Intro

Discover comprehensive Family Medical Insurance Plans, covering health, dental, and vision needs with affordable premiums, flexible deductibles, and extensive network providers, ensuring financial protection and peace of mind for you and your loved ones.

Having a family medical insurance plan is crucial in today's world, where medical expenses can be overwhelming and unpredictable. With the rising costs of healthcare, it's essential to have a financial safety net that can protect your family from unexpected medical bills. Family medical insurance plans provide coverage for various medical expenses, including hospitalization, doctor visits, prescriptions, and more. In this article, we will delve into the world of family medical insurance plans, exploring their importance, benefits, and how to choose the right plan for your family.

The importance of family medical insurance plans cannot be overstated. Without proper coverage, a single medical emergency can lead to financial ruin. Medical bills can quickly add up, and even a short hospital stay can result in thousands of dollars in expenses. Furthermore, preventive care, such as routine check-ups and screenings, can help detect health issues early on, reducing the risk of more severe and costly problems down the line. By investing in a family medical insurance plan, you can ensure that your loved ones receive the medical attention they need, without breaking the bank.

In addition to providing financial protection, family medical insurance plans also offer peace of mind. Knowing that you and your family are covered in case of a medical emergency can be a huge relief, allowing you to focus on more important things in life. Moreover, many family medical insurance plans offer additional benefits, such as dental and vision coverage, which can help promote overall health and well-being. With so many options available, it's essential to understand the different types of family medical insurance plans, their benefits, and how to choose the right one for your family's needs.

Types of Family Medical Insurance Plans

There are several types of family medical insurance plans available, each with its unique features and benefits. Some of the most common types of plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Exclusive Provider Organization (EPO) plans, and Point of Service (POS) plans. HMO plans, for example, require policyholders to receive medical care from a specific network of providers, while PPO plans offer more flexibility, allowing policyholders to see any healthcare provider they choose, albeit at a higher cost. Understanding the differences between these plans is crucial in selecting the right one for your family's needs.

Health Maintenance Organization (HMO) Plans

HMO plans are a popular choice for families, as they often offer lower premiums and comprehensive coverage. With an HMO plan, policyholders are required to receive medical care from a specific network of providers, which can help control costs. However, this can also limit flexibility, as policyholders may need to obtain a referral from their primary care physician to see a specialist. HMO plans often include benefits such as preventive care, hospitalization, and prescription coverage, making them a great option for families who want comprehensive coverage at an affordable price.Preferred Provider Organization (PPO) Plans

PPO plans, on the other hand, offer more flexibility than HMO plans, as policyholders can see any healthcare provider they choose, both in-network and out-of-network. While this flexibility can be beneficial, it often comes at a higher cost, as out-of-network care can result in higher copays and coinsurance. PPO plans often include benefits such as preventive care, hospitalization, and prescription coverage, making them a great option for families who want more control over their healthcare.Benefits of Family Medical Insurance Plans

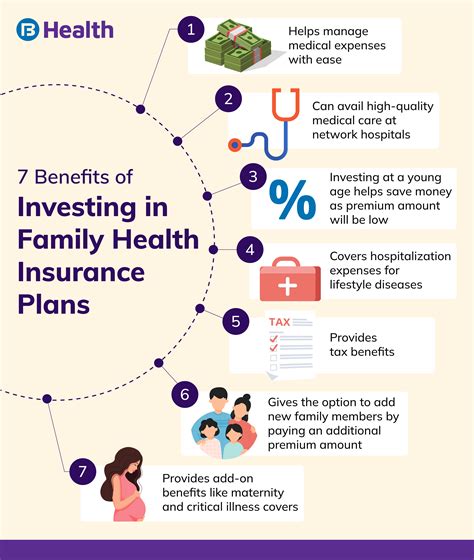

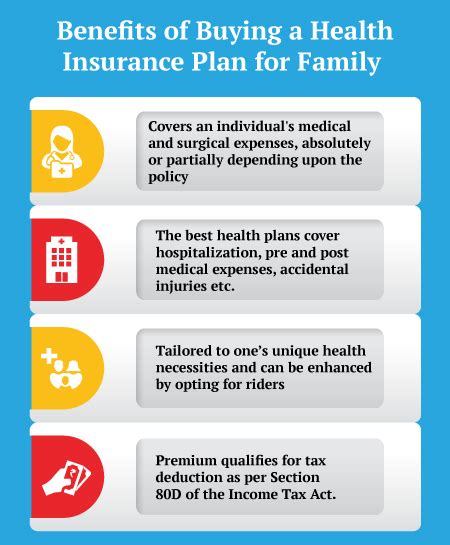

The benefits of family medical insurance plans are numerous and well-documented. Some of the most significant advantages include financial protection, access to quality healthcare, and peace of mind. With a family medical insurance plan, policyholders can rest assured that they will be protected from unexpected medical bills, which can help reduce stress and anxiety. Additionally, many plans offer preventive care benefits, such as routine check-ups and screenings, which can help detect health issues early on, reducing the risk of more severe and costly problems down the line.

