Intro

Find affordable health insurance plans with low premiums, flexible coverage, and comprehensive benefits, including medical, dental, and vision care, to suit individual and family needs, ensuring financial protection and access to quality healthcare services.

The cost of healthcare in the United States continues to rise, making it challenging for many individuals and families to access quality medical care. The importance of having health insurance cannot be overstated, as it provides financial protection against unexpected medical expenses and ensures that individuals receive necessary treatment. However, the high cost of health insurance premiums can be a significant barrier for many people. Fortunately, there are ways to get affordable health insurance, and this article will explore the various options available.

Having health insurance is crucial for maintaining good health and preventing financial ruin in the event of a medical emergency. Without insurance, individuals may be forced to delay or forego necessary medical care, which can lead to poorer health outcomes and increased healthcare costs in the long run. Moreover, the Affordable Care Act (ACA) requires most individuals to have minimum essential coverage, and those who do not comply may face penalties. Therefore, it is essential to explore affordable health insurance options to ensure that individuals and families have access to quality medical care.

The rising cost of health insurance premiums has led to an increase in the number of uninsured individuals. Many people struggle to afford the high cost of premiums, deductibles, and copays, making it challenging to access necessary medical care. However, there are various ways to get affordable health insurance, including government-sponsored programs, employer-sponsored plans, and private insurance marketplaces. Additionally, some states have implemented their own health insurance marketplaces, which offer more affordable options for residents. By understanding the different options available, individuals and families can make informed decisions about their health insurance needs.

Understanding Health Insurance Options

There are several health insurance options available, each with its own set of benefits and drawbacks. Understanding these options is crucial for making informed decisions about health insurance needs. The most common types of health insurance include employer-sponsored plans, individual and family plans, Medicare, Medicaid, and the Children's Health Insurance Program (CHIP). Employer-sponsored plans are typically the most affordable option, as employers often contribute to the cost of premiums. Individual and family plans, on the other hand, can be more expensive, but they offer more flexibility and customization options.

Employer-Sponsored Plans

Employer-sponsored plans are a popular option for many individuals and families. These plans are typically offered by employers as a benefit to their employees and often include a range of coverage options, such as medical, dental, and vision insurance. Employer-sponsored plans can be more affordable than individual and family plans, as employers often contribute to the cost of premiums. Additionally, these plans often have lower deductibles and copays, making it easier for individuals to access necessary medical care.Individual and Family Plans

Individual and family plans are designed for individuals and families who do not have access to employer-sponsored coverage. These plans can be purchased through private insurance marketplaces, such as eHealth or GetInsured, or through government-sponsored marketplaces, such as Healthcare.gov. Individual and family plans offer more flexibility and customization options, as individuals can choose from a range of coverage levels and premium prices. However, these plans can be more expensive than employer-sponsored plans, and individuals may be required to pay higher deductibles and copays.Affordable Health Insurance Options

There are several affordable health insurance options available, including government-sponsored programs, short-term health insurance, and catastrophic plans. Government-sponsored programs, such as Medicaid and the Children's Health Insurance Program (CHIP), provide coverage to low-income individuals and families. Short-term health insurance plans, on the other hand, offer temporary coverage for individuals who are between jobs or waiting for other coverage to begin. Catastrophic plans are designed for young adults and individuals who cannot afford other types of coverage, offering limited coverage at a lower premium price.

Government-Sponsored Programs

Government-sponsored programs, such as Medicaid and CHIP, provide coverage to low-income individuals and families. These programs are designed to ensure that vulnerable populations have access to necessary medical care, regardless of their income level. Medicaid, for example, provides comprehensive coverage to low-income individuals and families, including children, pregnant women, and individuals with disabilities. CHIP, on the other hand, provides coverage to children in low-income families who do not qualify for Medicaid.Short-Term Health Insurance

Short-term health insurance plans offer temporary coverage for individuals who are between jobs or waiting for other coverage to begin. These plans are designed to provide limited coverage for a short period, typically up to 12 months. Short-term plans can be more affordable than individual and family plans, but they often have limited coverage and higher deductibles. Additionally, short-term plans may not provide coverage for pre-existing conditions, making them less desirable for individuals with ongoing health needs.How to Get Affordable Health Insurance

Getting affordable health insurance requires careful planning and research. Individuals and families should start by exploring their options, including government-sponsored programs, employer-sponsored plans, and private insurance marketplaces. It is essential to compare premiums, deductibles, and coverage levels to find the most affordable option. Additionally, individuals should consider their health needs and choose a plan that provides adequate coverage.

