Intro

Discover affordable Health Insurance Plans for Individuals, including medical, dental, and vision coverage, with flexible options and competitive rates, to ensure comprehensive protection and financial security.

As the world grapples with the ever-increasing costs of healthcare, having a reliable health insurance plan has become more crucial than ever. For individuals, navigating the complex landscape of health insurance can be daunting, especially when trying to find the perfect balance between coverage and affordability. With so many options available, it's essential to understand the ins and outs of individual health insurance plans to make informed decisions. In this article, we'll delve into the world of individual health insurance, exploring its importance, types, benefits, and how to choose the right plan for your needs.

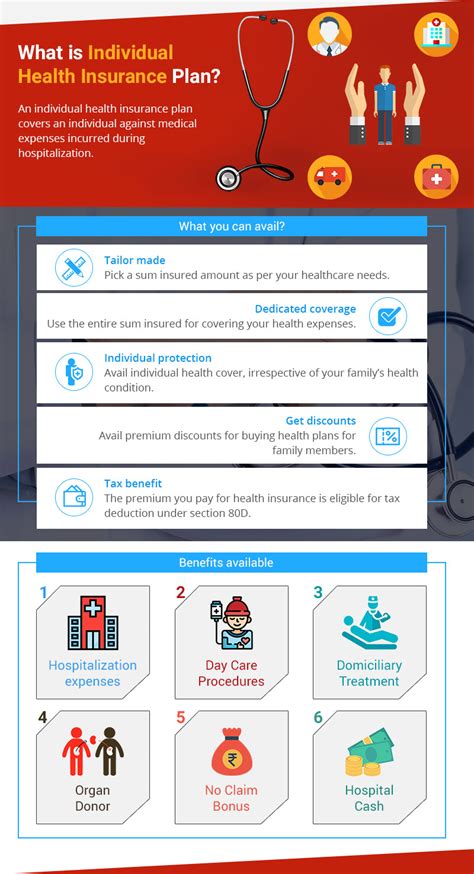

The importance of health insurance cannot be overstated. It provides financial protection against medical expenses, ensuring that you receive the care you need without breaking the bank. Individual health insurance plans are designed for people who are not covered by their employer or other group plans. These plans are ideal for self-employed individuals, freelancers, students, and those who are between jobs. With an individual plan, you can enjoy peace of mind knowing that you're protected against unexpected medical bills and can focus on your well-being.

The healthcare landscape is constantly evolving, with new technologies, treatments, and innovations emerging regularly. As such, having a comprehensive health insurance plan that adapts to these changes is vital. Individual plans offer flexibility, allowing you to choose from a range of options that cater to your specific needs and budget. From basic coverage to more comprehensive plans, there's an individual health insurance plan out there for everyone.

Understanding Individual Health Insurance Plans

Individual health insurance plans are designed to provide coverage for individuals and families who are not eligible for group coverage. These plans are typically more expensive than group plans but offer more flexibility and customization options. When shopping for an individual plan, it's essential to consider factors such as premium costs, deductibles, copays, and coinsurance. You should also look into the plan's network of providers, as well as any additional benefits, such as dental and vision coverage.

Types of Individual Health Insurance Plans

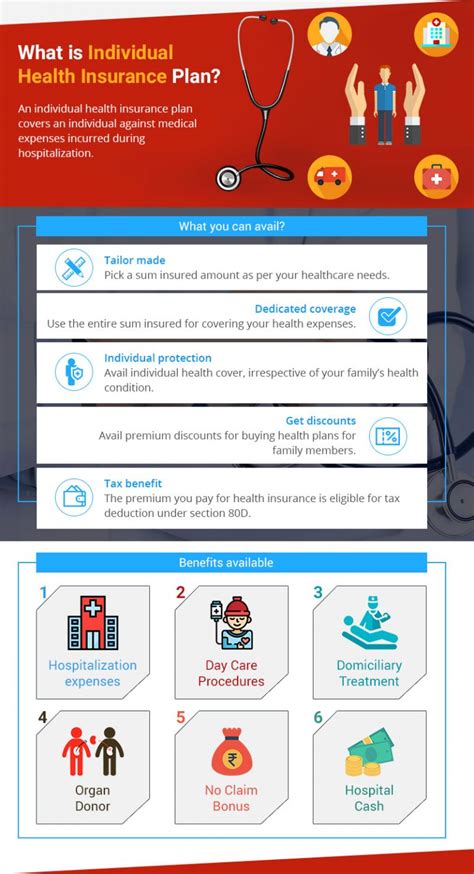

There are several types of individual health insurance plans available, each with its unique features and benefits. Some of the most common types include: * Major Medical Plans: These plans provide comprehensive coverage for essential health benefits, including doctor visits, hospital stays, and prescription medications. * Short-Term Plans: These plans offer temporary coverage for a limited period, usually up to 12 months. * Catastrophic Plans: These plans are designed for young adults and provide basic coverage for emergency services and preventive care. * High-Deductible Plans: These plans have higher deductibles but lower premiums, making them ideal for individuals who are healthy and don't expect to incur significant medical expenses.Benefits of Individual Health Insurance Plans

