Intro

Open an HSA account easily with our guide, covering Health Savings Account benefits, eligibility, and investment options, to maximize tax-free medical expenses and retirement savings.

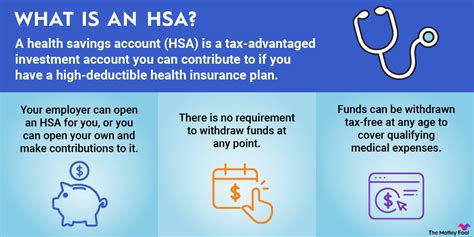

Opening a Health Savings Account (HSA) can be a great way to save money for medical expenses while also reducing your taxable income. With the rising costs of healthcare, it's essential to have a plan in place to manage your expenses. An HSA account can provide you with a tax-advantaged way to save for medical expenses, and it's easier to open one than you might think. In this article, we'll explore the benefits of having an HSA account, how to open one, and what you need to know to get started.

Having an HSA account can provide you with a sense of security and peace of mind, knowing that you have a dedicated fund for medical expenses. You can use the money in your HSA account to pay for a wide range of medical expenses, including doctor visits, prescriptions, and hospital stays. Additionally, the money in your HSA account grows tax-free, and you can withdraw it tax-free to pay for qualified medical expenses. This makes an HSA account an attractive option for anyone looking to save money on medical expenses.

The process of opening an HSA account is relatively straightforward. You can open an HSA account through a bank, credit union, or other financial institution that offers HSA accounts. You can also open an HSA account through your employer, if they offer one as part of their benefits package. To open an HSA account, you'll need to meet certain eligibility requirements, such as having a high-deductible health plan (HDHP). We'll explore these requirements in more detail later in this article.

Benefits of an HSA Account

- Tax advantages: Contributions to an HSA account are tax-deductible, and the money in your account grows tax-free.

- Flexibility: You can use the money in your HSA account to pay for a wide range of medical expenses, including doctor visits, prescriptions, and hospital stays.

- Portability: Your HSA account is portable, meaning you can take it with you if you change jobs or retire.

- Investment opportunities: You can invest the money in your HSA account in a variety of investments, such as stocks, bonds, and mutual funds.

How HSA Accounts Work

An HSA account is a type of savings account that's designed to help you save for medical expenses. You can contribute to your HSA account on a tax-free basis, and the money in your account grows tax-free. You can use the money in your HSA account to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays. If you use the money in your HSA account for non-medical expenses, you'll be subject to a penalty and income tax on the withdrawal.Eligibility Requirements for an HSA Account

- Having a high-deductible health plan (HDHP): To be eligible for an HSA account, you must have a high-deductible health plan (HDHP). An HDHP is a health plan that has a higher deductible than a traditional health plan.

- Not being eligible for Medicare: You're not eligible for an HSA account if you're eligible for Medicare.

- Not being claimed as a dependent on someone else's tax return: You're not eligible for an HSA account if you're claimed as a dependent on someone else's tax return.

How to Open an HSA Account

Opening an HSA account is relatively straightforward. You can open an HSA account through a bank, credit union, or other financial institution that offers HSA accounts. You can also open an HSA account through your employer, if they offer one as part of their benefits package. To open an HSA account, you'll need to provide some basic information, such as your name, address, and social security number. You'll also need to fund your HSA account, which you can do with a lump sum payment or through monthly contributions.Things to Consider When Opening an HSA Account

- Fees: Some HSA accounts come with fees, such as monthly maintenance fees or investment fees. Be sure to understand the fees associated with your HSA account before you open it.

- Investment options: If you want to invest the money in your HSA account, be sure to choose an account that offers investment options that align with your goals and risk tolerance.

- Customer service: Be sure to choose an HSA account provider that offers good customer service, in case you have questions or need help with your account.

HSA Account Contribution Limits

The contribution limits for an HSA account vary from year to year. For 2022, the contribution limit for an individual is $3,650, and the contribution limit for a family is $7,300. You can contribute to your HSA account at any time during the year, and you can also contribute to your HSA account through your employer, if they offer one as part of their benefits package.Using Your HSA Account for Medical Expenses

- Doctor visits

- Prescriptions

- Hospital stays

- Surgical procedures

- Medical equipment and supplies

You can also use the money in your HSA account to pay for expenses related to your spouse or dependents, as long as they're qualified medical expenses.

Qualified Medical Expenses

To be eligible for reimbursement from your HSA account, your medical expenses must be qualified medical expenses. Some examples of qualified medical expenses include:- Medical care: This includes doctor visits, hospital stays, and surgical procedures.

- Prescriptions: This includes prescription medications and equipment, such as insulin pumps and supplies.

- Medical equipment and supplies: This includes items such as wheelchairs, walkers, and hospital beds.

- Transportation: This includes transportation to and from medical appointments, as well as transportation for medical purposes, such as to pick up prescriptions.

HSA Account Investment Options

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

When choosing investment options for your HSA account, be sure to consider your goals and risk tolerance. You may also want to consider consulting with a financial advisor to help you choose the best investment options for your HSA account.

Investing in Your HSA Account

Investing in your HSA account can help your money grow over time, allowing you to build a larger nest egg for medical expenses. When investing in your HSA account, be sure to consider the following:- Fees: Some investment options come with fees, such as management fees or trading fees. Be sure to understand the fees associated with your investment options before you invest.

- Risk: Investing in your HSA account involves risk, including the risk of losing some or all of your investment. Be sure to consider your risk tolerance before investing in your HSA account.

- Diversification: Diversifying your investments can help you manage risk and increase your potential for returns. Be sure to consider diversifying your investments across different asset classes, such as stocks, bonds, and mutual funds.

Common Mistakes to Avoid with HSA Accounts

- Using your HSA account for non-medical expenses: If you use your HSA account for non-medical expenses, you'll be subject to a penalty and income tax on the withdrawal.

- Not keeping receipts: You'll need to keep receipts for your medical expenses, in case you're audited by the IRS.

- Not understanding the rules: Be sure to understand the rules and regulations surrounding HSA accounts, including the eligibility requirements and contribution limits.

Best Practices for HSA Accounts

To get the most out of your HSA account, be sure to follow these best practices:- Contribute regularly: Contributing to your HSA account on a regular basis can help you build a larger nest egg for medical expenses.

- Invest wisely: Investing your HSA account can help your money grow over time, allowing you to build a larger nest egg for medical expenses.

- Keep receipts: Keeping receipts for your medical expenses can help you keep track of your expenses and ensure that you're eligible for reimbursement from your HSA account.

What is an HSA account?

+An HSA account is a type of savings account that's designed to help you save for medical expenses. You can contribute to your HSA account on a tax-free basis, and the money in your account grows tax-free.

How do I open an HSA account?

+You can open an HSA account through a bank, credit union, or other financial institution that offers HSA accounts. You can also open an HSA account through your employer, if they offer one as part of their benefits package.

What are the benefits of an HSA account?

+The benefits of an HSA account include tax advantages, flexibility, and portability. You can use the money in your HSA account to pay for a wide range of medical expenses, and you can take your HSA account with you if you change jobs or retire.

In final thoughts, opening an HSA account can be a great way to save money for medical expenses while also reducing your taxable income. By understanding the benefits and rules surrounding HSA accounts, you can make informed decisions about your healthcare and finances. We encourage you to share this article with others who may benefit from learning about HSA accounts, and to take the first step in opening your own HSA account today.