Intro

Explore Medicare Kaiser Permanente options, including Advantage plans, supplemental insurance, and Part D coverage, to find the best fit for your healthcare needs and budget, with benefits like preventive care and prescription drug coverage.

As the US population ages, the demand for comprehensive and affordable healthcare options continues to grow. For many seniors and individuals with disabilities, Medicare provides essential coverage for medical expenses. However, navigating the complexities of Medicare can be overwhelming, especially when considering additional coverage options. Kaiser Permanente, a well-established healthcare organization, offers a range of Medicare plans that can help bridge the gaps in original Medicare coverage. In this article, we will delve into the world of Medicare Kaiser Permanente options, exploring the benefits, working mechanisms, and key information you need to know.

The importance of understanding Medicare Kaiser Permanente options cannot be overstated. With the rising costs of healthcare, it is crucial to have a comprehensive coverage plan that meets your unique needs. Kaiser Permanente's Medicare plans are designed to provide seamless integration with your existing Medicare coverage, ensuring that you receive the best possible care without breaking the bank. Whether you are a current Kaiser Permanente member or considering switching to their Medicare plans, this article will provide you with the insights you need to make informed decisions about your healthcare.

For individuals who are new to Medicare, it is essential to understand the different parts of the program. Medicare Part A covers hospital stays, skilled nursing care, and hospice care, while Medicare Part B covers doctor visits, outpatient care, and medical equipment. Medicare Part D, on the other hand, provides prescription drug coverage. Kaiser Permanente's Medicare plans are designed to work in conjunction with these parts, offering additional benefits and services that can enhance your overall healthcare experience.

Introduction to Kaiser Permanente Medicare Plans

Benefits of Kaiser Permanente Medicare Plans

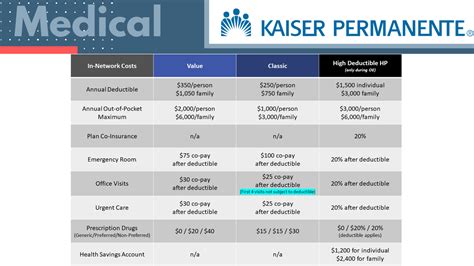

The benefits of Kaiser Permanente Medicare plans are numerous. With their Medicare Advantage plans, you can enjoy: * Comprehensive coverage for medical expenses, including hospital stays, doctor visits, and prescription medications * Additional benefits for vision, dental, and hearing services * Access to a network of healthcare providers and specialists * Predictable costs and reduced out-of-pocket expenses * Seamless integration with your existing Medicare coverageHow Kaiser Permanente Medicare Plans Work

The process of enrolling in a Kaiser Permanente Medicare plan is relatively straightforward. You can start by visiting the Kaiser Permanente website or contacting their customer service department to learn more about their plans and pricing. You can also use the Medicare Plan Finder tool to compare Kaiser Permanente's plans with other Medicare options in your area.

Steps to Enroll in Kaiser Permanente Medicare Plans

To enroll in a Kaiser Permanente Medicare plan, follow these steps: 1. Determine your eligibility for Medicare and Kaiser Permanente's plans 2. Research and compare Kaiser Permanente's Medicare plans and pricing 3. Contact Kaiser Permanente's customer service department to learn more about their plans 4. Use the Medicare Plan Finder tool to compare Kaiser Permanente's plans with other Medicare options 5. Enroll in a Kaiser Permanente Medicare plan during the annual enrollment period or special enrollment periodsKaiser Permanente Medicare Advantage Plans

The benefits of Kaiser Permanente's Medicare Advantage plans include:

- Comprehensive coverage for medical expenses, including hospital stays, doctor visits, and prescription medications

- Additional benefits for vision, dental, and hearing services

- Access to a network of healthcare providers and specialists

- Predictable costs and reduced out-of-pocket expenses

- Seamless integration with your existing Medicare coverage

Types of Kaiser Permanente Medicare Advantage Plans

Kaiser Permanente offers several types of Medicare Advantage plans, including: * Health Maintenance Organization (HMO) plans * Preferred Provider Organization (PPO) plans * Private Fee-for-Service (PFFS) plans * Special Needs Plans (SNPs)Each type of plan has its unique features and benefits, and it is essential to research and compare these plans to determine which one best meets your needs.

