Intro

Discover top 5 health insurance plans, including individual, family, and group coverage, with benefits like medical, dental, and vision care, to find the best policy for your needs.

Health insurance is a crucial aspect of modern life, providing individuals and families with financial protection against unexpected medical expenses. With the rising costs of healthcare, having a comprehensive health insurance plan is essential to avoid financial ruin. In this article, we will delve into the world of health insurance, exploring the importance of having a plan, the different types of plans available, and the benefits of each.

The importance of health insurance cannot be overstated. Medical bills can quickly add up, and without insurance, individuals may be forced to pay out of pocket for expensive treatments and procedures. This can lead to financial hardship, debt, and even bankruptcy. Furthermore, health insurance provides individuals with access to preventive care, such as routine check-ups and screenings, which can help detect health problems early on, reducing the risk of more severe and costly conditions.

Having a health insurance plan also provides individuals with peace of mind, knowing that they are protected against unexpected medical expenses. This can be especially important for families, who may have dependents to care for. With a health insurance plan, individuals can rest assured that they will be able to provide for their loved ones, even in the face of unexpected medical expenses.

Understanding Health Insurance Plans

There are several types of health insurance plans available, each with its own unique benefits and drawbacks. Understanding these plans is essential to making an informed decision about which plan is right for you. Some of the most common types of health insurance plans include HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), EPOs (Exclusive Provider Organizations), and POS (Point of Service) plans.

Types of Health Insurance Plans

These plans differ in terms of their network of providers, out-of-pocket costs, and flexibility. For example, HMOs typically require individuals to receive care from a specific network of providers, while PPOs offer more flexibility in terms of provider choice. EPOs, on the other hand, combine elements of HMOs and PPOs, offering a balance between cost and flexibility.Top 5 Health Insurance Plans

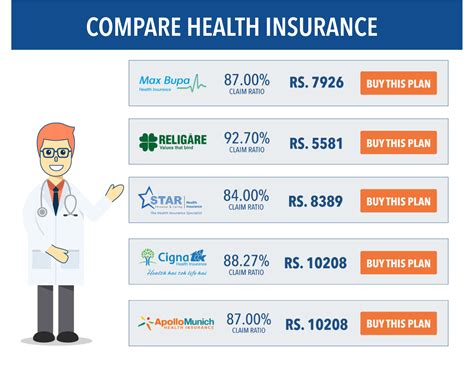

When it comes to choosing a health insurance plan, there are several factors to consider. Some of the top health insurance plans include UnitedHealthcare, Kaiser Permanente, Blue Cross Blue Shield, Aetna, and Cigna. These plans offer a range of benefits, including comprehensive coverage, flexible provider networks, and affordable premiums.

UnitedHealthcare

UnitedHealthcare is one of the largest health insurance providers in the United States, offering a range of plans to individuals, families, and employers. Their plans include comprehensive coverage for medical, dental, and vision care, as well as flexible provider networks and affordable premiums.Kaiser Permanente

Kaiser Permanente is a non-profit health insurance provider that offers a range of plans to individuals and families. Their plans include comprehensive coverage for medical, dental, and vision care, as well as a focus on preventive care and wellness programs.Blue Cross Blue Shield

Blue Cross Blue Shield is a nationwide health insurance provider that offers a range of plans to individuals, families, and employers. Their plans include comprehensive coverage for medical, dental, and vision care, as well as flexible provider networks and affordable premiums.Aetna

Aetna is a health insurance provider that offers a range of plans to individuals, families, and employers. Their plans include comprehensive coverage for medical, dental, and vision care, as well as a focus on preventive care and wellness programs.Cigna

Cigna is a global health insurance provider that offers a range of plans to individuals, families, and employers. Their plans include comprehensive coverage for medical, dental, and vision care, as well as flexible provider networks and affordable premiums.Benefits of Health Insurance Plans

