Intro

Explore Kp Medicare Plans Options, including Advantage, Supplement, and Part D plans, to find the best coverage for your healthcare needs, with flexible choices and affordable rates, and discover how to enroll in a Medicare plan that suits you.

Choosing the right Medicare plan can be a daunting task, especially with the numerous options available. As a Medicare beneficiary, it's essential to understand the different types of plans, their benefits, and how they can impact your healthcare costs. In this article, we'll delve into the world of KP Medicare plans, exploring the various options, their advantages, and what you need to know to make an informed decision.

Medicare is a federal health insurance program designed for individuals 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). With the rising costs of healthcare, having the right Medicare plan can help you manage your expenses and ensure you receive the necessary medical care. KP Medicare plans, offered by Kaiser Permanente, are a popular choice among Medicare beneficiaries due to their comprehensive coverage, network of healthcare providers, and emphasis on preventive care.

As you navigate the complex world of Medicare, it's crucial to understand the different parts of the program, including Part A, Part B, Part C (Medicare Advantage), and Part D (prescription drug coverage). Each part covers specific healthcare services, and some KP Medicare plans combine these parts to provide more comprehensive coverage. With the various options available, it's essential to evaluate your healthcare needs, budget, and preferences to select the most suitable plan.

KP Medicare Plan Options

KP Medicare plans offer a range of options to cater to different needs and preferences. These plans include:

- KP Medicare Advantage plans, which combine Part A, Part B, and often Part D coverage

- KP Medicare Supplement plans, which help fill the gaps in Original Medicare (Part A and Part B)

- KP Medicare Part D plans, which provide prescription drug coverage

Each type of plan has its unique benefits, drawbacks, and eligibility requirements. For instance, KP Medicare Advantage plans often include additional benefits like dental, vision, and hearing coverage, as well as fitness programs and wellness services. On the other hand, KP Medicare Supplement plans can help reduce out-of-pocket costs, but they may not offer the same level of comprehensive coverage as Medicare Advantage plans.

Understanding KP Medicare Advantage Plans

KP Medicare Advantage plans are a popular choice among Medicare beneficiaries due to their comprehensive coverage and network of healthcare providers. These plans combine Part A, Part B, and often Part D coverage, providing a single, streamlined plan for all your healthcare needs. With a KP Medicare Advantage plan, you'll have access to a network of doctors, hospitals, and other healthcare providers who work together to provide coordinated care.

Some of the benefits of KP Medicare Advantage plans include:

- Comprehensive coverage, including hospital stays, doctor visits, and prescription medications

- Additional benefits like dental, vision, and hearing coverage

- Fitness programs and wellness services to promote healthy living

- Predictable costs, with a fixed monthly premium and out-of-pocket expenses

However, KP Medicare Advantage plans also have some limitations, such as:

- Network restrictions, which may limit your access to certain doctors or hospitals

- Prior authorization requirements for certain services or medications

- Out-of-pocket costs, including copays, coinsurance, and deductibles

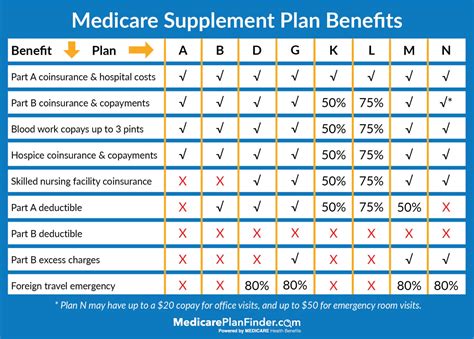

KP Medicare Supplement Plans

KP Medicare Supplement plans, also known as Medigap plans, are designed to help fill the gaps in Original Medicare (Part A and Part B). These plans can help reduce out-of-pocket costs, such as copays, coinsurance, and deductibles, but they may not offer the same level of comprehensive coverage as Medicare Advantage plans.

