Intro

Discover expert 5 Tips for Individual Health Coverage, including affordable plans, deductible options, and preventive care, to ensure comprehensive medical insurance and financial protection for yourself and your loved ones.

As the healthcare landscape continues to evolve, individual health coverage has become an essential consideration for many people. With the rising costs of medical care and the increasing complexity of healthcare systems, having the right insurance coverage can make all the difference in ensuring access to quality care and protecting one's financial well-being. In this article, we will delve into the world of individual health coverage, exploring its importance, benefits, and key considerations for those seeking to navigate this complex and often confusing terrain.

The importance of individual health coverage cannot be overstated. Without adequate insurance, individuals and families may find themselves facing significant financial burdens in the event of a medical emergency or chronic illness. Moreover, the lack of coverage can lead to delayed or foregone care, exacerbating health problems and reducing overall well-being. As such, it is crucial for individuals to understand their options and make informed decisions about their health insurance needs.

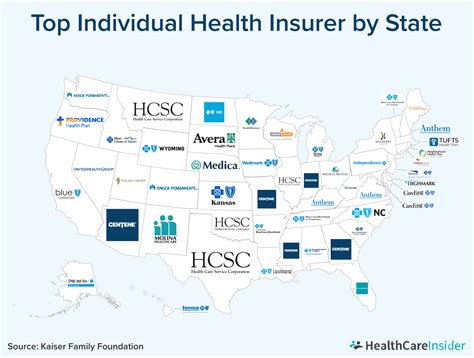

In recent years, the individual health insurance market has undergone significant changes, driven in part by regulatory reforms and shifting consumer preferences. Today, individuals have a wider range of options than ever before, from traditional major medical plans to alternative arrangements such as short-term limited-duration insurance and health sharing ministries. While these options can provide greater flexibility and affordability, they also introduce new complexities and trade-offs that individuals must carefully consider.

Understanding Individual Health Coverage Options

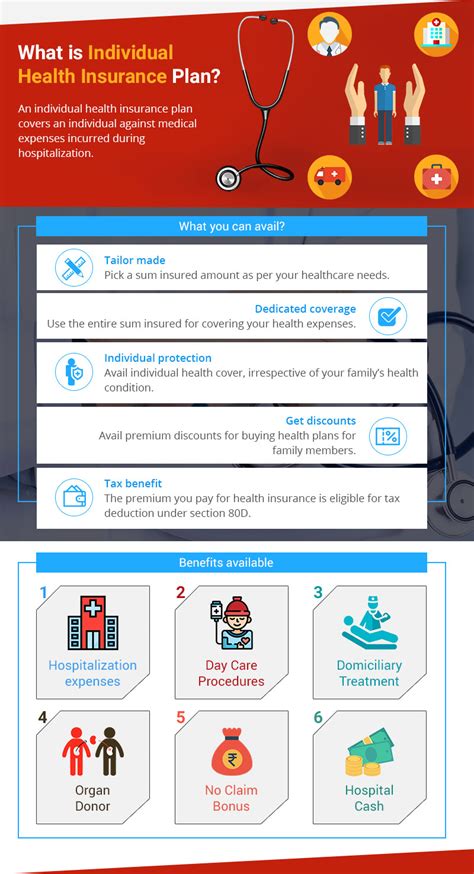

When it comes to individual health coverage, there are several key options to consider. These include major medical plans, which provide comprehensive coverage for essential health benefits, as well as alternative arrangements such as short-term limited-duration insurance and health sharing ministries. Major medical plans are typically more comprehensive, covering a wide range of services including doctor visits, hospital stays, and prescription medications. Alternative arrangements, on the other hand, may offer more limited coverage at a lower cost, but often come with significant trade-offs in terms of benefits and provider networks.

Major Medical Plans

Major medical plans are the most comprehensive type of individual health coverage, providing essential health benefits such as ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, laboratory services, preventive and wellness services, and pediatric services. These plans are typically more expensive than alternative arrangements, but offer greater financial protection and access to care.Alternative Arrangements

Alternative arrangements, such as short-term limited-duration insurance and health sharing ministries, offer more limited coverage at a lower cost. Short-term limited-duration insurance, for example, provides temporary coverage for a specified period, typically up to 12 months. These plans often have lower premiums than major medical plans, but may not cover pre-existing conditions and typically do not provide essential health benefits. Health sharing ministries, on the other hand, are faith-based organizations that allow members to share medical expenses. While these arrangements can be more affordable, they often come with significant limitations and may not provide the same level of financial protection as major medical plans.Benefits of Individual Health Coverage

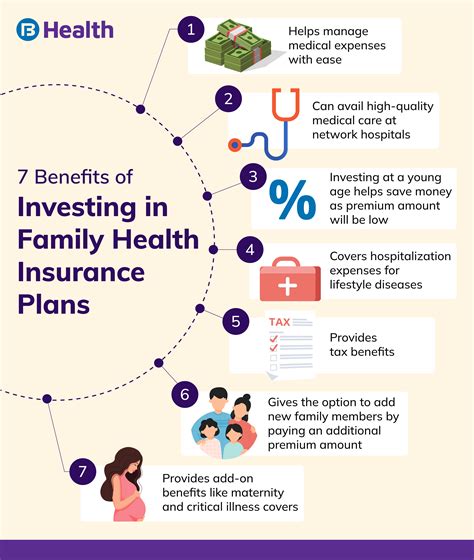

Individual health coverage offers numerous benefits, from financial protection to improved health outcomes. With the right insurance coverage, individuals can access necessary care without fear of incurring significant medical debt. This, in turn, can lead to better health outcomes, as individuals are more likely to seek preventive care and address health problems early on. Additionally, individual health coverage can provide peace of mind, reducing stress and anxiety related to medical expenses.

