Intro

Learn about HMO insurance definition, benefits, and coverage. Understand Health Maintenance Organization plans, networks, and costs, and how they differ from other health insurance types, including PPOs and EPOs, to make informed decisions about your healthcare coverage.

The concept of health insurance is not new, and over the years, various models have emerged to cater to the diverse needs of individuals and families. One such model is the Health Maintenance Organization (HMO) insurance. Understanding what HMO insurance entails is crucial for making informed decisions about health coverage. In this article, we will delve into the definition, benefits, and workings of HMO insurance, providing a comprehensive overview for those seeking to navigate the complex landscape of health insurance options.

HMO insurance has been a part of the health insurance landscape for decades, offering a unique approach to healthcare delivery. At its core, an HMO is a type of health insurance plan that provides coverage for a range of healthcare services in exchange for a monthly premium. The defining feature of an HMO is its network of healthcare providers, which includes doctors, hospitals, and other medical facilities that have agreed to provide services to HMO members at negotiated rates. This network-based approach is designed to control costs and improve the quality of care by promoting preventive care and early intervention.

The importance of understanding HMO insurance cannot be overstated, especially in today's healthcare environment. With the rising costs of medical care and the increasing complexity of health insurance options, individuals and families need to be well-informed about the different types of health plans available. HMO insurance, with its emphasis on preventive care and network-based delivery, offers a distinct alternative to other types of health insurance plans. By exploring the ins and outs of HMO insurance, readers can gain valuable insights into how this model works, its benefits and drawbacks, and how it compares to other health insurance options.

HMO Insurance Definition and How It Works

To grasp the concept of HMO insurance, it's essential to understand its core components and how they interact. An HMO plan typically requires members to receive medical care from a specific network of providers, except in emergency situations. This network includes primary care physicians (PCPs), specialists, hospitals, and other healthcare facilities that have contracted with the HMO to provide services at predetermined rates. Members usually select a PCP from the network, who then coordinates their care, including referrals to specialists when necessary.

The workings of an HMO plan are designed to promote efficiency, quality, and cost-effectiveness. By limiting care to network providers, HMOs can negotiate lower rates for services, which helps keep premiums lower for members. Additionally, the emphasis on preventive care and the coordination of services by a PCP can lead to better health outcomes and reduced healthcare costs in the long run.

Key Components of HMO Insurance

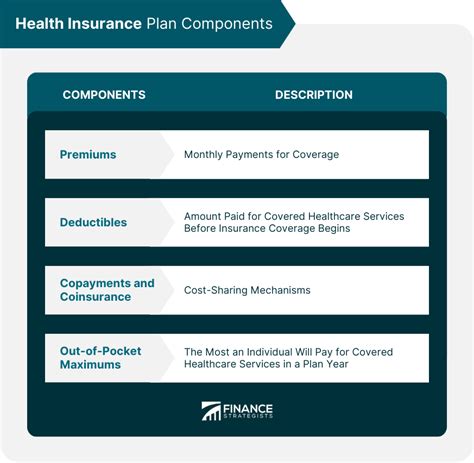

Some key components of HMO insurance include:

- Network of Providers: HMOs have a network of healthcare providers who have agreed to provide services to members at negotiated rates.

- Primary Care Physician (PCP): Members typically select a PCP from the network, who coordinates their care and provides referrals to specialists.

- Preventive Care: HMO plans often emphasize preventive care, including routine check-ups, screenings, and health education, to promote early detection and treatment of health issues.

- Referrals: To see a specialist, members usually need a referral from their PCP, although some HMO plans may allow direct access to certain specialists without a referral.

Benefits of HMO Insurance

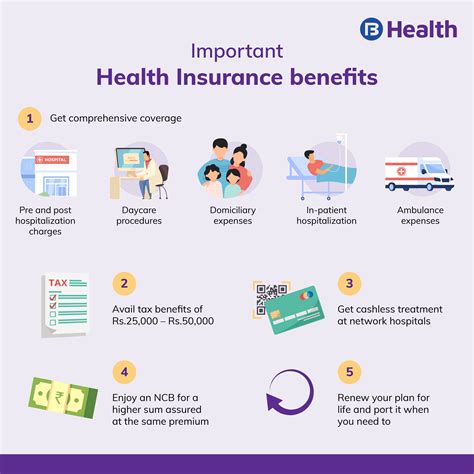

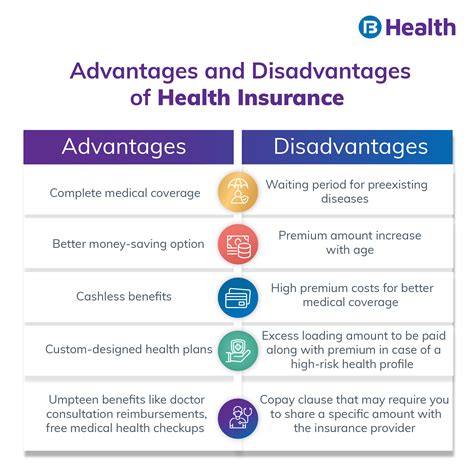

HMO insurance offers several benefits to its members, including:

- Cost Savings: By negotiating rates with providers and emphasizing preventive care, HMOs can offer lower premiums compared to other types of health insurance plans.