Some of the benefits of KP Medicare Supplement plans include:

- Reduced out-of-pocket costs, with lower copays and coinsurance

- Predictable costs, with a fixed monthly premium

- Access to a network of healthcare providers who accept Medicare

However, KP Medicare Supplement plans also have some limitations, such as:

- Limited coverage, with no additional benefits like dental, vision, or hearing coverage

- Higher premiums, compared to Medicare Advantage plans

- No coverage for prescription medications, unless you have a separate Part D plan

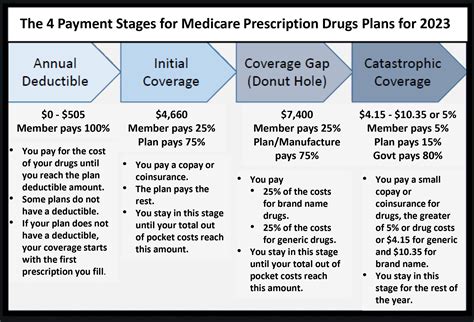

Understanding KP Medicare Part D Plans

KP Medicare Part D plans provide prescription drug coverage, which is essential for managing chronic conditions and maintaining overall health. These plans can be purchased as a standalone plan or combined with a Medicare Advantage plan.

Some of the benefits of KP Medicare Part D plans include:

- Comprehensive coverage, with access to a wide range of prescription medications

- Predictable costs, with a fixed monthly premium and out-of-pocket expenses

- Additional benefits, such as discounts on certain medications or pharmacy services

However, KP Medicare Part D plans also have some limitations, such as:

- Coverage gaps, which may leave you with high out-of-pocket costs for certain medications

- Prior authorization requirements for certain medications or services

- Restrictions on certain medications or pharmacy services

How to Choose the Right KP Medicare Plan

Choosing the right KP Medicare plan requires careful consideration of your healthcare needs, budget, and preferences. Here are some tips to help you make an informed decision:

- Evaluate your healthcare needs, including any chronic conditions or medications you take

- Compare the different KP Medicare plans, including their benefits, costs, and network of healthcare providers

- Consider your budget, including your monthly premium, out-of-pocket expenses, and any additional costs

- Research the plan's reputation, including customer reviews and ratings

- Consult with a licensed insurance agent or broker to get personalized advice and guidance

By following these tips, you can find a KP Medicare plan that meets your needs and provides the comprehensive coverage you deserve.

KP Medicare Plan Enrollment

Enrolling in a KP Medicare plan is a straightforward process, but it's essential to understand the different enrollment periods and requirements. Here are some key things to know:

- Initial Enrollment Period (IEP): This is the 7-month period around your 65th birthday, during which you can enroll in a KP Medicare plan.

- Annual Election Period (AEP): This is the period from October 15 to December 7, during which you can change or enroll in a new KP Medicare plan.

- Special Enrollment Periods (SEPs): These are special periods during which you can enroll in a KP Medicare plan, such as when you move to a new area or lose your current coverage.

To enroll in a KP Medicare plan, you'll need to:

- Meet the eligibility requirements, including being 65 or older or having a qualifying disability

- Choose a plan that meets your needs and budget

- Complete the enrollment application, either online, by phone, or in person

- Provide required documentation, such as proof of age, residency, and citizenship

By understanding the enrollment process and requirements, you can ensure a smooth transition into a KP Medicare plan.

What is the difference between KP Medicare Advantage and Medicare Supplement plans?

+KP Medicare Advantage plans combine Part A, Part B, and often Part D coverage, providing comprehensive coverage and a network of healthcare providers. Medicare Supplement plans, on the other hand, help fill the gaps in Original Medicare (Part A and Part B), reducing out-of-pocket costs but offering limited coverage.

Can I change my KP Medicare plan during the year?

+Generally, you can only change your KP Medicare plan during the Annual Election Period (AEP) from October 15 to December 7. However, you may be eligible for a Special Enrollment Period (SEP) if you experience a qualifying event, such as moving to a new area or losing your current coverage.

How do I know if a KP Medicare plan is right for me?

+To determine if a KP Medicare plan is right for you, evaluate your healthcare needs, budget, and preferences. Consider factors such as the plan's benefits, costs, network of healthcare providers, and reputation. You can also consult with a licensed insurance agent or broker to get personalized advice and guidance.

In conclusion, KP Medicare plans offer a range of options to cater to different needs and preferences. By understanding the different types of plans, their benefits, and limitations, you can make an informed decision and find a plan that meets your healthcare needs and budget. Remember to evaluate your options carefully, consider your priorities, and seek guidance from a licensed insurance agent or broker if needed. With the right KP Medicare plan, you can enjoy comprehensive coverage, predictable costs, and peace of mind, knowing you're prepared for any healthcare needs that may arise. We invite you to share your thoughts and experiences with KP Medicare plans in the comments below, and don't forget to share this article with friends and family who may be navigating the complex world of Medicare.