Intro

Discover affordable health insurance options, including low-cost plans, cheap rates, and budget-friendly coverage, to save on medical expenses and find inexpensive healthcare solutions.

The cost of health insurance can be a significant burden for many individuals and families. With the rising costs of medical care and the increasing demand for health insurance, it can be challenging to find affordable options. However, there are several inexpensive health insurance options available that can provide individuals and families with the coverage they need without breaking the bank. In this article, we will explore some of these options and discuss their benefits and drawbacks.

Health insurance is a crucial aspect of maintaining good health and financial stability. Without health insurance, individuals and families may be forced to pay out-of-pocket for medical expenses, which can lead to financial ruin. Moreover, health insurance can provide individuals with access to preventive care, diagnostic tests, and treatments that can help prevent and manage chronic diseases. Despite its importance, many individuals and families struggle to afford health insurance due to its high cost. This is where inexpensive health insurance options come in – they can provide individuals and families with the coverage they need at a price they can afford.

The importance of health insurance cannot be overstated. It can provide individuals and families with financial protection against unexpected medical expenses, as well as access to necessary medical care. Moreover, health insurance can help individuals and families maintain good health and prevent chronic diseases. With the rising costs of medical care, it is more important than ever to have health insurance. Inexpensive health insurance options can provide individuals and families with the coverage they need without breaking the bank.

Inexpensive Health Insurance Options

There are several inexpensive health insurance options available, including short-term health insurance, catastrophic health insurance, and health maintenance organization (HMO) plans. Short-term health insurance plans provide temporary coverage for individuals and families who are between jobs, waiting for group coverage to start, or need temporary coverage. Catastrophic health insurance plans, on the other hand, provide limited coverage for individuals and families who cannot afford more comprehensive coverage. HMO plans, meanwhile, provide comprehensive coverage for individuals and families who are willing to receive care from a network of providers.

Short-Term Health Insurance

Short-term health insurance plans are designed to provide temporary coverage for individuals and families who are between jobs, waiting for group coverage to start, or need temporary coverage. These plans typically have lower premiums than major medical plans, but they also have limited coverage and may not provide coverage for pre-existing conditions. Short-term health insurance plans can be a good option for individuals and families who need temporary coverage, but they should be careful to read the fine print and understand what is covered and what is not.Benefits of Inexpensive Health Insurance Options

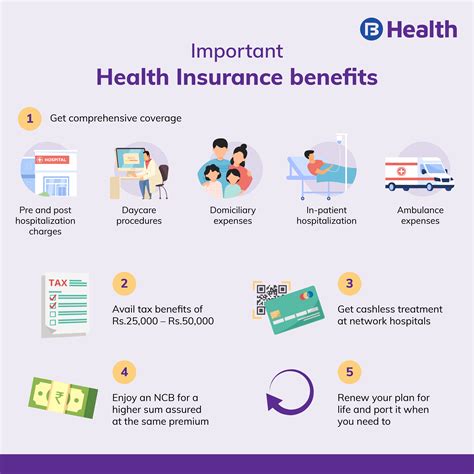

Inexpensive health insurance options can provide individuals and families with several benefits, including lower premiums, access to necessary medical care, and financial protection against unexpected medical expenses. Lower premiums can make health insurance more affordable for individuals and families who are on a tight budget. Access to necessary medical care can help individuals and families maintain good health and prevent chronic diseases. Financial protection against unexpected medical expenses can provide individuals and families with peace of mind and prevent financial ruin.