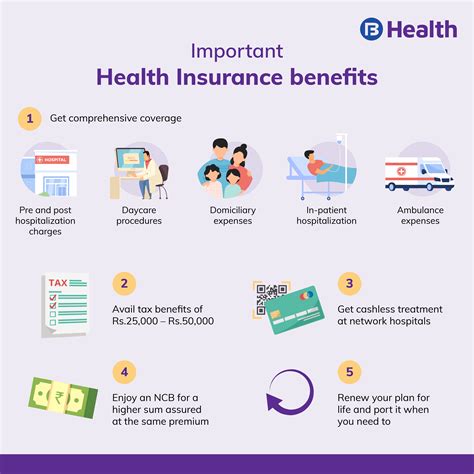

The benefits of health insurance plans are numerous. Some of the most significant benefits include financial protection against unexpected medical expenses, access to preventive care, and improved health outcomes. Additionally, health insurance plans can provide individuals with peace of mind, knowing that they are protected against unexpected medical expenses.

Financial Protection

Health insurance plans provide individuals with financial protection against unexpected medical expenses. This can include coverage for hospital stays, surgical procedures, and prescription medications. Without health insurance, individuals may be forced to pay out of pocket for these expenses, which can lead to financial hardship and debt.Access to Preventive Care

Health insurance plans also provide individuals with access to preventive care, such as routine check-ups and screenings. This can help detect health problems early on, reducing the risk of more severe and costly conditions. Preventive care can also help individuals maintain their overall health and well-being, reducing the risk of chronic diseases and improving quality of life.Improved Health Outcomes

Health insurance plans can also improve health outcomes by providing individuals with access to necessary medical care. This can include coverage for chronic disease management, mental health services, and substance abuse treatment. By providing individuals with access to necessary medical care, health insurance plans can help improve health outcomes and reduce the risk of premature death.How to Choose a Health Insurance Plan

Choosing a health insurance plan can be a daunting task, especially with the numerous options available. However, by considering several factors, individuals can make an informed decision about which plan is right for them. Some of the most important factors to consider include the plan's network of providers, out-of-pocket costs, and coverage for essential health benefits.

Network of Providers

One of the most important factors to consider when choosing a health insurance plan is the plan's network of providers. This includes the plan's list of participating doctors, hospitals, and other healthcare providers. Individuals should ensure that their plan's network includes their preferred providers, as well as any specialists they may need to see.Out-of-Pocket Costs

Another important factor to consider is the plan's out-of-pocket costs. This includes the plan's deductible, copayments, and coinsurance. Individuals should ensure that they can afford the plan's out-of-pocket costs, as well as any premiums or other fees associated with the plan.Coverage for Essential Health Benefits

Finally, individuals should ensure that their plan provides coverage for essential health benefits. This includes coverage for medical, dental, and vision care, as well as coverage for prescription medications and mental health services. Individuals should also ensure that their plan provides coverage for preventive care, such as routine check-ups and screenings.Conclusion and Next Steps

In conclusion, health insurance plans are a crucial aspect of modern life, providing individuals and families with financial protection against unexpected medical expenses. By understanding the different types of health insurance plans available, individuals can make an informed decision about which plan is right for them. Whether you are looking for comprehensive coverage, flexible provider networks, or affordable premiums, there is a health insurance plan out there to meet your needs.

We invite you to share your thoughts and experiences with health insurance plans in the comments section below. If you have any questions or need further guidance, please do not hesitate to reach out. Additionally, we encourage you to share this article with others who may be interested in learning more about health insurance plans.

What is health insurance?

+Health insurance is a type of insurance that provides financial protection against unexpected medical expenses.

What are the benefits of health insurance plans?

+The benefits of health insurance plans include financial protection against unexpected medical expenses, access to preventive care, and improved health outcomes.

How do I choose a health insurance plan?

+To choose a health insurance plan, consider factors such as the plan's network of providers, out-of-pocket costs, and coverage for essential health benefits.

What is the difference between an HMO and a PPO?

+An HMO (Health Maintenance Organization) typically requires individuals to receive care from a specific network of providers, while a PPO (Preferred Provider Organization) offers more flexibility in terms of provider choice.

Can I purchase health insurance outside of the open enrollment period?

+In most cases, individuals can only purchase health insurance during the open enrollment period, unless they experience a qualifying life event, such as losing their job or getting married.