Some of the key benefits of individual health coverage include:

- Financial protection: Individual health coverage can help protect against significant medical expenses, reducing the risk of financial ruin.

- Access to care: With the right insurance coverage, individuals can access necessary care, including preventive services, diagnostic tests, and treatments.

- Improved health outcomes: By accessing necessary care, individuals can improve their health outcomes, reducing the risk of complications and improving overall well-being.

- Peace of mind: Individual health coverage can provide peace of mind, reducing stress and anxiety related to medical expenses.

Financial Protection

Financial protection is one of the most significant benefits of individual health coverage. Without adequate insurance, individuals may face significant medical expenses, leading to financial ruin. With the right coverage, individuals can protect themselves against these expenses, ensuring that they can access necessary care without breaking the bank.Access to Care

Access to care is another critical benefit of individual health coverage. With the right insurance coverage, individuals can access necessary care, including preventive services, diagnostic tests, and treatments. This, in turn, can lead to better health outcomes, as individuals are more likely to seek care early on and address health problems before they become more serious.Steps to Choose the Right Individual Health Coverage

Choosing the right individual health coverage can be a daunting task, particularly given the complexity of the healthcare landscape. However, by following a few key steps, individuals can make informed decisions about their insurance needs. These steps include:

- Assessing insurance needs: Individuals should assess their insurance needs, considering factors such as age, health status, and financial situation.

- Researching options: Individuals should research their options, considering major medical plans, alternative arrangements, and other types of coverage.

- Comparing plans: Individuals should compare plans, considering factors such as premiums, deductibles, copays, and coinsurance.

- Evaluating provider networks: Individuals should evaluate provider networks, ensuring that their preferred providers are included in the network.

- Reviewing plan details: Individuals should review plan details, considering factors such as coverage, exclusions, and limitations.

Assessing Insurance Needs

Assessing insurance needs is the first step in choosing the right individual health coverage. Individuals should consider factors such as age, health status, and financial situation, as these can impact insurance needs. For example, younger individuals may require less comprehensive coverage, while older individuals may require more comprehensive coverage.Researching Options

Researching options is the next step in choosing the right individual health coverage. Individuals should consider major medical plans, alternative arrangements, and other types of coverage, weighing the pros and cons of each. This may involve consulting with insurance brokers, conducting online research, and reviewing plan documents.Common Mistakes to Avoid

When it comes to individual health coverage, there are several common mistakes to avoid. These include:

- Failing to assess insurance needs: Individuals should assess their insurance needs, considering factors such as age, health status, and financial situation.

- Not researching options: Individuals should research their options, considering major medical plans, alternative arrangements, and other types of coverage.

- Not comparing plans: Individuals should compare plans, considering factors such as premiums, deductibles, copays, and coinsurance.

- Not evaluating provider networks: Individuals should evaluate provider networks, ensuring that their preferred providers are included in the network.

- Not reviewing plan details: Individuals should review plan details, considering factors such as coverage, exclusions, and limitations.

Failing to Assess Insurance Needs

Failing to assess insurance needs is one of the most common mistakes individuals make when it comes to individual health coverage. Without a clear understanding of insurance needs, individuals may choose plans that are inadequate or overly comprehensive, leading to financial strain or reduced access to care.Not Researching Options

Not researching options is another common mistake individuals make when it comes to individual health coverage. Without a thorough understanding of the options available, individuals may choose plans that are not well-suited to their needs, leading to reduced access to care or financial strain.Conclusion and Next Steps

In conclusion, individual health coverage is a critical consideration for many people, providing financial protection, access to care, and improved health outcomes. By understanding the options available, assessing insurance needs, researching options, comparing plans, evaluating provider networks, and reviewing plan details, individuals can make informed decisions about their insurance needs. Whether you are seeking to purchase individual health coverage for the first time or are looking to switch plans, it is essential to approach the process with care and attention to detail.

We invite you to share your thoughts and experiences with individual health coverage in the comments below. Have you navigated the individual health insurance market? What challenges did you face, and how did you overcome them? Your insights can help others make informed decisions about their insurance needs.

What is individual health coverage?

+Individual health coverage refers to health insurance that is purchased by an individual or family, rather than through an employer or other group.

What are the benefits of individual health coverage?

+The benefits of individual health coverage include financial protection, access to care, and improved health outcomes. With the right insurance coverage, individuals can access necessary care without fear of incurring significant medical debt.

How do I choose the right individual health coverage?

+To choose the right individual health coverage, individuals should assess their insurance needs, research options, compare plans, evaluate provider networks, and review plan details. This may involve consulting with insurance brokers, conducting online research, and reviewing plan documents.