Intro

Explore Minnesota health insurance options, including individual, family, and group plans, with coverage for medical, dental, and vision care, to find affordable and comprehensive policies from top providers.

The state of Minnesota has a reputation for being a leader in healthcare, with a strong network of hospitals, clinics, and medical professionals. When it comes to health insurance, Minnesota residents have a variety of options to choose from, ranging from private insurance plans to public programs. Understanding the different types of health insurance options available in Minnesota can help individuals and families make informed decisions about their healthcare coverage.

Minnesota's health insurance landscape is complex, with multiple carriers offering a range of plans. The state's health insurance marketplace, MNsure, provides a platform for individuals and small businesses to compare and purchase health insurance plans. In addition to MNsure, Minnesota residents can also purchase health insurance plans directly from insurance carriers or through private exchanges. With so many options available, it's essential to understand the pros and cons of each type of plan and to carefully consider factors such as cost, coverage, and provider networks.

Minnesota's strong economy and high standard of living contribute to a high demand for quality healthcare services. As a result, the state's health insurance market is highly competitive, with multiple carriers offering a range of plans. From individual and family plans to group plans and Medicare supplements, Minnesota residents have a wide range of health insurance options to choose from. By understanding the different types of plans available and carefully evaluating their needs and budget, individuals and families can select the health insurance coverage that best meets their needs.

Private Health Insurance Options in Minnesota

Private health insurance plans are a popular option for Minnesota residents who do not have access to employer-sponsored coverage or who prefer to purchase their own plan. Private plans are offered by a variety of carriers, including Blue Cross Blue Shield, Medica, and UnitedHealthcare. These plans can be purchased directly from the carrier or through a private exchange. Private health insurance plans in Minnesota typically offer a range of benefits, including doctor visits, hospital stays, and prescription medication coverage.

Some of the benefits of private health insurance plans in Minnesota include:

- Flexibility: Private plans can be tailored to meet the specific needs of individuals and families.

- Choice: Private plans offer a range of provider networks, allowing individuals to choose their own doctors and hospitals.

- Portability: Private plans can be taken with you if you change jobs or move to a different location.

However, private health insurance plans can also be more expensive than other types of coverage, and may have higher deductibles and copays.

Types of Private Health Insurance Plans

Private health insurance plans in Minnesota come in a variety of forms, including: * HMOs (Health Maintenance Organizations): These plans require individuals to receive care from a specific network of providers. * PPOs (Preferred Provider Organizations): These plans offer a range of benefits, including doctor visits and hospital stays, and allow individuals to see any provider they choose. * POS (Point of Service) plans: These plans combine elements of HMOs and PPOs, allowing individuals to receive care from a specific network of providers while also offering the option to see any provider they choose.Public Health Insurance Options in Minnesota

In addition to private health insurance plans, Minnesota residents may also be eligible for public health insurance programs. These programs are designed to provide affordable healthcare coverage to low-income individuals and families, as well as to those with disabilities or other special needs. Public health insurance programs in Minnesota include:

- Medical Assistance (MA): This program provides comprehensive healthcare coverage to low-income individuals and families.

- MinnesotaCare: This program provides affordable healthcare coverage to individuals and families who do not qualify for MA but still need assistance.

- Medicare: This program provides healthcare coverage to individuals 65 and older, as well as to those with disabilities.

Public health insurance programs in Minnesota offer a range of benefits, including:

- Affordable premiums: Public programs are designed to be affordable, with premiums based on income and family size.

- Comprehensive coverage: Public programs offer a range of benefits, including doctor visits, hospital stays, and prescription medication coverage.

- Access to care: Public programs provide access to a network of healthcare providers, including doctors, hospitals, and clinics.

However, public health insurance programs may have eligibility requirements and limitations on coverage, and may not offer the same level of flexibility as private plans.

