Intro

Discover Kaiser Permanente Pension Plan details, including retirement benefits, eligibility, and investment options, to help you plan your future with confidence and security in healthcare retirement planning.

Kaiser Permanente is one of the largest and most renowned healthcare organizations in the United States, providing comprehensive medical services to millions of members. As a leading employer in the healthcare industry, Kaiser Permanente offers a range of benefits to its employees, including a pension plan. The pension plan is an essential aspect of the organization's compensation package, providing employees with a secure financial future upon retirement. In this article, we will delve into the details of the Kaiser Permanente pension plan, exploring its features, benefits, and requirements.

The importance of a pension plan cannot be overstated, as it provides employees with a steady income stream in their golden years. With the rising cost of living and increasing life expectancy, having a reliable pension plan is crucial for ensuring a comfortable retirement. Kaiser Permanente's pension plan is designed to help employees achieve their retirement goals, offering a range of benefits and features that set it apart from other employer-sponsored plans. Whether you are a current or prospective Kaiser Permanente employee, understanding the details of the pension plan is essential for making informed decisions about your financial future.

Kaiser Permanente's commitment to providing a comprehensive benefits package, including a pension plan, is a testament to its dedication to employee well-being. The organization recognizes that employees are its most valuable asset, and investing in their financial security is essential for attracting and retaining top talent. As we explore the details of the Kaiser Permanente pension plan, it becomes clear that the organization is committed to helping employees achieve their long-term financial goals. From vesting requirements to benefit calculations, we will examine the key aspects of the plan, providing readers with a thorough understanding of what to expect.

Kaiser Permanente Pension Plan Overview

Eligibility Requirements

To participate in the Kaiser Permanente pension plan, employees must meet the following eligibility requirements: * Be a regular full-time or part-time employee * Complete a minimum of one year of service * Reach age 21 * Work a minimum of 1,000 hours per year Employees who meet these requirements are automatically enrolled in the pension plan, although they may opt out if they choose to do so.Pension Plan Benefits

Benefit Calculation

The Kaiser Permanente pension plan benefit is calculated using the following formula: * 1.5% of final average pay multiplied by years of service * Plus a guaranteed minimum benefit amount * Adjusted for inflation The final average pay is based on an employee's highest 36 months of pay, and years of service are calculated from the employee's date of hire.Vesting Requirements

Leaving the Organization

If an employee leaves Kaiser Permanente before retiring, they may be eligible to receive a portion of their pension benefit. The amount of the benefit will depend on the employee's years of service and vesting percentage. Employees who leave the organization may also be able to take their pension benefit with them, although this may be subject to certain restrictions and penalties.Pension Plan Administration

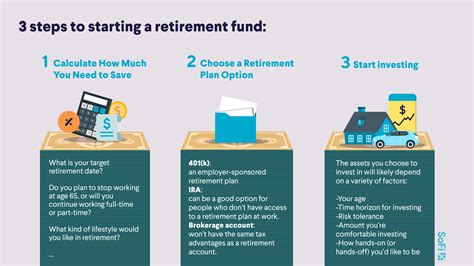

Investment Options

The Kaiser Permanente pension plan offers a range of investment options, including: * Stocks * Bonds * Real estate * Alternative investments The plan's investment portfolio is designed to provide a balanced return, with a focus on long-term growth and stability.Retirement Options

Retirement Benefits

The Kaiser Permanente pension plan provides a range of retirement benefits, including: * A predictable income stream * A guaranteed minimum benefit amount * The potential for benefit increases based on inflation * The option to receive benefits in the form of a lump sum or annuity Retirees may also be eligible for other benefits, such as health insurance and life insurance.Tax Implications

Tax-Deferred Savings

The Kaiser Permanente pension plan offers tax-deferred savings options, including: * 401(k) plan * 403(b) plan * Thrift plan Employees may contribute to these plans on a pre-tax basis, reducing their taxable income and lowering their tax liability.What is the Kaiser Permanente pension plan?

+The Kaiser Permanente pension plan is a defined benefit plan that provides employees with a predictable income stream in retirement.

How do I become eligible for the pension plan?

+To become eligible for the pension plan, employees must meet certain requirements, including completing a specified number of years of service and reaching a minimum age.

Can I take my pension benefit with me if I leave the organization?

+Yes, employees who leave the organization may be eligible to take their pension benefit with them, although this may be subject to certain restrictions and penalties.

In conclusion, the Kaiser Permanente pension plan is a valuable benefit that provides employees with a secure financial future upon retirement. With its predictable income stream, guaranteed minimum benefit amount, and potential for benefit increases based on inflation, the plan is an attractive option for employees looking to build a stable retirement portfolio. Whether you are a current or prospective Kaiser Permanente employee, understanding the details of the pension plan is essential for making informed decisions about your financial future. We invite you to share your thoughts and experiences with the Kaiser Permanente pension plan in the comments below, and to share this article with others who may be interested in learning more about this valuable benefit.