Intro

Maximize health insurance tax benefits with 5 expert tips, including premium deductions, HSA contributions, and medical expense credits, to minimize taxes and optimize financial savings on healthcare costs.

Health insurance is a crucial aspect of financial planning, providing individuals and families with protection against unexpected medical expenses. In addition to its primary function, health insurance also offers several tax benefits that can help reduce an individual's tax liability. Understanding these tax benefits is essential to maximize savings and make informed decisions about health insurance coverage.

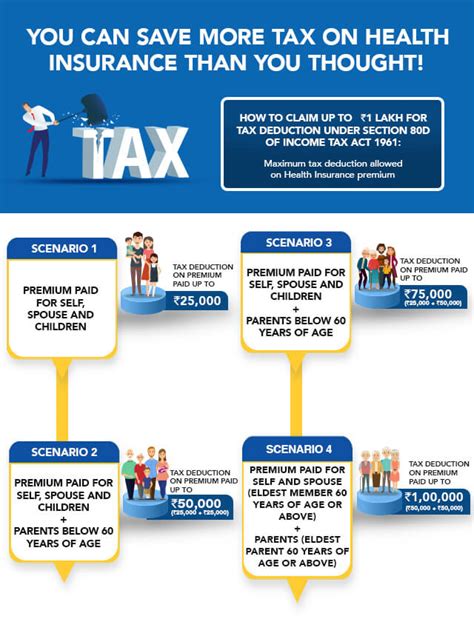

The tax implications of health insurance can be complex, and navigating the rules and regulations can be challenging. However, with the right guidance, individuals can take advantage of the tax benefits associated with health insurance and reduce their tax burden. From deductions for medical expenses to tax credits for health insurance premiums, there are several ways to save on taxes when it comes to health insurance.

In recent years, the healthcare landscape has undergone significant changes, and the tax implications of health insurance have evolved accordingly. The Affordable Care Act (ACA), also known as Obamacare, has introduced new tax provisions and modified existing ones, affecting individuals and families with health insurance coverage. Staying up-to-date with the latest tax rules and regulations is crucial to ensure that individuals and families are taking full advantage of the tax benefits available to them.

Understanding Health Insurance Tax Deductions

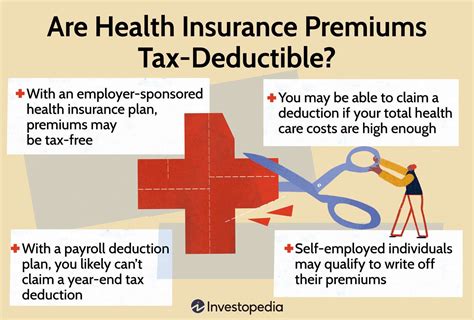

To qualify for the medical expense deduction, individuals must itemize their deductions on their tax return. This means that they must complete Schedule A of Form 1040 and list all their medical expenses, including health insurance premiums, out-of-pocket expenses, and other qualified medical expenses. The total amount of medical expenses must exceed the threshold percentage of AGI to qualify for the deduction.

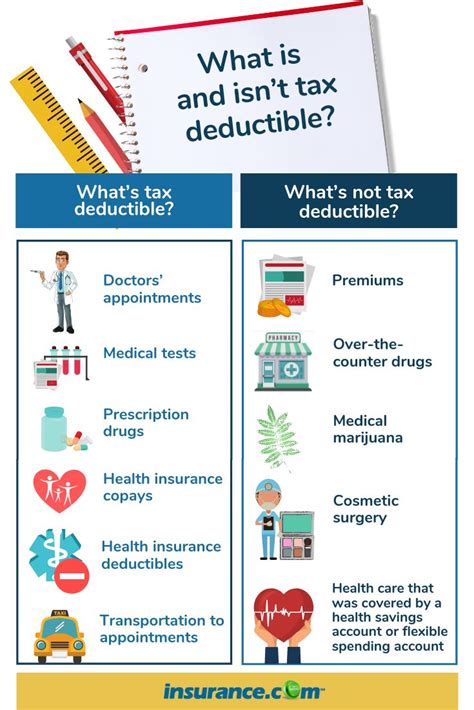

Qualified Medical Expenses

Qualified medical expenses include a wide range of expenses related to medical care, including: * Health insurance premiums * Doctor visits and copays * Hospital stays and surgery * Prescription medications * Medical equipment and supplies * Transportation costs for medical care * Home modifications for medical purposesIt is essential to keep accurate records of medical expenses throughout the year, including receipts, invoices, and bank statements. This documentation will be necessary to support the deduction on the tax return.

