Intro

Discover expert 5 Tips Health Insurance advice, including policy selection, claim process, and premium management, to ensure comprehensive medical coverage and financial security with affordable plans and benefits.

Health insurance is an essential aspect of our lives, providing financial protection against medical expenses that can be devastating to our wallets. With the rising costs of healthcare, having a good health insurance plan can be the difference between receiving quality medical care and facing financial ruin. In this article, we will delve into the world of health insurance, exploring its importance, benefits, and providing valuable tips on how to choose the right plan for your needs.

The importance of health insurance cannot be overstated. Medical bills are a leading cause of bankruptcy in many countries, and the financial burden of healthcare can be overwhelming. Health insurance helps to mitigate this risk, providing a safety net that ensures you can receive the medical care you need without breaking the bank. Moreover, health insurance plans often provide preventive care services, such as routine check-ups and screenings, which can help to detect health problems early on, reducing the risk of costly medical interventions down the line.

As the healthcare landscape continues to evolve, it's essential to stay informed about the latest developments and trends in health insurance. From changes in government policies to the emergence of new insurance products, there's a lot to keep track of. In this article, we'll provide you with the latest insights and expert advice on how to navigate the complex world of health insurance. Whether you're a seasoned insurance professional or just starting to explore your options, this article is designed to provide you with the knowledge and tools you need to make informed decisions about your health insurance.

Understanding Health Insurance

Types of Health Insurance Plans

There are several types of health insurance plans, each with its own set of benefits and limitations. Some of the most common types of plans include: * Individual and family plans: These plans are designed for individuals and families who are not eligible for group coverage. * Group plans: These plans are offered by employers to their employees and are often less expensive than individual plans. * Medicare and Medicaid plans: These plans are government-sponsored programs that provide coverage to eligible individuals, such as seniors and low-income families. * Short-term plans: These plans provide temporary coverage for individuals who are between jobs or waiting for other coverage to start.Benefits of Health Insurance

How Health Insurance Works

Health insurance works by pooling the risks of a large group of people to provide financial protection against medical expenses. When you purchase a health insurance plan, you pay a premium, which is a monthly or annual fee, in exchange for coverage. The insurance company then uses the collected premiums to pay for the medical expenses of its policyholders. Health insurance plans often have a deductible, which is the amount you must pay out-of-pocket before the insurance company starts paying. There may also be copays, which are fixed amounts you pay for specific services, such as doctor visits or prescription medications.Choosing the Right Health Insurance Plan

5 Tips for Choosing the Right Health Insurance Plan

Here are five tips to help you choose the right health insurance plan: 1. **Consider your budget**: Health insurance plans can be expensive, so it's essential to consider your budget when choosing a plan. Look for plans that offer affordable premiums, deductibles, and copays. 2. **Assess your needs**: Consider your health status, medical history, and lifestyle to determine what type of coverage you need. If you have a pre-existing condition, look for plans that provide comprehensive coverage for that condition. 3. **Check the network**: Make sure the plan's network includes your preferred healthcare providers and hospitals. If you have a favorite doctor or hospital, check if they are part of the plan's network. 4. **Read the fine print**: Health insurance plans can be complex, so it's essential to read the fine print to understand what's covered and what's not. Look for plans that provide clear and concise information about coverage and exclusions. 5. **Seek professional advice**: Choosing a health insurance plan can be overwhelming, especially if you're not familiar with insurance terminology. Consider seeking professional advice from a licensed insurance agent or broker who can help you navigate the process and choose the right plan for your needs.Common Mistakes to Avoid When Choosing a Health Insurance Plan

How to Avoid Common Mistakes

To avoid common mistakes when choosing a health insurance plan, follow these tips: * Take your time: Don't rush into choosing a plan. Take the time to research and compare different plans. * Read reviews: Check online reviews and ratings from other policyholders to get an idea of the insurance company's reputation and customer service. * Seek professional advice: Consider seeking professional advice from a licensed insurance agent or broker who can help you navigate the process and choose the right plan for your needs. * Ask questions: Don't be afraid to ask questions. If you're unsure about something, ask the insurance company or a licensed agent for clarification.Conclusion and Next Steps

Final Thoughts

As you navigate the complex world of health insurance, remember that it's essential to prioritize your health and well-being. Don't be afraid to ask questions or seek professional advice if you're unsure about something. By taking the time to choose the right health insurance plan, you can ensure that you receive the medical care you need without breaking the bank.What is health insurance, and why do I need it?

+Health insurance is a type of insurance that provides financial protection against medical expenses. It's essential to have health insurance to ensure that you can receive quality medical care without facing financial ruin.

How do I choose the right health insurance plan?

+Choosing the right health insurance plan requires careful consideration of your needs, budget, and lifestyle. Consider factors such as premium costs, deductibles, copays, and network providers when selecting a plan.

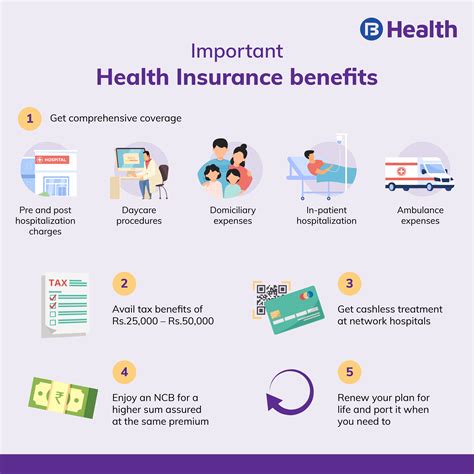

What are the benefits of having health insurance?

+The benefits of having health insurance include financial protection, access to quality care, preventive care, and reduced out-of-pocket costs. Health insurance provides a safety net against unexpected medical expenses, ensuring that you can receive the medical care you need without breaking the bank.

We hope this article has provided you with valuable insights and tips on how to choose the right health insurance plan for your needs. If you have any further questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them make informed decisions about their health insurance. Together, we can ensure that everyone has access to quality medical care without facing financial ruin.