Financial Protection

One of the most significant benefits of family medical insurance plans is financial protection. Without proper coverage, a single medical emergency can lead to financial ruin. Medical bills can quickly add up, and even a short hospital stay can result in thousands of dollars in expenses. With a family medical insurance plan, policyholders can ensure that they are protected from unexpected medical bills, which can help reduce stress and anxiety.Access to Quality Healthcare

Another significant benefit of family medical insurance plans is access to quality healthcare. With a plan, policyholders can ensure that they receive the medical attention they need, without breaking the bank. Many plans offer comprehensive coverage, including benefits such as preventive care, hospitalization, and prescription coverage, which can help promote overall health and well-being.How to Choose the Right Family Medical Insurance Plan

Choosing the right family medical insurance plan can be a daunting task, especially with so many options available. However, by considering a few key factors, policyholders can make an informed decision that meets their family's needs. Some of the most important factors to consider include premium costs, coverage options, network providers, and out-of-pocket expenses.

Premium Costs

One of the most significant factors to consider when choosing a family medical insurance plan is premium costs. Premiums can vary significantly depending on the plan, provider, and location. Policyholders should carefully review their budget and consider their premium costs, as well as any potential discounts or subsidies that may be available.Coverage Options

Another important factor to consider is coverage options. Policyholders should carefully review the plan's benefits, including preventive care, hospitalization, and prescription coverage, to ensure that they meet their family's needs. Additionally, policyholders should consider any potential limitations or exclusions, such as pre-existing condition exclusions or waiting periods.Common Mistakes to Avoid When Choosing a Family Medical Insurance Plan

When choosing a family medical insurance plan, there are several common mistakes to avoid. Some of the most significant mistakes include not carefully reviewing the plan's benefits, not considering premium costs, and not reviewing the plan's network providers. Policyholders should carefully review their plan's benefits, including preventive care, hospitalization, and prescription coverage, to ensure that they meet their family's needs.

Not Carefully Reviewing the Plan's Benefits

One of the most significant mistakes policyholders can make is not carefully reviewing the plan's benefits. Policyholders should carefully review the plan's benefits, including preventive care, hospitalization, and prescription coverage, to ensure that they meet their family's needs. Additionally, policyholders should consider any potential limitations or exclusions, such as pre-existing condition exclusions or waiting periods.Not Considering Premium Costs

Another significant mistake policyholders can make is not considering premium costs. Premiums can vary significantly depending on the plan, provider, and location. Policyholders should carefully review their budget and consider their premium costs, as well as any potential discounts or subsidies that may be available.Conclusion and Next Steps

In conclusion, family medical insurance plans are a crucial investment for any family. By understanding the different types of plans, their benefits, and how to choose the right one, policyholders can ensure that they and their loved ones receive the medical attention they need, without breaking the bank. Whether you're looking for comprehensive coverage or more flexible options, there's a family medical insurance plan out there that can meet your needs. By taking the time to carefully review your options and consider your family's unique needs, you can make an informed decision that will provide peace of mind and financial protection for years to come.

We invite you to share your thoughts and experiences with family medical insurance plans in the comments below. Have you had a positive or negative experience with a particular plan? Do you have any questions or concerns about choosing the right plan for your family? Share your story and help others make informed decisions about their healthcare.

What is the difference between an HMO and a PPO plan?

+HMO plans require policyholders to receive medical care from a specific network of providers, while PPO plans offer more flexibility, allowing policyholders to see any healthcare provider they choose, albeit at a higher cost.

How do I choose the right family medical insurance plan for my family?

+When choosing a family medical insurance plan, consider factors such as premium costs, coverage options, network providers, and out-of-pocket expenses. Carefully review the plan's benefits and consider your family's unique needs to make an informed decision.

What are the benefits of having a family medical insurance plan?

+The benefits of having a family medical insurance plan include financial protection, access to quality healthcare, and peace of mind. With a plan, policyholders can ensure that they and their loved ones receive the medical attention they need, without breaking the bank.