Intro

The cost of healthcare in the United States continues to rise, making it challenging for many individuals and families to afford health insurance. However, having health insurance is crucial for protecting one's financial well-being and ensuring access to necessary medical care. Low price health insurance options are available, and it's essential to understand the various choices and how to navigate the system to find an affordable plan.

The importance of health insurance cannot be overstated. Without it, a single medical emergency or chronic illness can lead to financial ruin. Moreover, preventive care, such as annual check-ups and screenings, can help detect health issues early on, reducing the risk of more severe and costly problems down the line. Fortunately, there are numerous low price health insurance options available, including government-sponsored programs, employer-sponsored plans, and individual market plans.

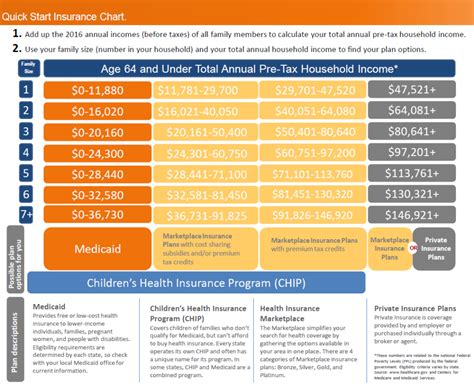

The Affordable Care Act (ACA), also known as Obamacare, has expanded health insurance coverage to millions of Americans. The law requires most individuals to have health insurance or face a penalty, although this penalty has been eliminated. The ACA also established the Health Insurance Marketplace, where individuals can purchase subsidized health insurance plans during open enrollment periods. These plans are categorized into four metal tiers: Bronze, Silver, Gold, and Platinum, with varying levels of coverage and premiums.

Understanding Low Price Health Insurance Options

Low price health insurance options are available through various channels. Employer-sponsored plans are often the most affordable option, as employers typically contribute to the premium costs. However, not everyone has access to these plans, and individual market plans may be the only choice for some. The Health Insurance Marketplace offers subsidized plans to eligible individuals, with premiums based on income and family size. Short-term health insurance plans are another option, providing temporary coverage for a limited period, usually up to 12 months.

Types of Low Price Health Insurance Plans

Low price health insurance plans can be categorized into several types, each with its unique characteristics and benefits. Catastrophic plans are designed for young adults or those who cannot afford other types of coverage. These plans have lower premiums but higher deductibles and limited coverage. Bronze plans, on the other hand, offer more comprehensive coverage, including essential health benefits, but with higher deductibles and out-of-pocket costs.Benefits of Low Price Health Insurance

The benefits of low price health insurance are numerous. Firstly, it provides financial protection against unexpected medical expenses, ensuring that individuals and families can access necessary care without breaking the bank. Secondly, low price health insurance plans often include preventive care services, such as vaccinations, screenings, and check-ups, which can help prevent more severe health issues. Finally, having health insurance can reduce stress and anxiety, allowing individuals to focus on their well-being and quality of life.

How to Choose a Low Price Health Insurance Plan

Choosing a low price health insurance plan can be overwhelming, especially with the numerous options available. It's essential to consider several factors, including premium costs, deductible amounts, copays, and coinsurance. Individuals should also evaluate the plan's network of providers, ensuring that their preferred doctors and hospitals are included. Additionally, policyholders should review the plan's coverage, including any exclusions or limitations, to ensure it meets their specific needs.Low Price Health Insurance Providers

Several low price health insurance providers offer affordable plans to individuals and families. Blue Cross Blue Shield, UnitedHealthcare, and Aetna are some of the largest and most well-established providers. These companies offer a range of plans, including catastrophic, Bronze, Silver, Gold, and Platinum options. Other providers, such as Kaiser Permanente and Humana, also offer low price health insurance plans, often with unique features and benefits.

