, allowing policyholders to choose between different types of coverage.

Key Features of Family Health Insurance Plans

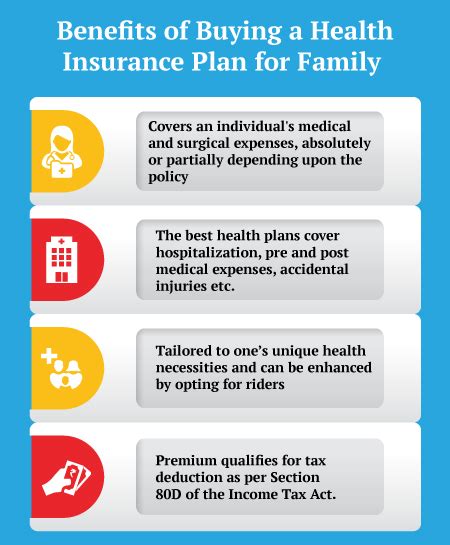

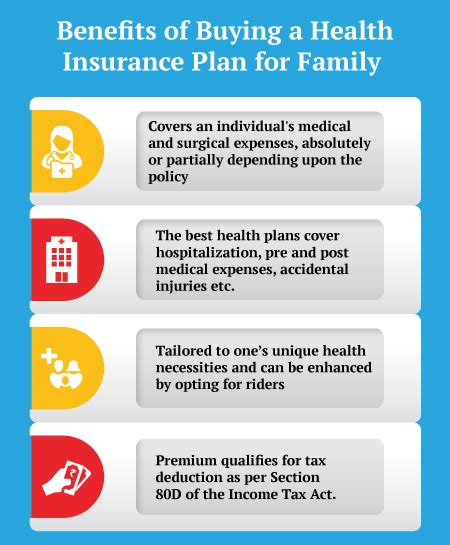

Family health insurance plans typically include a range of key features, such as deductibles, copayments, and coinsurance. Deductibles are the amounts that policyholders must pay out-of-pocket before their insurance coverage kicks in, while copayments are the fixed amounts that policyholders must pay for specific medical services. Coinsurance, on the other hand, refers to the percentage of medical expenses that policyholders must pay after meeting their deductible. Understanding these key features is essential for choosing the right family health insurance plan and avoiding unexpected medical expenses.Benefits of Family Health Insurance Plans

The benefits of family health insurance plans are numerous and well-documented. Some of the most significant benefits include financial protection, access to preventive care, and improved health outcomes. By covering routine check-ups, screenings, and vaccinations, family health insurance plans can help families stay healthy and avoid costly medical procedures. Additionally, family health insurance plans can provide peace of mind and reduce stress, which is essential for maintaining good mental health.

How to Choose the Right Family Health Insurance Plan

Choosing the right family health insurance plan can be a daunting task, especially for individuals who are new to the world of health insurance. To make the process easier, it's essential to consider several factors, such as premium costs, deductible amounts, and provider networks. Policyholders should also consider their family's specific health needs and choose a plan that provides comprehensive coverage for those needs. By doing their research and comparing different plans, individuals can find a family health insurance plan that meets their needs and budget.Cost of Family Health Insurance Plans

The cost of family health insurance plans can vary significantly depending on several factors, such as the type of plan, the number of family members, and the level of coverage. On average, family health insurance plans can cost anywhere from $500 to $2,000 per month, depending on the specific plan and provider. While these costs may seem prohibitively expensive, it's essential to remember that family health insurance plans can provide significant financial protection and peace of mind.

Ways to Reduce the Cost of Family Health Insurance Plans

There are several ways to reduce the cost of family health insurance plans, such as choosing a plan with a higher deductible, opting for a catastrophic plan, or taking advantage of tax credits and subsidies. Policyholders can also reduce their costs by choosing a plan with a narrower provider network or by using generic or preferred brand medications. By exploring these options, individuals can find a family health insurance plan that meets their needs and budget.Family Health Insurance Plan Providers

There are several family health insurance plan providers available, each with its own unique features and benefits. Some of the most popular providers include Blue Cross Blue Shield, UnitedHealthcare, and Kaiser Permanente. These providers offer a range of plans, from basic to comprehensive, and often have extensive networks of participating providers. By researching these providers and comparing their plans, individuals can find a family health insurance plan that meets their needs and budget.

How to Apply for a Family Health Insurance Plan

Applying for a family health insurance plan can be a straightforward process, especially for individuals who are familiar with the world of health insurance. To apply, individuals typically need to provide basic information, such as their name, address, and date of birth, as well as information about their family members and income level. Policyholders can apply online, by phone, or in person, and may need to provide additional documentation, such as proof of income or citizenship.Common Mistakes to Avoid When Choosing a Family Health Insurance Plan

There are several common mistakes to avoid when choosing a family health insurance plan, such as not reading the fine print, not considering the provider network, and not evaluating the plan's coverage for specific health needs. Policyholders should also avoid choosing a plan based solely on price, as this can lead to inadequate coverage and unexpected medical expenses. By avoiding these mistakes, individuals can find a family health insurance plan that meets their needs and budget.

Family Health Insurance Plan FAQs

Here are some frequently asked questions about family health insurance plans: * What is the difference between an HMO and a PPO plan? * How do I choose the right family health insurance plan for my family? * What is the average cost of a family health insurance plan? * Can I customize my family health insurance plan to meet my specific needs? * How do I apply for a family health insurance plan?What is the difference between an HMO and a PPO plan?

+An HMO plan requires policyholders to receive medical care from a network of participating providers, while a PPO plan offers more flexibility in terms of provider choice.

How do I choose the right family health insurance plan for my family?

+To choose the right family health insurance plan, consider factors such as premium costs, deductible amounts, and provider networks, as well as your family's specific health needs.

What is the average cost of a family health insurance plan?

+The average cost of a family health insurance plan can vary significantly depending on several factors, such as the type of plan, the number of family members, and the level of coverage.

Conclusion and Final Thoughts

In conclusion, family health insurance plans are a vital investment for individuals who want to ensure that their loved ones are protected against unexpected medical expenses. By understanding the different types of plans, their benefits, and key features, individuals can make informed decisions about their family's health insurance needs. Whether you're looking for a basic or comprehensive plan, there are many options available to meet your needs and budget. We encourage you to share your thoughts and experiences with family health insurance plans in the comments below, and to consider consulting with a licensed insurance professional to find the best plan for your family.