Eligibility for Public Health Insurance Programs

To be eligible for public health insurance programs in Minnesota, individuals must meet certain income and eligibility requirements. These requirements vary depending on the program, but may include: * Income limits: Public programs have income limits, which vary depending on family size and income level. * Residency requirements: Individuals must be residents of Minnesota to be eligible for public programs. * Disability or special needs: Certain public programs, such as Medicare, require individuals to have a disability or special needs.Minnesota's Health Insurance Marketplace

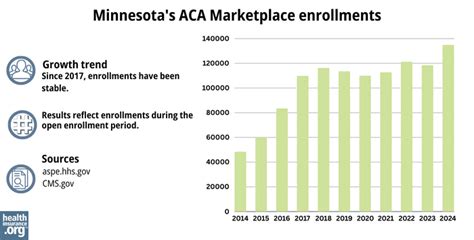

Minnesota's health insurance marketplace, MNsure, provides a platform for individuals and small businesses to compare and purchase health insurance plans. MNsure offers a range of plans from multiple carriers, allowing individuals to choose the plan that best meets their needs and budget. MNsure also provides tools and resources to help individuals understand their options and make informed decisions about their healthcare coverage.

Some of the benefits of using MNsure include:

- One-stop shopping: MNsure allows individuals to compare and purchase plans from multiple carriers in one place.

- Subsidies: MNsure offers subsidies to individuals who are eligible, which can help reduce the cost of premiums.

- Expert assistance: MNsure provides expert assistance to help individuals understand their options and make informed decisions about their healthcare coverage.

However, MNsure may have limited plan options and higher premiums than other types of coverage.

How to Use MNsure

To use MNsure, individuals can follow these steps: * Create an account: Individuals can create an account on the MNsure website, which will allow them to compare and purchase plans. * Compare plans: MNsure offers a range of plans from multiple carriers, allowing individuals to compare and choose the plan that best meets their needs and budget. * Apply for subsidies: Individuals who are eligible can apply for subsidies, which can help reduce the cost of premiums.Short-Term Health Insurance Options in Minnesota

Short-term health insurance plans are a type of temporary coverage that can be purchased for a limited period of time, typically up to 12 months. These plans are designed to provide coverage during a transition period, such as when an individual is between jobs or waiting for other coverage to begin. Short-term plans are available in Minnesota, but may have limited benefits and higher deductibles than other types of coverage.

Some of the benefits of short-term health insurance plans include:

- Flexibility: Short-term plans can be purchased for a limited period of time, allowing individuals to get coverage during a transition period.

- Affordability: Short-term plans may be less expensive than other types of coverage, making them a more affordable option for individuals who need temporary coverage.

- Quick enrollment: Short-term plans can be enrolled in quickly, often in a matter of days.

However, short-term plans may have limited benefits and higher deductibles than other types of coverage, and may not be renewable.

Limitations of Short-Term Health Insurance Plans

Short-term health insurance plans in Minnesota have several limitations, including: * Limited benefits: Short-term plans may not offer the same level of benefits as other types of coverage, such as doctor visits, hospital stays, and prescription medication coverage. * Higher deductibles: Short-term plans may have higher deductibles than other types of coverage, which can make them more expensive to use. * Pre-existing condition exclusions: Short-term plans may exclude pre-existing conditions, which can limit their usefulness for individuals who have ongoing health needs.Group Health Insurance Options in Minnesota

Group health insurance plans are a type of coverage that is offered to employees by their employer. These plans are designed to provide comprehensive healthcare coverage to employees and their families, and may be more affordable than individual plans. Group plans are available in Minnesota, and may offer a range of benefits, including doctor visits, hospital stays, and prescription medication coverage.

Some of the benefits of group health insurance plans include:

- Comprehensive coverage: Group plans offer a range of benefits, including doctor visits, hospital stays, and prescription medication coverage.

- Affordability: Group plans may be more affordable than individual plans, as the cost of premiums is shared among employees.

- Convenience: Group plans are often administered by the employer, making it easy for employees to enroll and manage their coverage.