Access to Preventive Care

Inexpensive health insurance options can provide individuals and families with access to preventive care, including routine check-ups, screenings, and vaccinations. Preventive care can help individuals and families maintain good health and prevent chronic diseases. Routine check-ups, for example, can help individuals and families detect health problems early, when they are easier to treat. Screenings, meanwhile, can help individuals and families detect health problems before they become serious. Vaccinations can help individuals and families prevent infectious diseases.How to Choose an Inexpensive Health Insurance Option

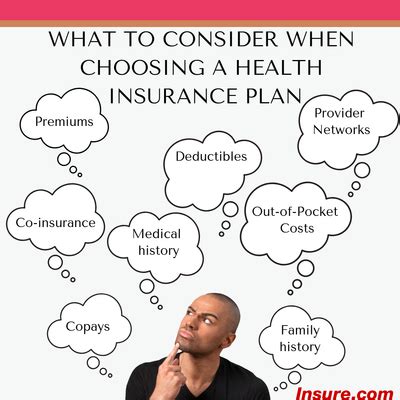

Choosing an inexpensive health insurance option can be challenging, but there are several steps individuals and families can take to make the process easier. First, individuals and families should assess their health insurance needs and determine what type of coverage they require. They should then research different health insurance options and compare their premiums, coverage, and benefits. Individuals and families should also read the fine print and understand what is covered and what is not. Finally, individuals and families should consider seeking the advice of a licensed health insurance agent or broker who can help them navigate the process and find the best option for their needs and budget.

Researching Different Health Insurance Options

Researching different health insurance options is an essential step in choosing an inexpensive health insurance option. Individuals and families should research different types of health insurance plans, including short-term health insurance, catastrophic health insurance, and HMO plans. They should also research different health insurance providers and compare their premiums, coverage, and benefits. Individuals and families can research health insurance options online, by phone, or in person. They can also seek the advice of a licensed health insurance agent or broker who can help them navigate the process and find the best option for their needs and budget.Tips for Saving Money on Health Insurance

There are several tips individuals and families can follow to save money on health insurance. First, they should shop around and compare different health insurance options. They should also consider increasing their deductible, which can lower their premiums. Individuals and families should also take advantage of preventive care, which can help them maintain good health and prevent chronic diseases. Finally, individuals and families should consider seeking the advice of a licensed health insurance agent or broker who can help them navigate the process and find the best option for their needs and budget.

Increasing Your Deductible

Increasing your deductible can be a good way to save money on health insurance. A deductible is the amount individuals and families must pay out-of-pocket before their health insurance kicks in. By increasing their deductible, individuals and families can lower their premiums. However, they should be careful not to increase their deductible too much, as this can leave them with high out-of-pocket expenses if they need medical care.Common Mistakes to Avoid When Choosing an Inexpensive Health Insurance Option

There are several common mistakes individuals and families can make when choosing an inexpensive health insurance option. First, they should avoid choosing a health insurance plan based solely on price. They should also avoid failing to read the fine print and understand what is covered and what is not. Individuals and families should also avoid failing to research different health insurance providers and compare their premiums, coverage, and benefits. Finally, individuals and families should avoid failing to seek the advice of a licensed health insurance agent or broker who can help them navigate the process and find the best option for their needs and budget.

Failing to Read the Fine Print

Failing to read the fine print is a common mistake individuals and families can make when choosing an inexpensive health insurance option. The fine print can contain important information about what is covered and what is not, as well as any limitations or exclusions. Individuals and families should take the time to read the fine print and understand what they are getting into before they sign up for a health insurance plan.Conclusion and Next Steps

In conclusion, inexpensive health insurance options can provide individuals and families with the coverage they need at a price they can afford. There are several options available, including short-term health insurance, catastrophic health insurance, and HMO plans. Individuals and families should take the time to research different health insurance options and compare their premiums, coverage, and benefits. They should also read the fine print and understand what is covered and what is not. By following these tips, individuals and families can find an inexpensive health insurance option that meets their needs and budget.

We hope this article has provided you with valuable information about inexpensive health insurance options. If you have any questions or comments, please feel free to share them below. We would love to hear from you and help you navigate the process of choosing an inexpensive health insurance option.

What is short-term health insurance?

+Short-term health insurance is a type of health insurance that provides temporary coverage for individuals and families who are between jobs, waiting for group coverage to start, or need temporary coverage.

What is catastrophic health insurance?

+Catastrophic health insurance is a type of health insurance that provides limited coverage for individuals and families who cannot afford more comprehensive coverage.

What is an HMO plan?

+An HMO plan is a type of health insurance plan that provides comprehensive coverage for individuals and families who are willing to receive care from a network of providers.