Individual health insurance plans offer numerous benefits, including:

- Financial protection against medical expenses

- Access to a network of healthcare providers

- Preventive care services, such as routine check-ups and screenings

- Coverage for prescription medications and medical equipment

- Flexibility to choose from a range of plan options and providers

How to Choose the Right Individual Health Insurance Plan

With so many options available, choosing the right individual health insurance plan can be overwhelming. Here are some tips to help you make an informed decision: * Assess your health needs: Consider your medical history, current health status, and any ongoing health conditions. * Evaluate your budget: Determine how much you can afford to pay in premiums, deductibles, and out-of-pocket expenses. * Research plan options: Compare different plans, including their coverage, networks, and additional benefits. * Read reviews and ask questions: Look into the insurance company's reputation, customer service, and claims process.Key Considerations for Individual Health Insurance Plans

When selecting an individual health insurance plan, there are several key considerations to keep in mind:

- Network of providers: Ensure that your plan includes a network of healthcare providers that meet your needs.

- Out-of-pocket costs: Consider the deductibles, copays, and coinsurance associated with your plan.

- Prescription medication coverage: If you take prescription medications, look into the plan's coverage and any restrictions.

- Additional benefits: Some plans may offer additional benefits, such as dental, vision, or wellness programs.

Common Mistakes to Avoid When Choosing an Individual Health Insurance Plan

When navigating the complex world of individual health insurance, it's easy to make mistakes. Here are some common pitfalls to avoid: * Not reading the fine print: Make sure you understand the plan's terms, conditions, and exclusions. * Not considering your health needs: Choose a plan that meets your medical requirements and budget. * Not comparing plans: Shop around and compare different plans to find the best option for you.Individual Health Insurance Plan Enrollment

Enrolling in an individual health insurance plan can be a straightforward process. Here are the steps to follow:

- Research and compare plans: Look into different plans, their coverage, and networks.

- Check eligibility: Ensure you meet the plan's eligibility requirements.

- Apply for coverage: Submit your application, providing required documentation and information.

- Review and finalize: Carefully review your plan documents and ask questions before finalizing your enrollment.

Special Enrollment Periods

In certain circumstances, you may be eligible for a special enrollment period, allowing you to enroll in an individual health insurance plan outside of the regular open enrollment period. These circumstances include: * Losing job-based coverage * Getting married or divorced * Having a baby or adopting a child * Moving to a new areaIndividual Health Insurance Plan Costs

The cost of an individual health insurance plan can vary significantly depending on several factors, including:

- Age: Older individuals tend to pay higher premiums.

- Health status: Pre-existing conditions may increase premiums or limit coverage.

- Location: Plans and premiums can differ depending on your location.

- Plan type: Different plan types, such as major medical or catastrophic, can affect costs.

Affordability and Financial Assistance

For many individuals, affordability is a significant concern when it comes to health insurance. Fortunately, there are options available to help make individual health insurance plans more affordable: * Subsidies: Depending on your income, you may be eligible for subsidies to reduce your premium costs. * Tax credits: You may be able to claim tax credits for your health insurance premiums. * Cost-sharing reductions: Some plans may offer cost-sharing reductions, which can lower your out-of-pocket expenses.Individual Health Insurance Plan Providers

When selecting an individual health insurance plan, it's essential to choose a reputable and reliable provider. Here are some factors to consider:

- Network of providers: Ensure the provider has a comprehensive network of healthcare professionals.

- Plan options: Look for providers that offer a range of plan options to meet your needs.

- Customer service: Evaluate the provider's customer service, including their claims process and support.

Top Individual Health Insurance Plan Providers

Some of the top individual health insurance plan providers include: * Blue Cross Blue Shield * UnitedHealthcare * Aetna * Cigna * HumanaWhat is individual health insurance?

+Individual health insurance is a type of health insurance plan designed for individuals and families who are not eligible for group coverage.

How do I choose the right individual health insurance plan?

+To choose the right individual health insurance plan, consider your health needs, budget, and plan options. Research and compare different plans, and read reviews to find the best plan for you.

Can I enroll in an individual health insurance plan at any time?

+No, individual health insurance plans typically have an open enrollment period. However, you may be eligible for a special enrollment period if you experience a qualifying life event, such as losing job-based coverage or getting married.

How much does an individual health insurance plan cost?

+The cost of an individual health insurance plan can vary depending on several factors, including age, health status, location, and plan type. Premiums can range from a few hundred to several thousand dollars per month.

Can I get financial assistance for an individual health insurance plan?

+Yes, depending on your income, you may be eligible for subsidies or tax credits to reduce your premium costs. Additionally, some plans may offer cost-sharing reductions to lower your out-of-pocket expenses.

As you navigate the world of individual health insurance plans, remember that knowledge is power. By understanding your options, considering your needs, and choosing the right plan, you can enjoy peace of mind and financial protection against medical expenses. Don't hesitate to reach out to insurance providers, ask questions, and seek guidance to find the perfect plan for you. Share your experiences, and help others make informed decisions about their health insurance. Together, we can create a healthier, more informed community.