- Coordinated Care: The PCP acts as a gatekeeper, ensuring that members receive coordinated and comprehensive care, which can lead to better health outcomes.

- Preventive Care Focus: The emphasis on preventive care can help members avoid more severe and costly health issues down the line.

- Access to a Network of Providers: Members have access to a network of healthcare providers who are committed to delivering high-quality care.

Drawbacks of HMO Insurance

While HMO insurance has its advantages, there are also some drawbacks to consider:

- Limited Provider Choice: Members are generally limited to receiving care from providers within the HMO's network, which may not include all the healthcare providers in their area.

- Referral Requirements: The need for a referral to see a specialist can sometimes delay care, although this can also ensure that members receive necessary and appropriate care.

- Out-of-Network Care: Receiving care from providers outside the network can result in higher out-of-pocket costs or even no coverage at all, except in emergency situations.

HMO vs. Other Health Insurance Plans

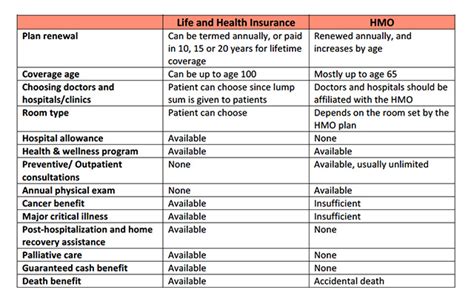

When choosing a health insurance plan, individuals and families often compare HMOs with other types of plans, such as Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans. Each type of plan has its unique features, benefits, and drawbacks.

- PPO Plans: Offer more flexibility than HMOs by allowing members to receive care from both in-network and out-of-network providers, although out-of-network care is typically more expensive.

- EPO Plans: Similar to HMOs but do not cover care from out-of-network providers except in emergencies.

- POS Plans: Combine elements of HMOs and PPOs, allowing members to choose between receiving care from in-network providers (with a referral) or out-of-network providers at a higher cost.

Choosing the Right Health Insurance Plan

Selecting the right health insurance plan depends on various factors, including personal health needs, budget, and preferences regarding provider choice and flexibility. For those who value coordinated care, are willing to choose providers from a network, and prioritize cost savings, an HMO plan might be the most suitable option. On the other hand, individuals who require more flexibility in choosing healthcare providers or anticipate needing care from specialists frequently might find other types of plans more appealing.

Future of HMO Insurance

The healthcare landscape is continually evolving, with changes in policy, technology, and consumer expectations influencing the development of health insurance models. The future of HMO insurance will likely be shaped by efforts to enhance quality, improve patient experience, and reduce costs. Innovations such as telemedicine, personalized medicine, and value-based care models are expected to play significant roles in the evolution of HMOs and other health insurance plans.

As healthcare systems worldwide strive for better outcomes at lower costs, the principles underlying HMO insurance—emphasis on preventive care, coordination of services, and cost containment—will remain relevant. However, the way these principles are implemented may change, with greater emphasis on patient-centered care, digital health technologies, and data-driven decision-making.

Impact of Technology on HMO Insurance

Technology is poised to significantly impact the delivery and administration of HMO insurance. Digital platforms can enhance patient engagement, improve access to care through telehealth services, and facilitate more efficient communication between providers and patients. Additionally, data analytics and artificial intelligence can help in predicting health risks, personalizing care plans, and optimizing network performance.

The integration of technology into HMO plans can also streamline administrative tasks, such as claims processing and premium payments, making the overall experience more user-friendly for members. As technology continues to advance, it is likely to play an increasingly vital role in shaping the future of HMO insurance and healthcare delivery as a whole.

What is the primary difference between HMO and PPO health insurance plans?

+The primary difference between HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans is the flexibility in choosing healthcare providers. HMO plans require members to receive care from a specific network of providers, with some exceptions for emergency care, while PPO plans offer more flexibility by allowing members to see any healthcare provider, both in-network and out-of-network, although out-of-network care typically costs more.

Do HMO plans cover preventive care services?

+Yes, HMO plans typically cover preventive care services. In fact, one of the core principles of HMOs is the emphasis on preventive care to promote early detection and treatment of health issues, which can help reduce healthcare costs in the long run. Preventive services may include routine check-ups, vaccinations, screenings, and health education.

Can I see a specialist without a referral in an HMO plan?

+Generally, in an HMO plan, members need a referral from their primary care physician (PCP) to see a specialist. However, some HMO plans may allow direct access to certain specialists without a referral. It's essential to check the specifics of your plan to understand its referral policies.

In conclusion, HMO insurance represents a unique approach to health insurance that combines cost savings, coordinated care, and an emphasis on preventive services. While it offers several benefits, including lower premiums and a focus on preventive care, it also has its drawbacks, such as limited provider choice and the need for referrals to see specialists. As the healthcare landscape continues to evolve, understanding the nuances of HMO insurance and how it compares to other health insurance options is crucial for making informed decisions about health coverage. We invite readers to share their thoughts and experiences with HMO insurance, and we hope this comprehensive overview has provided valuable insights into the world of health maintenance organizations.