Tax Credits for Health Insurance Premiums

To qualify for the PTC, individuals must meet certain income and eligibility requirements, including:

- Income between 100% and 400% of the federal poverty level (FPL)

- Not eligible for affordable coverage through an employer or other government program

- Enrolled in a qualified health plan through the Health Insurance Marketplace

- Not incarcerated or eligible for Medicare

The PTC is calculated based on the individual's or family's income and the cost of the benchmark plan in their area. The credit can be claimed on the tax return or received in advance as a subsidy to help pay for health insurance premiums.

Claiming the Premium Tax Credit

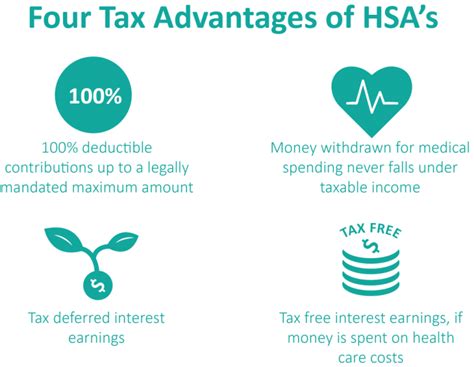

To claim the PTC, individuals must complete Form 8962 and attach it to their tax return. The form requires information about the individual's or family's income, health insurance coverage, and benchmark plan costs. The credit is calculated based on the information provided, and any excess credit is refunded to the taxpayer.Health Savings Accounts (HSAs) and Tax Benefits

To qualify for an HSA, individuals must have an HDHP with a minimum deductible amount, which varies by year. In 2022, the minimum deductible amount is $1,400 for individual coverage and $2,800 for family coverage.

HSA Contribution Limits

The contribution limits for HSAs also vary by year. In 2022, the contribution limit is $3,650 for individual coverage and $7,300 for family coverage. Individuals 55 or older can contribute an additional $1,000 as a catch-up contribution.Other Health Insurance Tax Tips

It is essential to consult with a tax professional or financial advisor to ensure that you are taking advantage of all the health insurance tax benefits available to you.

Health Insurance Tax Planning Strategies

Effective tax planning involves considering multiple factors, including income, expenses, and tax credits. When it comes to health insurance, tax planning strategies may include: * Maximizing HSA contributions to reduce taxable income * Claiming the PTC to reduce health insurance premiums * Itemizing deductions to claim medical expense deductions * Considering a cafeteria plan or other employer-sponsored plan to pay for health insurance premiums with pretax dollarsBy understanding the tax implications of health insurance and implementing effective tax planning strategies, individuals and families can reduce their tax liability and maximize their savings.

What are the eligibility requirements for the Premium Tax Credit?

+To be eligible for the Premium Tax Credit, individuals must have income between 100% and 400% of the federal poverty level, not be eligible for affordable coverage through an employer or other government program, and be enrolled in a qualified health plan through the Health Insurance Marketplace.

Can I claim the medical expense deduction if I have an HSA?

+Yes, you can claim the medical expense deduction if you have an HSA. However, you must itemize your deductions on Schedule A and meet the threshold percentage of AGI to qualify for the deduction.

How do I report HSA contributions on my tax return?

+To report HSA contributions on your tax return, complete Form 8889 and attach it to your Form 1040. You will need to report the amount of contributions made to your HSA and any distributions taken during the year.

As the healthcare landscape continues to evolve, it is essential to stay informed about the tax implications of health insurance. By understanding the tax benefits and planning strategies available, individuals and families can make informed decisions about their health insurance coverage and reduce their tax liability. If you have any questions or concerns about health insurance tax tips, we encourage you to share your thoughts in the comments below or consult with a tax professional or financial advisor for personalized guidance.