Intro

Discover 5 ways to calculate costs, including fixed, variable, and overhead expenses, to optimize financial management and reduce expenditure with effective cost estimation techniques and budgeting strategies.

Calculating costs is an essential aspect of personal finance, business management, and economic analysis. Understanding the different methods of calculating costs can help individuals and organizations make informed decisions, optimize resources, and achieve their financial goals. In this article, we will explore five ways to calculate costs, including their benefits, limitations, and applications.

The importance of calculating costs cannot be overstated. Accurate cost calculation helps individuals and businesses to budget, forecast, and make strategic decisions. It also enables them to identify areas of inefficiency, reduce waste, and improve profitability. Moreover, cost calculation is crucial in evaluating the feasibility of projects, investments, and business ventures. By understanding the various methods of calculating costs, individuals and organizations can develop a comprehensive approach to financial management and decision-making.

In today's fast-paced and competitive business environment, calculating costs is more critical than ever. With the rise of globalization, technological advancements, and changing consumer behaviors, companies must be agile and responsive to stay ahead of the curve. By adopting effective cost calculation methods, businesses can respond quickly to market changes, capitalize on new opportunities, and maintain a competitive edge. Furthermore, accurate cost calculation helps individuals and organizations to mitigate risks, ensure sustainability, and achieve long-term success.

Introduction to Cost Calculation Methods

Absorption Costing Method

Benefits of Absorption Costing

The absorption costing method offers several benefits, including: * Provides a comprehensive picture of costs * Helps businesses to determine the full cost of production * Enables companies to calculate the cost of goods sold * Facilitates budgeting and forecastingLimitations of Absorption Costing

However, the absorption costing method also has some limitations: * Can be complex and time-consuming to implement * May not accurately reflect the variable costs of production * Can lead to over-absorption or under-absorption of costsMarginal Costing Method

Benefits of Marginal Costing

The marginal costing method offers several benefits, including: * Provides a clear picture of the contribution margin * Helps businesses to make short-term decisions * Enables companies to calculate the break-even point * Facilitates cost-volume-profit analysisLimitations of Marginal Costing

However, the marginal costing method also has some limitations: * May not accurately reflect the fixed costs of production * Can lead to under-pricing or over-pricing of products * May not provide a comprehensive picture of costsStandard Costing Method

Benefits of Standard Costing

The standard costing method offers several benefits, including: * Provides a clear picture of the standard cost * Helps businesses to budget and forecast * Enables companies to calculate the variance between actual and standard costs * Facilitates cost control and reductionLimitations of Standard Costing

However, the standard costing method also has some limitations: * May not accurately reflect the actual costs of production * Can lead to over-standardization or under-standardization of costs * May not provide a comprehensive picture of costsActivity-Based Costing Method

Benefits of Activity-Based Costing

The activity-based costing method offers several benefits, including: * Provides a clear picture of the costs of activities * Helps businesses to identify areas of inefficiency * Enables companies to calculate the cost of activities * Facilitates cost reduction and improvementLimitations of Activity-Based Costing

However, the activity-based costing method also has some limitations: * Can be complex and time-consuming to implement * May require significant changes to existing cost accounting systems * Can lead to over-assignment or under-assignment of costsLean Costing Method

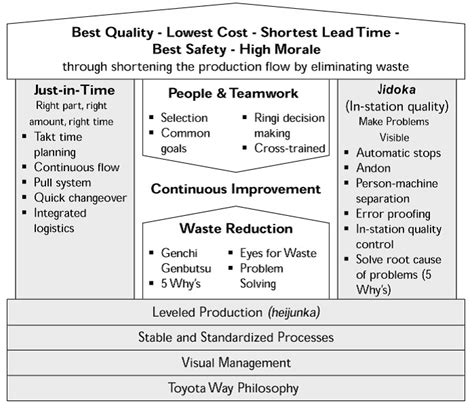

Benefits of Lean Costing

The lean costing method offers several benefits, including: * Provides a clear picture of the costs of waste * Helps businesses to identify areas of inefficiency * Enables companies to calculate the cost of waste * Facilitates cost reduction and improvementLimitations of Lean Costing

However, the lean costing method also has some limitations: * Can be complex and time-consuming to implement * May require significant changes to existing cost accounting systems * Can lead to over-assignment or under-assignment of costsWhat is the difference between absorption costing and marginal costing?

+Absorption costing involves assigning all costs, including fixed and variable costs, to products or services, while marginal costing focuses on the variable costs of production.

What are the benefits of activity-based costing?

+Activity-based costing provides a clear picture of the costs of activities, helps businesses to identify areas of inefficiency, and enables companies to calculate the cost of activities.

How does lean costing differ from traditional costing methods?

+Lean costing involves eliminating waste and optimizing costs, while traditional costing methods focus on assigning costs to products or services.

In conclusion, calculating costs is a critical aspect of personal finance, business management, and economic analysis. By understanding the different methods of calculating costs, individuals and organizations can develop a comprehensive approach to financial management and decision-making. Whether you are a business owner, manager, or individual, it is essential to choose the right cost calculation method to achieve your financial goals. We invite you to share your thoughts and experiences on cost calculation methods and how they have helped you to make informed decisions.