Intro

Discover 5 Health Plans Washington offers, including medicare, individual, and family plans, with coverage options for dental, vision, and prescription medications, to find the best healthcare plan for your needs.

In the state of Washington, residents have a variety of health plan options to choose from, each with its unique benefits and drawbacks. With the ever-changing landscape of healthcare, it's essential to stay informed about the different types of health plans available. Whether you're an individual, family, or employer, selecting the right health plan can be a daunting task. In this article, we'll delve into the world of health plans in Washington, exploring the various options, their advantages, and what to consider when making a decision.

The importance of having a comprehensive health plan cannot be overstated. A good health plan provides financial protection against unexpected medical expenses, ensures access to quality care, and offers peace of mind. In Washington, residents can choose from a range of health plans, including individual and family plans, group plans, Medicare, and Medicaid. Each type of plan has its own set of benefits, deductibles, copays, and coinsurance, making it crucial to understand the details before enrolling.

With so many options available, it's natural to feel overwhelmed. However, by taking the time to research and compare different health plans, individuals can make informed decisions that meet their unique needs and budget. In this article, we'll provide an in-depth look at five health plans available in Washington, discussing their features, advantages, and disadvantages. Whether you're looking for a plan with low premiums, comprehensive coverage, or a wide network of providers, we'll help you navigate the complex world of health insurance.

Introduction to Health Plans in Washington

Washington state offers a range of health plans, including those offered through the Washington Healthplanfinder, the state's health insurance marketplace. The Washington Healthplanfinder allows individuals and families to compare and enroll in health plans from various insurance companies, including Premera Blue Cross, Kaiser Permanente, and UnitedHealthcare. In addition to these plans, Washington residents can also purchase health insurance directly from insurance companies or through a licensed broker.

Types of Health Plans in Washington

There are several types of health plans available in Washington, each with its unique characteristics. These include: * Individual and family plans: These plans are designed for individuals and families who do not have access to group coverage through an employer. * Group plans: These plans are offered through employers and provide coverage to employees and their families. * Medicare: This federal program provides health coverage to individuals 65 and older, as well as certain younger individuals with disabilities. * Medicaid: This joint federal-state program provides health coverage to low-income individuals and families.5 Health Plans in Washington

Here are five health plans available in Washington, along with their features and benefits:

- Premera Blue Cross: Premera Blue Cross is a popular health insurance option in Washington, offering a range of plans with varying levels of coverage. Their plans include preventive care, hospital stays, and prescription medication coverage.

- Kaiser Permanente: Kaiser Permanente is a non-profit health plan that offers comprehensive coverage, including medical, dental, and vision care. Their plans are known for their emphasis on preventive care and wellness.

- UnitedHealthcare: UnitedHealthcare is a national health insurance company that offers a range of plans in Washington, including individual and family plans, group plans, and Medicare Advantage plans.

- Ambetter: Ambetter is a health insurance company that offers affordable plans with a range of coverage options. Their plans include preventive care, hospital stays, and prescription medication coverage.

- Molina Healthcare: Molina Healthcare is a health insurance company that offers Medicaid and Medicare plans, as well as individual and family plans. Their plans are designed to provide comprehensive coverage at an affordable cost.

Benefits and Drawbacks of Each Plan

Each of the five health plans in Washington has its benefits and drawbacks. For example: * Premera Blue Cross plans are known for their comprehensive coverage, but may have higher premiums. * Kaiser Permanente plans emphasize preventive care, but may have limited provider networks. * UnitedHealthcare plans offer a wide range of coverage options, but may have higher deductibles. * Ambetter plans are affordable, but may have limited coverage for certain services. * Molina Healthcare plans are designed for low-income individuals and families, but may have limited provider networks.How to Choose a Health Plan in Washington

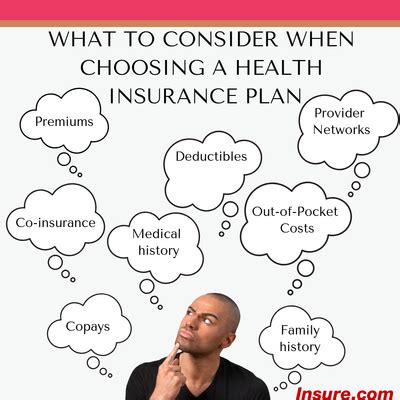

Choosing a health plan in Washington can be a complex process, but there are several factors to consider when making a decision. These include:

- Premiums: The monthly cost of the plan, which can vary depending on the level of coverage and the insurance company.

- Deductibles: The amount that must be paid out-of-pocket before the insurance company begins to pay for covered services.

- Copays: The amount that must be paid for each doctor visit or prescription medication.

- Coinsurance: The percentage of costs that must be paid for covered services after the deductible has been met.

- Provider network: The list of doctors, hospitals, and other healthcare providers that participate in the plan's network.

- Coverage: The types of services and treatments that are covered under the plan, including preventive care, hospital stays, and prescription medication.

Additional Considerations

In addition to the factors listed above, there are several other considerations to keep in mind when choosing a health plan in Washington. These include: * **Pre-existing conditions**: If you have a pre-existing condition, you may want to choose a plan that covers that condition without exclusions or limitations. * **Prescription medication**: If you take prescription medication, you may want to choose a plan that covers your medication without high copays or coinsurance. * **Mental health and substance abuse coverage**: If you or a family member needs mental health or substance abuse treatment, you may want to choose a plan that covers these services.Conclusion and Next Steps

In conclusion, choosing a health plan in Washington requires careful consideration of several factors, including premiums, deductibles, copays, coinsurance, provider network, and coverage. By taking the time to research and compare different health plans, individuals can make informed decisions that meet their unique needs and budget. If you're looking for a health plan in Washington, we encourage you to explore the options available through the Washington Healthplanfinder or by contacting a licensed broker.

We invite you to share your thoughts and experiences with health plans in Washington in the comments below. Have you had a positive or negative experience with a particular health plan? What factors do you consider when choosing a health plan? Your input can help others make informed decisions about their health insurance.

What is the Washington Healthplanfinder?

+The Washington Healthplanfinder is the state's health insurance marketplace, where individuals and families can compare and enroll in health plans from various insurance companies.

What types of health plans are available in Washington?

+There are several types of health plans available in Washington, including individual and family plans, group plans, Medicare, and Medicaid.

How do I choose a health plan in Washington?

+To choose a health plan in Washington, consider factors such as premiums, deductibles, copays, coinsurance, provider network, and coverage. You can also contact a licensed broker or explore options through the Washington Healthplanfinder.