Intro

Unlock affordable healthcare with 5 Kaiser Insurance tips, including policy selection, cost optimization, and claim management, to maximize your medical benefits and minimize expenses with Kaiser Permanente insurance plans.

The world of health insurance can be complex and overwhelming, with numerous options and plans to choose from. Kaiser Insurance, also known as Kaiser Permanente, is a popular choice for many individuals and families. With its comprehensive coverage and emphasis on preventive care, Kaiser Insurance has become a trusted name in the healthcare industry. However, navigating the various plans and benefits can be daunting, even for the most informed consumers. In this article, we will delve into the world of Kaiser Insurance, providing valuable tips and insights to help you make the most of your coverage.

Kaiser Insurance offers a wide range of plans, each with its unique features and benefits. From individual and family plans to group and Medicare plans, there is something for everyone. One of the key advantages of Kaiser Insurance is its emphasis on preventive care, which can help you stay healthy and avoid costly medical bills. With Kaiser Insurance, you can enjoy access to a network of top-notch healthcare providers, state-of-the-art medical facilities, and a range of wellness programs and services. Whether you're looking for basic coverage or more comprehensive protection, Kaiser Insurance has a plan that can meet your needs.

As you explore the world of Kaiser Insurance, it's essential to understand the various options and benefits available to you. With so many plans to choose from, it can be challenging to determine which one is right for you. That's why we've put together these five Kaiser Insurance tips, designed to help you navigate the system and make the most of your coverage. From choosing the right plan to maximizing your benefits, we'll cover everything you need to know to get the most out of your Kaiser Insurance policy.

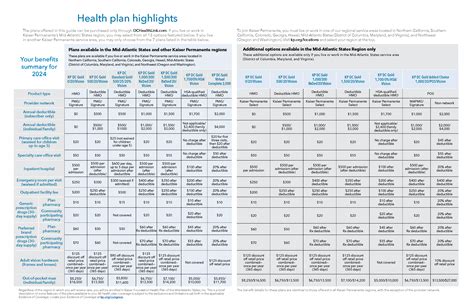

Kaiser Insurance Plans and Options

Choosing the Right Plan

When choosing a Kaiser Insurance plan, it's essential to consider your individual needs and circumstances. Here are a few factors to keep in mind: * Premium costs: How much can you afford to pay each month for your premium? * Deductibles and copays: How much will you need to pay out-of-pocket for medical expenses? * Network and coverage: Which healthcare providers and services are included in the plan's network? * Additional benefits: Are there any additional benefits, such as dental or vision coverage, that are included in the plan?Maximizing Your Benefits

Understanding Your Coverage

Understanding your coverage is essential to getting the most out of your Kaiser Insurance plan. Here are a few things to keep in mind: * What is covered: Which medical expenses and services are included in your plan? * What is not covered: Which medical expenses and services are not included in your plan? * How to file a claim: What is the process for filing a claim and receiving reimbursement for medical expenses?Kaiser Insurance Costs and Expenses

Reducing Your Costs

There are several ways to reduce your Kaiser Insurance costs and expenses. Here are a few tips: * Choose a plan with a lower premium: If you're on a tight budget, choosing a plan with a lower premium can help you save money. * Use in-network providers: Using healthcare providers within the plan's network can help you save money and ensure that you receive the best possible care. * Take advantage of discounts: Kaiser Insurance offers a range of discounts and promotions, which can help you save money on your premium and other expenses.Kaiser Insurance Customer Service and Support

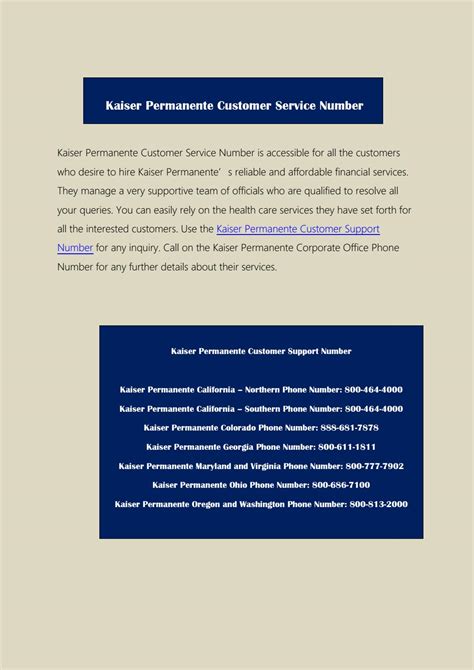

Getting Help When You Need It

Getting help when you need it is essential to getting the most out of your Kaiser Insurance coverage. Here are a few tips: * Don't hesitate to ask: If you have a question or concern, don't hesitate to ask. * Use online resources: Kaiser Insurance offers a range of online resources, which can help you get answers to your questions and resolve any issues you may have. * Visit a Kaiser Insurance office: If you need in-person support, visiting a Kaiser Insurance office can help you get the help you need.Kaiser Insurance Claims and Appeals

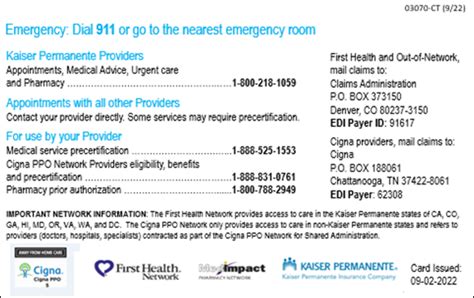

Understanding the Claims Process

Understanding the claims process is essential to getting the most out of your Kaiser Insurance coverage. Here are a few things to keep in mind: * What is covered: Which medical expenses and services are included in your plan? * What is not covered: Which medical expenses and services are not included in your plan? * How to file a claim: What is the process for filing a claim and receiving reimbursement for medical expenses?Kaiser Insurance FAQs

What is Kaiser Insurance?

+Kaiser Insurance, also known as Kaiser Permanente, is a popular health insurance provider that offers a range of plans and coverage options.

How do I choose a Kaiser Insurance plan?

+Choosing a Kaiser Insurance plan depends on your individual needs and circumstances. Consider factors such as premium costs, deductibles and copays, network and coverage, and additional benefits.

What is covered under a Kaiser Insurance plan?

+Kaiser Insurance plans cover a range of medical expenses and services, including doctor visits, hospital stays, prescriptions, and more. The specific coverage will depend on the plan you choose.

Now that you've learned more about Kaiser Insurance and how to get the most out of your coverage, it's time to take action. Whether you're looking to choose a new plan, maximize your benefits, or simply understand your coverage, we hope this article has provided you with the information and insights you need to make informed decisions about your health insurance. If you have any questions or comments, please don't hesitate to share them with us. We're always here to help. Additionally, if you found this article helpful, please consider sharing it with others who may benefit from this information. By working together, we can help ensure that everyone has access to the health insurance coverage they need to thrive.