Intro

Compare HMO vs PPO health insurance plans, understanding key differences in network, costs, flexibility, and coverage to make informed decisions about managed care, healthcare providers, and out-of-pocket expenses.

The world of health insurance can be complex and overwhelming, with numerous options and plans to choose from. Two of the most popular types of health insurance plans are Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans. While both types of plans have their advantages and disadvantages, they differ in several key ways. In this article, we will explore the 5 key differences between HMO and PPO plans, helping you make an informed decision about which type of plan is best for you.

When it comes to choosing a health insurance plan, it's essential to consider your individual needs and circumstances. Do you prioritize flexibility and freedom to choose your healthcare providers, or do you prefer a more structured approach to healthcare with lower out-of-pocket costs? Understanding the differences between HMO and PPO plans can help you make a decision that aligns with your priorities and budget.

The differences between HMO and PPO plans can have a significant impact on your healthcare experience and expenses. From network restrictions to out-of-pocket costs, each type of plan has its unique characteristics. By understanding these differences, you can make an informed decision about which type of plan is best for you and your family.

Introduction to HMO and PPO Plans

What is an HMO Plan?

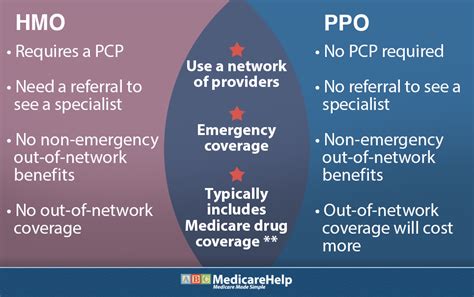

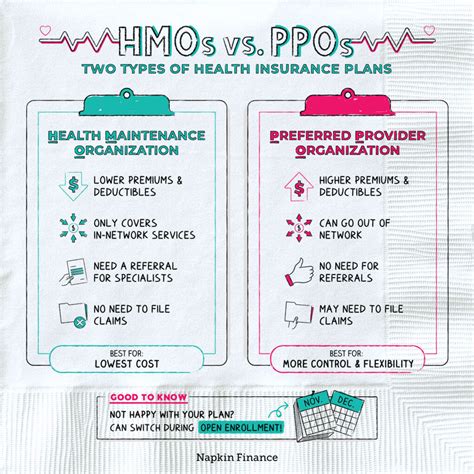

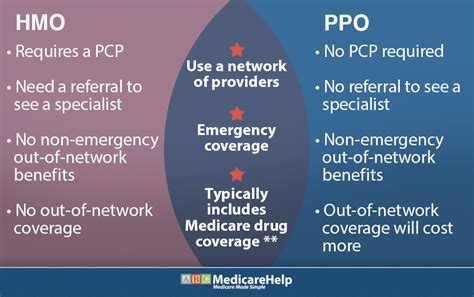

An HMO plan is a type of health insurance plan that emphasizes preventive care and requires policyholders to receive medical care from a specific network of providers. HMO plans typically have lower out-of-pocket costs, but they also come with more restrictions on healthcare providers and services. With an HMO plan, you will need to choose a primary care physician (PCP) who will coordinate your care and refer you to specialists within the network.What is a PPO Plan?

A PPO plan, on the other hand, offers more flexibility and freedom to choose healthcare providers. With a PPO plan, you can receive care from any healthcare provider, both in-network and out-of-network. While PPO plans often come with higher out-of-pocket costs, they also provide more options and flexibility when it comes to choosing healthcare providers.Key Differences Between HMO and PPO Plans

1. Network Restrictions

One of the main differences between HMO and PPO plans is the level of network restrictions. HMO plans require policyholders to receive care from a specific network of providers, while PPO plans allow policyholders to receive care from any healthcare provider, both in-network and out-of-network. With an HMO plan, you will need to choose a PCP who will coordinate your care and refer you to specialists within the network. In contrast, PPO plans offer more flexibility and freedom to choose healthcare providers.2. Out-of-Pocket Costs

Another key difference between HMO and PPO plans is the level of out-of-pocket costs. HMO plans typically have lower out-of-pocket costs, including lower deductibles, copays, and coinsurance. PPO plans, on the other hand, often come with higher out-of-pocket costs, including higher deductibles, copays, and coinsurance. However, PPO plans may offer more flexibility and options when it comes to choosing healthcare providers.3. Referrals and Pre-Authorizations

HMO plans often require referrals from a PCP to see a specialist, while PPO plans do not require referrals. Additionally, HMO plans may require pre-authorizations for certain services or procedures, while PPO plans may not require pre-authorizations. This can be an important consideration if you need to see a specialist or require ongoing care.4. Provider Choice

PPO plans offer more flexibility and freedom to choose healthcare providers, both in-network and out-of-network. With a PPO plan, you can receive care from any healthcare provider, without the need for a referral from a PCP. HMO plans, on the other hand, require policyholders to receive care from a specific network of providers.5. Cost and Premiums

Finally, the cost and premiums of HMO and PPO plans can differ significantly. HMO plans are often less expensive than PPO plans, with lower premiums and out-of-pocket costs. However, PPO plans may offer more flexibility and options when it comes to choosing healthcare providers, which can be an important consideration for some individuals and families.Benefits and Drawbacks of HMO and PPO Plans

Benefits of HMO Plans

The benefits of HMO plans include: * Lower out-of-pocket costs * Emphasis on preventive care * Structured approach to healthcare * Often less expensive than PPO plansDrawbacks of HMO Plans

The drawbacks of HMO plans include: * Network restrictions * Referrals required to see a specialist * Pre-authorizations may be required * Less flexibility and freedom to choose healthcare providersBenefits of PPO Plans

The benefits of PPO plans include: * More flexibility and freedom to choose healthcare providers * No referrals required to see a specialist * No pre-authorizations required * Often more comprehensive coverageDrawbacks of PPO Plans

The drawbacks of PPO plans include: * Higher out-of-pocket costs * Higher premiums * More complex and confusing than HMO plansChoosing the Right Plan for You

By answering these questions and considering your individual needs and circumstances, you can make an informed decision about which type of plan is best for you and your family.

Conclusion and Next Steps

We invite you to share your thoughts and experiences with HMO and PPO plans in the comments below. Have you had a positive or negative experience with one of these plans? What factors do you consider when choosing a health insurance plan? By sharing your insights and perspectives, you can help others make informed decisions about their health insurance needs.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the level of network restrictions and flexibility to choose healthcare providers. HMO plans require policyholders to receive care from a specific network of providers, while PPO plans allow policyholders to receive care from any healthcare provider, both in-network and out-of-network.

Which type of plan is best for someone who wants flexibility and freedom to choose healthcare providers?

+A PPO plan is best for someone who wants flexibility and freedom to choose healthcare providers. With a PPO plan, you can receive care from any healthcare provider, both in-network and out-of-network, without the need for a referral from a PCP.

What are the benefits of an HMO plan?

+The benefits of an HMO plan include lower out-of-pocket costs, emphasis on preventive care, and a structured approach to healthcare. HMO plans are often less expensive than PPO plans and may be a good option for someone who wants a more predictable and affordable healthcare experience.