Intro

Maximize your golden years with 5 expert Kaiser Permanente retirement tips, covering healthcare, financial planning, and lifestyle strategies for a secure and happy post-work life, including Medicare, pensions, and social security benefits.

Planning for retirement is a crucial step in securing a comfortable and enjoyable post-work life. As one of the largest and most reputable healthcare providers in the United States, Kaiser Permanente offers its employees a comprehensive retirement plan. However, navigating the complexities of retirement planning can be overwhelming, especially for those who are new to the process. In this article, we will delve into the world of Kaiser Permanente retirement, exploring the various tips and strategies that can help employees make the most of their retirement benefits.

Kaiser Permanente's retirement plan is designed to provide employees with a secure financial future, allowing them to enjoy their golden years without worrying about money. The plan includes a range of benefits, such as pension plans, 401(k) matching, and health insurance coverage. However, to maximize these benefits, employees need to understand how the plan works and how to make the most of it. This is where Kaiser Permanente retirement tips come in – to guide employees through the process and help them make informed decisions about their retirement.

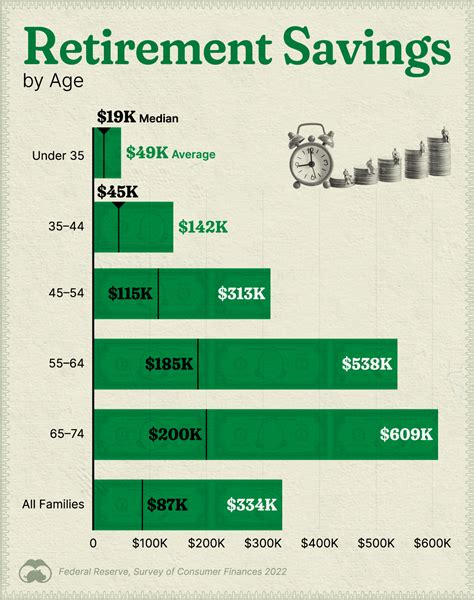

The importance of retirement planning cannot be overstated. With the rising cost of living and the increasing burden of healthcare expenses, it is essential to have a solid plan in place to ensure a comfortable retirement. Kaiser Permanente's retirement plan is a valuable resource, but it is only effective if employees take an active role in planning and managing their benefits. By understanding the various components of the plan and how they work together, employees can create a personalized retirement strategy that meets their unique needs and goals.

Kaiser Permanente Retirement Plan Overview

Understanding the Pension Plan

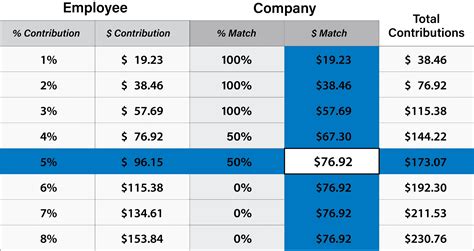

The pension plan is a critical component of the Kaiser Permanente retirement package. It provides a guaranteed income stream in retirement, allowing employees to enjoy a predictable and stable financial future. The plan is based on a formula that takes into account an employee's salary and years of service, providing a guaranteed benefit amount in retirement. To maximize the pension plan, employees should aim to work for Kaiser Permanente for as long as possible, as this will increase their benefit amount.Maximizing 401(k) Matching

Health Insurance Coverage in Retirement

Health insurance coverage is a critical component of the Kaiser Permanente retirement plan. It provides employees with access to comprehensive medical coverage in retirement, allowing them to enjoy good health and well-being without worrying about medical expenses. The plan includes a range of health insurance options, including Medicare Advantage plans and supplemental insurance coverage. To maximize health insurance coverage, employees should review and compare different plan options, choosing the one that best meets their needs and budget.Retirement Savings Strategies

Some key retirement savings strategies include:

- Starting to save early, even if it's just a small amount each month

- Contributing to a tax-deferred retirement account, such as an IRA or Roth IRA

- Reviewing and adjusting investment options regularly to ensure they align with retirement goals and risk tolerance

- Considering alternative retirement savings options, such as annuities or real estate investment trusts (REITs)

Creating a Personalized Retirement Plan

Creating a personalized retirement plan is essential to maximizing Kaiser Permanente retirement benefits. This involves reviewing and understanding the various components of the plan, as well as considering individual retirement goals and needs. Employees should start by assessing their current financial situation, including their income, expenses, and savings. They should then review and compare different retirement plan options, choosing the one that best meets their needs and budget.Seeking Professional Advice

Some key benefits of seeking professional advice include:

- Personalized guidance and support

- Expert knowledge of retirement planning and investing

- Ability to create a tailored retirement strategy that meets individual needs and goals

- Ongoing monitoring and adjustment of retirement plan to ensure it remains on track

Staying Informed and Engaged

Staying informed and engaged is essential to maximizing Kaiser Permanente retirement benefits. This involves regularly reviewing and updating retirement plans, as well as staying up-to-date with changes to the plan and retirement laws. Employees should also participate in retirement seminars and workshops, which provide valuable information and insights on retirement planning and investing.Conclusion and Next Steps

We invite you to share your thoughts and experiences with Kaiser Permanente retirement planning in the comments below. What strategies have you used to maximize your retirement benefits? What challenges have you faced, and how have you overcome them? Your insights and feedback are invaluable in helping others navigate the complex world of retirement planning.

What is the Kaiser Permanente retirement plan?

+The Kaiser Permanente retirement plan is a comprehensive package that includes a range of benefits, such as pension plans, 401(k) matching, and health insurance coverage.

How do I maximize my 401(k) matching benefits?

+To maximize your 401(k) matching benefits, contribute as much as possible to your 401(k) account, and review and adjust your investment options regularly to ensure they align with your retirement goals and risk tolerance.

What are the key components of the Kaiser Permanente retirement plan?

+The key components of the Kaiser Permanente retirement plan include pension plans, 401(k) matching, and health insurance coverage.

How do I create a personalized retirement plan?

+To create a personalized retirement plan, review and understand the various components of the Kaiser Permanente retirement plan, assess your current financial situation, and consider your individual retirement goals and needs.

Why is it essential to seek professional advice when planning for retirement?

+Seeking professional advice is essential when planning for retirement because it provides personalized guidance and support, expert knowledge of retirement planning and investing, and the ability to create a tailored retirement strategy that meets individual needs and goals.