Intro

Discover the 5 key Medicare dates, including enrollment periods, eligibility timelines, and coverage start dates, to navigate Medicare plans, supplements, and Advantage options with ease and avoid penalties.

Understanding the various dates associated with Medicare is crucial for beneficiaries to ensure they make the most out of their health coverage. Medicare, a federal health insurance program primarily for individuals 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant), offers a range of plans and options that can be somewhat confusing. Knowing the key dates helps in managing and optimizing Medicare benefits, avoiding penalties, and ensuring continuous coverage. The importance of these dates cannot be overstated, as they dictate when beneficiaries can enroll, change plans, or apply for coverage, directly impacting their healthcare access and financial planning.

The Medicare program is divided into several parts, including Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). Each part serves a different purpose, and understanding when and how to enroll in or change these plans is essential for maximizing benefits. Moreover, the costs associated with Medicare, such as premiums, deductibles, and copays, can vary significantly from year to year, making it vital for beneficiaries to stay informed about upcoming changes and deadlines. By staying on top of these key dates, individuals can better navigate the Medicare system, make informed decisions about their healthcare, and avoid potential pitfalls that could lead to gaps in coverage or unexpected expenses.

Navigating the world of Medicare can be daunting, especially for those new to the program. The myriad of plans, rules, and deadlines can seem overwhelming, and the consequences of missing a critical date can be significant. For instance, failing to enroll in Part B when first eligible can result in a penalty, increasing premiums for as long as the beneficiary has Part B. Similarly, not reviewing and potentially changing Medicare Advantage or Part D plans during the annual open enrollment period could mean missing out on better coverage options or cost savings. Therefore, it's crucial for beneficiaries to have a clear understanding of the key Medicare dates and how these dates impact their healthcare and financial planning.

Introduction to Key Medicare Dates

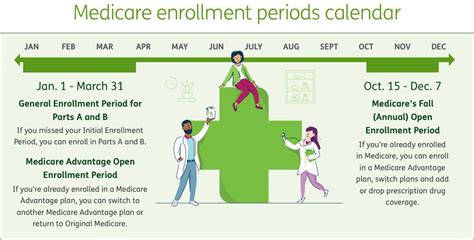

The key Medicare dates are designed to provide beneficiaries with opportunities to enroll, change, or review their coverage. These dates are critical because they dictate the times when beneficiaries can make changes to their Medicare plans, ensuring they have the best possible coverage for their healthcare needs. The most significant of these dates include the Initial Enrollment Period (IEP), the Annual Enrollment Period (AEP), the General Enrollment Period (GEP), and the Medicare Advantage Open Enrollment Period. Understanding the purpose and timing of each period is essential for navigating the Medicare system effectively.

Understanding the Initial Enrollment Period (IEP)

The Initial Enrollment Period is a seven-month period around the beneficiary's 65th birthday, including the three months before, the month of, and the three months after. This is typically the first opportunity for most people to enroll in Medicare Part A and Part B. It's also the time when individuals can enroll in a Medicare Advantage plan or a Part D prescription drug plan. The IEP is crucial because it sets the stage for a beneficiary's Medicare journey, offering a chance to secure comprehensive health coverage without incurring late enrollment penalties.

Importance of the IEP

The IEP is especially important because it allows beneficiaries to avoid late enrollment penalties for Part B and Part D. These penalties can significantly increase premiums over time, making healthcare more expensive. By enrolling during the IEP, individuals can ensure they have continuous coverage and avoid these costly penalties. Moreover, the IEP provides an opportunity to review and compare different Medicare plans, helping beneficiaries choose the coverage that best fits their healthcare needs and budget.

The Annual Enrollment Period (AEP)

The Annual Enrollment Period, also known as the Open Enrollment Period, occurs every year from October 15 to December 7. During this time, Medicare beneficiaries can make changes to their coverage, including switching from Original Medicare (Part A and Part B) to a Medicare Advantage plan, changing from one Medicare Advantage plan to another, or enrolling in, changing, or dropping a Part D prescription drug plan. The AEP is a critical period because it allows beneficiaries to reassess their healthcare needs and adjust their coverage accordingly, ensuring they have the best possible plan for the upcoming year.

