Intro

Unlock affordable healthcare with 5 Kaiser Insurance tips, including policy selection, cost optimization, and claim management, to maximize your medical benefits and minimize expenses with Kaiser Permanente insurance plans.

Kaiser insurance is a popular choice for many individuals and families due to its comprehensive coverage and network of healthcare providers. With so many options available, it can be overwhelming to navigate the world of health insurance. However, having the right information can make all the difference in choosing the best plan for your needs. In this article, we will delve into the world of Kaiser insurance, exploring its benefits, workings, and providing valuable tips to help you make informed decisions.

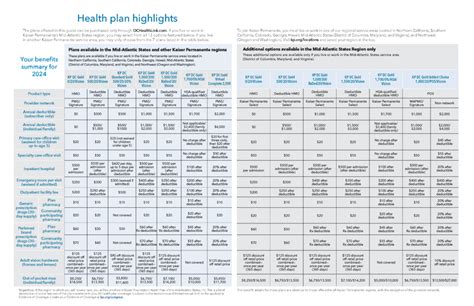

The importance of health insurance cannot be overstated, as it provides financial protection against unexpected medical expenses. Kaiser insurance, in particular, offers a wide range of plans, each with its unique features and benefits. From individual and family plans to group and Medicare plans, Kaiser insurance has something for everyone. Whether you are looking for basic coverage or more comprehensive protection, Kaiser insurance has a plan that can meet your needs.

Kaiser insurance is also known for its emphasis on preventive care, which is essential for maintaining good health and preventing illnesses. With a Kaiser insurance plan, you can enjoy access to a network of healthcare providers, including primary care physicians, specialists, and hospitals. This network is designed to provide high-quality care while keeping costs under control. Furthermore, Kaiser insurance offers a range of wellness programs and resources, including fitness classes, nutrition counseling, and stress management techniques, to help you stay healthy and thrive.

Kaiser Insurance Benefits

Comprehensive Coverage

Kaiser insurance plans provide comprehensive coverage for a wide range of medical services, including doctor visits, hospital stays, prescriptions, and more. This means that you can enjoy peace of mind knowing that you are protected against unexpected medical expenses. Whether you need routine care or more complex treatments, Kaiser insurance has got you covered.Affordable Premiums

Kaiser insurance premiums are often more affordable than those of other health insurance providers. This is because Kaiser insurance has a large network of healthcare providers, which enables it to negotiate better rates with hospitals and doctors. As a result, you can enjoy high-quality care at a lower cost.Kaiser Insurance Tips

Choosing the Right Plan

Choosing the right Kaiser insurance plan can be overwhelming, especially with so many options available. Here are some factors to consider when choosing a plan: * Premiums: Consider the cost of premiums and whether they fit within your budget. * Deductible: Consider the deductible, which is the amount you must pay out-of-pocket before your insurance kicks in. * Copays: Consider the copays, which are the amounts you must pay for doctor visits, prescriptions, and other services. * Network: Consider the network of healthcare providers and whether they meet your needs.Kaiser Insurance Working Mechanism

Steps to Enroll in Kaiser Insurance

Enrolling in Kaiser insurance is a straightforward process. Here are the steps to follow: 1. Research your options: Consider your needs, budget, and preferences when choosing a plan. 2. Apply for coverage: You can apply for coverage online, by phone, or in person. 3. Provide required documents: You will need to provide required documents, such as proof of income and identification. 4. Pay premiums: Once you are enrolled, you will need to pay premiums to maintain coverage. 5. Review your plan: Review your plan regularly to ensure it meets your changing needs.Kaiser Insurance FAQs

What is Kaiser insurance?

+Kaiser insurance is a type of health insurance that provides comprehensive coverage for medical services, including doctor visits, hospital stays, prescriptions, and more.

How do I choose the right Kaiser insurance plan?

+To choose the right Kaiser insurance plan, consider your needs, budget, and preferences. Research your options carefully, and take advantage of preventive care services to stay healthy and prevent illnesses.

What are the benefits of Kaiser insurance?

+The benefits of Kaiser insurance include comprehensive coverage, affordable premiums, and access to a network of healthcare providers. Additionally, Kaiser insurance plans often include preventive care services, such as routine check-ups, screenings, and vaccinations.

In conclusion, Kaiser insurance is a popular choice for many individuals and families due to its comprehensive coverage and network of healthcare providers. By following the tips outlined in this article, you can make informed decisions and get the most out of your Kaiser insurance plan. Remember to research your options carefully, take advantage of preventive care services, and review your plan regularly to ensure it meets your changing needs. With the right information and a little planning, you can enjoy peace of mind knowing that you are protected against unexpected medical expenses. We invite you to share your thoughts and experiences with Kaiser insurance in the comments below and to share this article with anyone who may benefit from this information.