However, group plans may have eligibility requirements and limitations on coverage, and may not be available to all employees.

Types of Group Health Insurance Plans

Group health insurance plans in Minnesota come in a variety of forms, including: * Fully insured plans: These plans are fully insured by the carrier, and the employer pays a fixed premium for each employee. * Self-insured plans: These plans are self-insured by the employer, and the employer pays the claims directly. * Level-funded plans: These plans are a combination of fully insured and self-insured plans, and the employer pays a fixed premium for each employee.Medicare and Medicaid Options in Minnesota

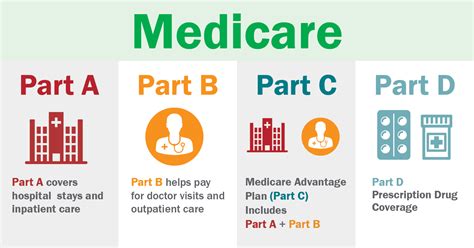

Medicare and Medicaid are two public health insurance programs that are available in Minnesota. Medicare is a federal program that provides healthcare coverage to individuals 65 and older, as well as to those with disabilities. Medicaid is a joint federal-state program that provides healthcare coverage to low-income individuals and families.

Some of the benefits of Medicare and Medicaid include:

- Comprehensive coverage: Medicare and Medicaid offer a range of benefits, including doctor visits, hospital stays, and prescription medication coverage.

- Affordability: Medicare and Medicaid are designed to be affordable, with premiums based on income and family size.

- Access to care: Medicare and Medicaid provide access to a network of healthcare providers, including doctors, hospitals, and clinics.

However, Medicare and Medicaid may have eligibility requirements and limitations on coverage, and may not offer the same level of flexibility as private plans.

Eligibility for Medicare and Medicaid

To be eligible for Medicare and Medicaid in Minnesota, individuals must meet certain income and eligibility requirements. These requirements vary depending on the program, but may include: * Age: Medicare is available to individuals 65 and older, while Medicaid is available to low-income individuals and families. * Income: Medicaid has income limits, which vary depending on family size and income level. * Disability or special needs: Certain Medicare and Medicaid programs require individuals to have a disability or special needs.What is the difference between Medicare and Medicaid?

+Medicare is a federal program that provides healthcare coverage to individuals 65 and older, as well as to those with disabilities. Medicaid is a joint federal-state program that provides healthcare coverage to low-income individuals and families.

How do I enroll in a health insurance plan in Minnesota?

+To enroll in a health insurance plan in Minnesota, individuals can use the MNsure website or contact a licensed insurance agent or broker. Individuals can also enroll in a plan directly through the carrier or through a private exchange.

What is the deadline for enrolling in a health insurance plan in Minnesota?

+The deadline for enrolling in a health insurance plan in Minnesota varies depending on the type of plan and the individual's eligibility. Generally, the open enrollment period for individual and family plans is from November to December, while the special enrollment period for group plans is typically year-round.

Can I purchase a health insurance plan outside of the open enrollment period?

+Yes, individuals can purchase a health insurance plan outside of the open enrollment period if they experience a qualifying life event, such as losing their job or getting married. Individuals can also purchase a short-term plan or a catastrophic plan outside of the open enrollment period.

How do I know which health insurance plan is right for me?

+To determine which health insurance plan is right for you, consider your budget, health needs, and provider preferences. You can also use online tools and resources, such as the MNsure website, to compare plans and estimate costs.

As we conclude our discussion on Minnesota health insurance options, we hope that you have gained a better understanding of the different types of plans available and how to choose the right one for your needs. Whether you are an individual, family, or employer, there are many options to consider, and it's essential to carefully evaluate your choices to ensure that you have the right coverage. We invite you to comment below with any questions or concerns you may have, and to share this article with others who may be interested in learning more about Minnesota health insurance options. Additionally, we encourage you to take action and explore your health insurance options today, whether it's through MNsure, a private exchange, or directly with a carrier.