Kaiser Permanente Medicare Supplement Insurance Plans

The benefits of Kaiser Permanente's Medicare Supplement Insurance plans include:

- Help paying for out-of-pocket expenses, such as deductibles, copayments, and coinsurance

- Comprehensive coverage for medical expenses, including hospital stays, doctor visits, and prescription medications

- Access to a network of healthcare providers and specialists

- Predictable costs and reduced out-of-pocket expenses

- Seamless integration with your existing Medicare coverage

Types of Kaiser Permanente Medicare Supplement Insurance Plans

Kaiser Permanente offers several types of Medicare Supplement Insurance plans, including: * Plan A * Plan B * Plan C * Plan D * Plan F * Plan G * Plan K * Plan L * Plan M * Plan NEach type of plan has its unique features and benefits, and it is essential to research and compare these plans to determine which one best meets your needs.

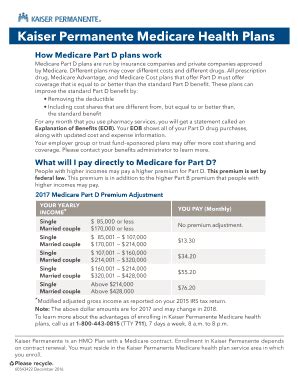

Kaiser Permanente Medicare Part D Plans

The benefits of Kaiser Permanente's Medicare Part D plans include:

- Help paying for prescription medications, including copayments, coinsurance, and deductibles

- Comprehensive coverage for prescription medications, including generic and brand-name drugs

- Access to a network of pharmacies and healthcare providers

- Predictable costs and reduced out-of-pocket expenses

- Seamless integration with your existing Medicare coverage

Types of Kaiser Permanente Medicare Part D Plans

Kaiser Permanente offers several types of Medicare Part D plans, including: * Standard plans * Enhanced plans * Premium plansEach type of plan has its unique features and benefits, and it is essential to research and compare these plans to determine which one best meets your needs.

What is the difference between Medicare Advantage and Medicare Supplement Insurance plans?

+Medicare Advantage plans combine the benefits of Medicare Part A and Part B, often with additional coverage for vision, dental, and hearing services. Medicare Supplement Insurance plans, on the other hand, help bridge the gaps in original Medicare coverage, paying for out-of-pocket expenses such as deductibles, copayments, and coinsurance.

Can I enroll in a Kaiser Permanente Medicare plan if I have a pre-existing condition?

+Yes, you can enroll in a Kaiser Permanente Medicare plan even if you have a pre-existing condition. Kaiser Permanente's Medicare plans are guaranteed issue, meaning that you cannot be denied coverage due to a pre-existing condition.

How do I know which Kaiser Permanente Medicare plan is right for me?

+To determine which Kaiser Permanente Medicare plan is right for you, research and compare the different plans and pricing. Consider your unique needs and preferences, including your budget, health status, and lifestyle. You can also contact Kaiser Permanente's customer service department for guidance and support.

As you consider your Medicare options, remember that Kaiser Permanente's plans are designed to provide comprehensive coverage and seamless integration with your existing Medicare coverage. By understanding the benefits and working mechanisms of Kaiser Permanente's Medicare plans, you can make informed decisions about your healthcare and enjoy peace of mind knowing that you are protected against unexpected medical expenses. We invite you to share your thoughts and experiences with Kaiser Permanente's Medicare plans in the comments below. If you found this article helpful, please share it with your friends and family who may be navigating the complexities of Medicare. Together, we can ensure that everyone has access to affordable and comprehensive healthcare coverage.