AEP Considerations

When approaching the AEP, beneficiaries should consider several factors, including changes in their health status, new medications they may need, and any updates to their current plan's coverage or costs. It's also a good time to review the Medicare Star Ratings, which can provide insights into the quality and performance of different plans. By carefully evaluating these factors, individuals can make informed decisions about their Medicare coverage, potentially saving money or improving their healthcare outcomes.

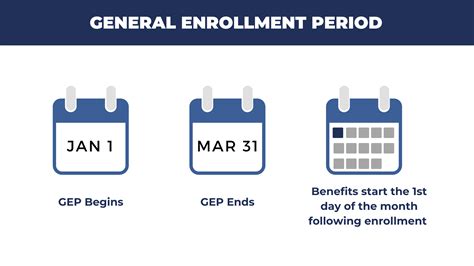

The General Enrollment Period (GEP)

The General Enrollment Period takes place from January 1 to March 31 each year. It's designed for individuals who missed their Initial Enrollment Period and didn't qualify for a Special Enrollment Period. During the GEP, these individuals can enroll in Medicare Part A and Part B. However, they may face penalties for late enrollment in Part B, and their coverage won't begin until July 1 of the same year. The GEP is an important safety net for those who missed their initial enrollment opportunity, providing a second chance to secure essential healthcare coverage.

GEP Implications

It's crucial for individuals considering the GEP to understand the implications of late enrollment. The late enrollment penalty for Part B can increase premiums by 10% for each full 12-month period that the individual could have had Part B but didn't. This penalty applies for as long as the beneficiary has Part B. Furthermore, the delay in coverage start date means that individuals may have to pay out-of-pocket for healthcare services until their Medicare coverage begins. Despite these considerations, the GEP offers a vital opportunity for individuals to correct past oversights and ensure they have the healthcare coverage they need.

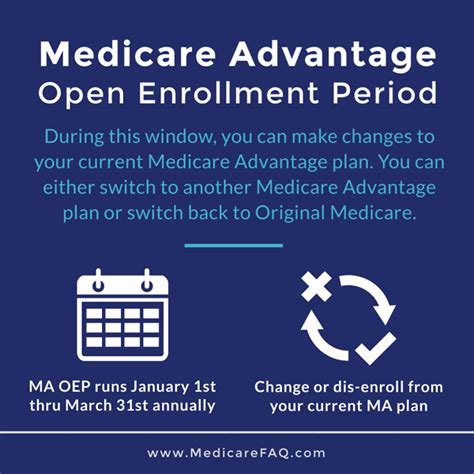

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31, allows individuals enrolled in a Medicare Advantage plan to switch to a different Medicare Advantage plan or to Original Medicare (and enroll in a Part D plan if needed). This period provides flexibility for beneficiaries who may find that their current Medicare Advantage plan no longer meets their needs or who wish to explore other coverage options.

MA OEP Considerations

When evaluating options during the Medicare Advantage Open Enrollment Period, beneficiaries should consider factors such as plan costs, coverage, provider networks, and the plan's quality ratings. It's also essential to review any changes to the plan's formulary, especially if the beneficiary relies on specific medications. By carefully comparing these elements, individuals can make informed decisions about their Medicare coverage, potentially improving their healthcare outcomes or reducing costs.