Low Price Health Insurance for Specific Groups

Low price health insurance options are available for specific groups, including students, self-employed individuals, and those with pre-existing conditions. Student health insurance plans are designed for students, often with lower premiums and limited coverage. Self-employed individuals can purchase individual market plans or join professional associations to access group coverage. Those with pre-existing conditions may be eligible for subsidized plans or join high-risk pools, which provide coverage to individuals who cannot access traditional plans.Low Price Health Insurance and the Affordable Care Act

The Affordable Care Act has significantly impacted the low price health insurance market. The law requires most individuals to have health insurance or face a penalty, although this penalty has been eliminated. The ACA also established the Health Insurance Marketplace, where individuals can purchase subsidized health insurance plans during open enrollment periods. Additionally, the law expanded Medicaid coverage to millions of low-income individuals, providing access to affordable health insurance.

Low Price Health Insurance and Preventive Care

Low price health insurance plans often include preventive care services, such as vaccinations, screenings, and check-ups. These services can help prevent more severe health issues, reducing the risk of costly medical interventions. Preventive care can also detect health problems early on, allowing for timely treatment and improving health outcomes. Policyholders should review their plan's coverage to ensure it includes essential preventive care services.Low Price Health Insurance and Chronic Conditions

Low price health insurance plans can provide essential coverage for individuals with chronic conditions. These plans often include prescription medication coverage, specialist care, and hospitalization services. Policyholders should review their plan's coverage to ensure it meets their specific needs, including any necessary treatments or medications. Additionally, individuals with chronic conditions may be eligible for subsidized plans or join high-risk pools, which provide coverage to individuals who cannot access traditional plans.

Low Price Health Insurance and Mental Health

Low price health insurance plans often include mental health services, such as counseling, therapy, and medication management. These services can help individuals manage mental health conditions, such as depression, anxiety, and substance use disorders. Policyholders should review their plan's coverage to ensure it includes essential mental health services.Low Price Health Insurance and Dental Care

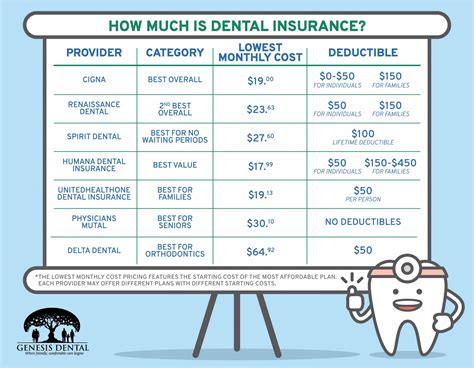

Low price health insurance plans may not always include dental care services. However, some plans offer optional dental coverage or discount programs, which can help reduce the cost of dental care. Policyholders should review their plan's coverage to ensure it includes essential dental services, such as routine cleanings, fillings, and extractions.

Low Price Health Insurance and Vision Care

Low price health insurance plans may not always include vision care services. However, some plans offer optional vision coverage or discount programs, which can help reduce the cost of vision care. Policyholders should review their plan's coverage to ensure it includes essential vision services, such as eye exams, glasses, and contact lenses.What is low price health insurance?

+Low price health insurance refers to health insurance plans that offer affordable premiums and coverage to individuals and families.

How do I choose a low price health insurance plan?

+To choose a low price health insurance plan, consider factors such as premium costs, deductible amounts, copays, and coinsurance. Evaluate the plan's network of providers and coverage to ensure it meets your specific needs.

What are the benefits of low price health insurance?

+The benefits of low price health insurance include financial protection against unexpected medical expenses, access to necessary care, and reduced stress and anxiety.

Can I get low price health insurance with a pre-existing condition?

+Yes, individuals with pre-existing conditions may be eligible for subsidized plans or join high-risk pools, which provide coverage to individuals who cannot access traditional plans.

How do I apply for low price health insurance?

+To apply for low price health insurance, visit the Health Insurance Marketplace or contact a licensed insurance agent or broker. You can also apply directly through an insurance provider's website or by phone.

In conclusion, low price health insurance options are available to individuals and families, providing essential coverage and financial protection. By understanding the various types of plans, benefits, and providers, individuals can make informed decisions and choose a plan that meets their specific needs. Remember to review your plan's coverage, including any exclusions or limitations, and take advantage of preventive care services to maintain good health and reduce the risk of costly medical interventions. If you have any questions or concerns, don't hesitate to reach out to a licensed insurance agent or broker for guidance. Share your thoughts and experiences with low price health insurance in the comments below, and help others make informed decisions about their health insurance coverage.