Intro

Discover Kaiser Permanente Medicare Plans, including Advantage, Supplement, and Part D options, offering comprehensive coverage, affordable premiums, and quality healthcare services for seniors and retirees, with flexible benefits and network providers.

As the US population ages, the demand for comprehensive and affordable healthcare plans continues to rise. For seniors and individuals with disabilities, Medicare plays a vital role in providing essential health coverage. Among the various Medicare plan providers, Kaiser Permanente has established itself as a reputable and trusted name. With its extensive network of medical facilities, innovative approach to healthcare, and commitment to patient satisfaction, Kaiser Permanente Medicare plans have become a popular choice among beneficiaries. In this article, we will delve into the world of Kaiser Permanente Medicare plans, exploring their benefits, working mechanisms, and what sets them apart from other Medicare providers.

The importance of selecting the right Medicare plan cannot be overstated. With so many options available, it can be overwhelming to navigate the complex landscape of Medicare Advantage plans, Supplement plans, and Prescription Drug plans. Kaiser Permanente, with its long history of providing high-quality healthcare services, has designed its Medicare plans to cater to the diverse needs of its members. From preventive care to chronic disease management, Kaiser Permanente's Medicare plans prioritize the well-being and health outcomes of its members. As we explore the features and benefits of Kaiser Permanente Medicare plans, it becomes clear that these plans are designed to provide comprehensive, coordinated, and patient-centered care.

For individuals approaching Medicare eligibility or currently enrolled in a Medicare plan, understanding the intricacies of Kaiser Permanente's offerings is crucial. With its integrated care model, Kaiser Permanente brings together medical professionals, hospitals, and health insurance services under one umbrella, ensuring seamless communication and coordination. This approach enables members to receive personalized care, with their healthcare team working together to address their unique needs. Moreover, Kaiser Permanente's emphasis on preventive care and health education empowers members to take an active role in maintaining their health and well-being. As we examine the specifics of Kaiser Permanente Medicare plans, it becomes apparent that these plans are tailored to provide exceptional value, flexibility, and peace of mind for members.

Kaiser Permanente Medicare Plan Options

Medicare Advantage Plans

Kaiser Permanente's Medicare Advantage plans are designed to provide comprehensive coverage, including medical, hospital, and prescription drug benefits. These plans often include additional benefits, such as dental, vision, and hearing coverage, as well as fitness programs and health education resources. With a Medicare Advantage plan from Kaiser Permanente, members can enjoy the convenience of a single plan that covers all their healthcare needs. Moreover, Kaiser Permanente's Medicare Advantage plans often feature lower out-of-pocket costs, predictable expenses, and a wide range of provider networks.Benefits of Kaiser Permanente Medicare Plans

Working with Healthcare Providers

Kaiser Permanente's Medicare plans are designed to foster collaborative relationships between members and their healthcare providers. With a focus on preventive care and health education, Kaiser Permanente's healthcare providers work closely with members to address their unique needs and develop personalized care plans. This approach enables members to receive high-quality, patient-centered care, with their healthcare team working together to ensure the best possible health outcomes.Enrollment and Eligibility

Steps to Enroll

To enroll in a Kaiser Permanente Medicare plan, individuals can follow these steps: 1. Research and compare plans: Individuals can research and compare Kaiser Permanente's Medicare plans to find the one that best suits their needs and budget. 2. Check eligibility: Individuals can verify their eligibility for a Kaiser Permanente Medicare plan by contacting the plan directly or visiting the Medicare website. 3. Apply for coverage: Individuals can apply for coverage during the designated enrollment periods, either online, by phone, or in person. 4. Review and finalize: Individuals can review their plan details and finalize their enrollment by signing and returning the necessary documents.Plan Costs and Coverage

Plan Comparison

To compare Kaiser Permanente's Medicare plans, individuals can consider the following factors: * Premiums: The monthly cost of the plan * Deductibles: The amount individuals must pay out-of-pocket before coverage begins * Copayments: The amount individuals pay for each medical service or prescription * Coinsurance: The percentage of medical expenses individuals pay after meeting the deductible * Out-of-pocket maximum: The maximum amount individuals pay for medical expenses per yearCustomer Support and Resources

Member Testimonials

Kaiser Permanente's Medicare plans have received high praise from members, who appreciate the comprehensive coverage, affordable costs, and exceptional customer service. Some member testimonials include: * "I've been with Kaiser Permanente for over 10 years, and I've always been impressed with the quality of care and the convenience of having all my healthcare needs met in one place." * "I was hesitant to switch to a Medicare Advantage plan, but Kaiser Permanente's plan has been a game-changer for me. The costs are lower, and the coverage is more comprehensive than my old plan." * "I've never had a problem with Kaiser Permanente's customer service. They're always friendly, helpful, and responsive to my needs."Conclusion and Next Steps

We invite you to share your thoughts and experiences with Kaiser Permanente's Medicare plans in the comments below. If you have any questions or would like to learn more about these plans, please don't hesitate to reach out. You can also share this article with friends and family who may be interested in learning more about Kaiser Permanente's Medicare plans.

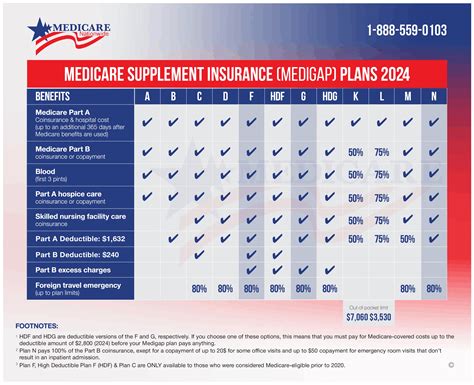

What is the difference between Medicare Advantage and Medicare Supplement plans?

+Medicare Advantage plans combine the benefits of Original Medicare (Part A and Part B) with additional coverage for services like dental, vision, and hearing. Medicare Supplement plans, also known as Medigap plans, help fill the gaps in Original Medicare coverage, including copayments, coinsurance, and deductibles.

Can I enroll in a Kaiser Permanente Medicare plan if I have a pre-existing condition?

+Yes, Kaiser Permanente's Medicare plans are available to individuals with pre-existing conditions. The Affordable Care Act prohibits health insurance companies from denying coverage based on pre-existing conditions.

How do I know which Kaiser Permanente Medicare plan is right for me?

+To determine which Kaiser Permanente Medicare plan is right for you, consider your healthcare needs, budget, and preferences. You can research and compare plans, contact Kaiser Permanente directly, or speak with a licensed insurance agent for guidance.