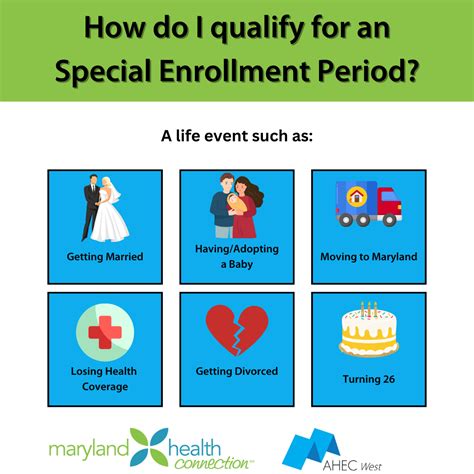

Special Enrollment Periods (SEPs)

Special Enrollment Periods are available for individuals who experience certain qualifying life events, such as moving to a new area, losing current health coverage, or becoming eligible for Medicaid. These periods allow beneficiaries to enroll in, change, or drop Medicare coverage outside the regular enrollment periods. SEPs are crucial for ensuring that individuals maintain continuous healthcare coverage, even when their life circumstances change.

SEP Eligibility

To be eligible for a Special Enrollment Period, individuals must meet specific criteria related to their qualifying life event. For example, moving to a new area where the current plan is not available, losing employer coverage, or becoming eligible for Medicare due to a disability. It's essential for beneficiaries to understand what qualifies as a SEP and to act promptly, as these periods are typically time-limited and offer a one-time opportunity to make changes to Medicare coverage.

Preparing for Medicare Enrollment

Preparing for Medicare enrollment involves several steps, including understanding the different parts of Medicare, researching available plans, and reviewing personal healthcare needs. Beneficiaries should also consider factors such as plan costs, provider networks, and coverage for specific services or medications. By being well-prepared, individuals can navigate the enrollment process more effectively, ensuring they secure the Medicare coverage that best suits their needs.

Enrollment Tips

Some valuable tips for Medicare enrollment include starting the research process early, using online tools to compare plans, and seeking advice from a licensed insurance agent or a State Health Insurance Assistance Program (SHIP) counselor. Beneficiaries should also review and understand the terms of their coverage, including any exclusions, limitations, or requirements for pre-authorization. By taking a proactive and informed approach to Medicare enrollment, individuals can make the most of their healthcare benefits and avoid potential pitfalls.

What is the Initial Enrollment Period for Medicare?

+The Initial Enrollment Period is a seven-month period around the beneficiary's 65th birthday, including the three months before, the month of, and the three months after, during which they can first enroll in Medicare Part A and Part B.

Can I change my Medicare plan during the Annual Enrollment Period?

+Yes, during the Annual Enrollment Period from October 15 to December 7, you can change from Original Medicare to a Medicare Advantage plan, switch from one Medicare Advantage plan to another, or enroll in, change, or drop a Part D prescription drug plan.

What happens if I miss my Initial Enrollment Period for Medicare Part B?

+If you miss your Initial Enrollment Period for Medicare Part B and do not qualify for a Special Enrollment Period, you can enroll during the General Enrollment Period from January 1 to March 31, but you may face a late enrollment penalty, and your coverage will not start until July 1.

How do I prepare for Medicare enrollment?

+Preparing for Medicare enrollment involves understanding the different parts of Medicare, researching available plans, reviewing personal healthcare needs, and considering factors such as plan costs, provider networks, and coverage for specific services or medications.

What is a Special Enrollment Period for Medicare?

+A Special Enrollment Period is a time outside the regular enrollment periods when you can enroll in, change, or drop Medicare coverage due to certain qualifying life events, such as moving to a new area, losing current health coverage, or becoming eligible for Medicaid.

In conclusion, understanding the key Medicare dates is essential for navigating the complex world of Medicare effectively. By staying informed about these critical periods, beneficiaries can ensure they have the best possible coverage for their healthcare needs, avoid penalties, and make the most out of their Medicare benefits. Whether it's the Initial Enrollment Period, the Annual Enrollment Period, the General Enrollment Period, or a Special Enrollment Period, each date plays a vital role in the Medicare journey. As the healthcare landscape continues to evolve, staying up-to-date on these dates and how they impact Medicare coverage will remain crucial for beneficiaries seeking to optimize their healthcare and financial well-being. We invite readers to share their experiences and questions about navigating Medicare enrollment periods and to explore further resources for making informed decisions about their healthcare coverage.