Intro

Discover 5 Health Plans, including wellness programs, fitness plans, and nutrition advice, to improve overall health and wellbeing with preventive care, disease management, and holistic approaches.

Maintaining good health is crucial for overall well-being, and having a solid health plan in place can make a significant difference. With the numerous health plans available, it can be challenging to choose the right one that suits your needs. In this article, we will explore five different health plans, their benefits, and how they work, to help you make an informed decision.

Having a health plan provides peace of mind, knowing that you are protected in case of unexpected medical expenses. It also encourages you to prioritize your health, by covering preventive care services such as routine check-ups, screenings, and vaccinations. A good health plan can help you stay healthy, detect health problems early, and manage chronic conditions effectively.

The importance of health plans cannot be overstated, especially with the rising costs of healthcare. A health plan can help you avoid financial hardship, by covering a significant portion of your medical expenses. Moreover, many health plans offer additional benefits such as dental, vision, and prescription drug coverage, which can enhance your overall health and well-being. With so many options available, it's essential to understand the different types of health plans, their advantages, and disadvantages, to make the best choice for yourself and your family.

Introduction to Health Plans

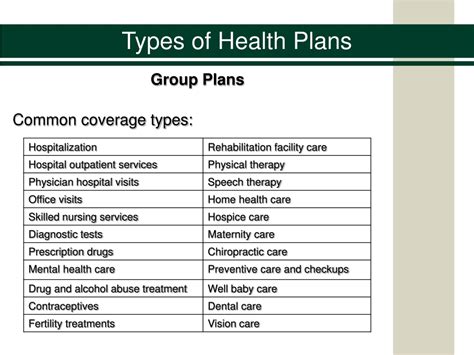

Types of Health Plans

Health Maintenance Organization (HMO) Plans

HMO plans are a type of health plan that provides coverage for medical services, in exchange for a premium. These plans have a network of participating providers, who offer discounted services to plan members. HMO plans typically require you to choose a primary care physician, who coordinates your care and refers you to specialists when necessary.Preferred Provider Organization (PPO) Plans

PPO plans are another type of health plan that offers a network of participating providers. However, unlike HMO plans, PPO plans allow you to see any healthcare provider, both in-network and out-of-network. You typically pay a higher copayment or coinsurance for out-of-network services.Benefits of Health Plans

Financial Protection

Health plans provide financial protection against unexpected medical expenses, which can be devastating without coverage. With a health plan, you can avoid financial hardship, and focus on recovering from an illness or injury.Preventive Care Services

Health plans typically cover preventive care services, such as routine check-ups, screenings, and vaccinations. These services can help detect health problems early, and prevent chronic conditions from developing.How Health Plans Work

Choosing the Right Health Plan

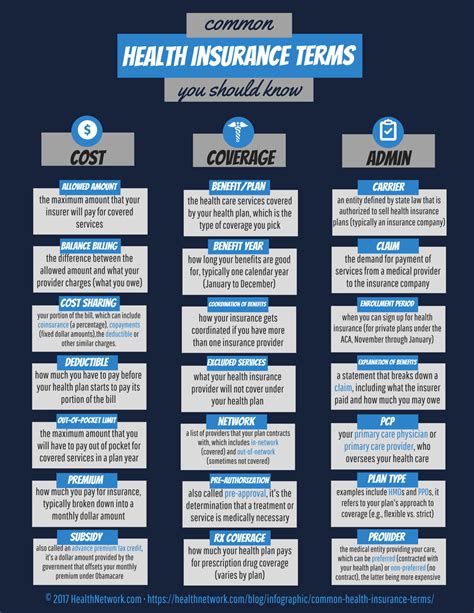

Choosing the right health plan can be overwhelming, with so many options available. Here are some tips to help you make an informed decision: * Consider your health needs and budget * Research different types of health plans, and their benefits * Compare premiums, deductibles, and out-of-pocket maximums * Check the network of participating providers * Read reviews and ask for referrals from friends and familyCommon Health Plan Terms

Premium

The premium is the amount you pay for coverage, which can vary depending on the plan and your age. Premiums can be paid monthly or annually, and may be tax-deductible.Deductible

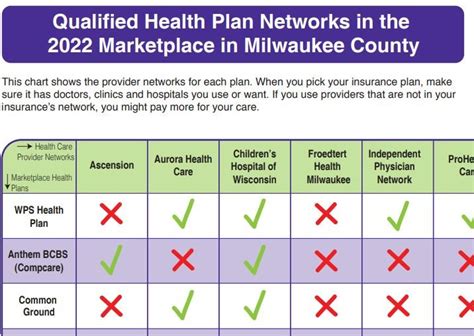

The deductible is the amount you pay out-of-pocket, before the health plan starts paying. Deductibles can vary depending on the plan, and may be waived for certain services, such as preventive care.Health Plan Networks

Primary Care Physicians

Primary care physicians are healthcare providers, who coordinate your care and refer you to specialists when necessary. They typically provide routine check-ups, screenings, and vaccinations.Specialists

Specialists are healthcare providers, who specialize in a particular area of medicine, such as cardiology or oncology. They typically provide more complex care, and may require a referral from a primary care physician.What is a health plan?

+A health plan is an insurance policy that covers medical expenses, in exchange for a premium.

What are the benefits of health plans?

+Health plans offer numerous benefits, including financial protection, access to preventive care services, and coverage for chronic condition management and treatment.

How do health plans work?

+Health plans work by providing coverage for medical services, in exchange for a premium. You pay a premium, and receive coverage for medical services, including doctor visits, hospital stays, and prescriptions.

In conclusion, having a health plan is essential for maintaining good health, and avoiding financial hardship. With so many options available, it's crucial to understand the different types of health plans, their benefits, and how they work. By choosing the right health plan, you can ensure that you and your family receive the medical care you need, without breaking the bank. We invite you to share your thoughts and experiences with health plans, and to ask any questions you may have. Together, we can navigate the complex healthcare system, and make informed decisions about our health.