Comparing Health Insurance Plans

Comparing health insurance plans is crucial for finding the most affordable option. Individuals and families should consider several factors, including premiums, deductibles, copays, and coverage levels. Premiums are the monthly payments made to the insurance company, while deductibles are the amount individuals must pay out-of-pocket before coverage begins. Copays, on the other hand, are the amount individuals must pay for each medical service, such as doctor visits or prescriptions. Coverage levels, including the types of services covered and the network of providers, should also be carefully considered.Enrolling in a Health Insurance Plan

Enrolling in a health insurance plan can be a complex process, but it is essential for getting affordable coverage. Individuals and families can enroll in a plan through private insurance marketplaces, government-sponsored marketplaces, or directly through an insurance company. The enrollment process typically involves completing an application, providing documentation, and paying the first premium payment. It is essential to carefully review the plan details and ask questions before enrolling to ensure that the chosen plan meets individual or family needs.Tips for Saving Money on Health Insurance

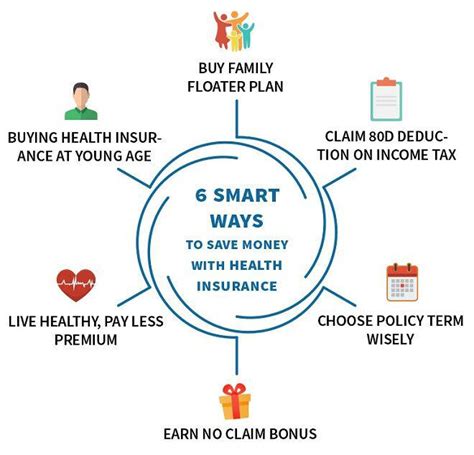

There are several tips for saving money on health insurance, including choosing a high-deductible plan, using a health savings account (HSA), and taking advantage of preventive care services. High-deductible plans often have lower premiums, but individuals must pay more out-of-pocket before coverage begins. HSAs, on the other hand, allow individuals to set aside pre-tax dollars for medical expenses, reducing their taxable income. Preventive care services, such as annual check-ups and screenings, can help prevent costly medical conditions and reduce healthcare costs in the long run.

Using a Health Savings Account (HSA)

Using an HSA can help individuals save money on health insurance by reducing their taxable income. HSAs are tax-advantaged accounts that allow individuals to set aside pre-tax dollars for medical expenses. Contributions to an HSA are tax-deductible, and the funds grow tax-free. Additionally, HSAs can be used to pay for a range of medical expenses, including doctor visits, prescriptions, and hospital stays.Taking Advantage of Preventive Care Services

Taking advantage of preventive care services can help individuals save money on health insurance by preventing costly medical conditions. Preventive care services, such as annual check-ups and screenings, can help identify health problems early, reducing the need for costly treatments and medications. Many health insurance plans cover preventive care services at no additional cost, making it essential to take advantage of these services to maintain good health and reduce healthcare costs.Conclusion and Next Steps

In conclusion, getting affordable health insurance requires careful planning and research. Individuals and families should explore their options, compare premiums and coverage levels, and consider their health needs to find the most affordable option. By taking advantage of government-sponsored programs, short-term health insurance, and catastrophic plans, individuals can access quality medical care at a lower cost. Additionally, using a health savings account (HSA) and taking advantage of preventive care services can help reduce healthcare costs and maintain good health.

To take the next step, individuals and families can start by visiting the Healthcare.gov website or contacting a licensed insurance agent to explore their options. It is essential to carefully review plan details and ask questions before enrolling to ensure that the chosen plan meets individual or family needs. By taking control of their health insurance needs, individuals and families can access quality medical care, reduce healthcare costs, and maintain good health.

What is the difference between a high-deductible plan and a low-deductible plan?

+A high-deductible plan typically has a lower premium but a higher deductible, while a low-deductible plan has a higher premium but a lower deductible. High-deductible plans often require individuals to pay more out-of-pocket before coverage begins, while low-deductible plans provide more comprehensive coverage at a higher premium price.

Can I use a health savings account (HSA) to pay for medical expenses?

+Yes, you can use an HSA to pay for medical expenses, including doctor visits, prescriptions, and hospital stays. HSAs are tax-advantaged accounts that allow individuals to set aside pre-tax dollars for medical expenses, reducing their taxable income.

What is the difference between Medicaid and the Children's Health Insurance Program (CHIP)?

+Medicaid provides comprehensive coverage to low-income individuals and families, including children, pregnant women, and individuals with disabilities. CHIP, on the other hand, provides coverage to children in low-income families who do not qualify for Medicaid. Both programs are designed to ensure that vulnerable populations have access to necessary medical care, regardless of their income level.

We hope this article has provided you with valuable information and insights on how to get affordable health insurance. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please consider sharing it with your friends and family who may be struggling to access quality medical care. By working together, we can ensure that everyone has access to affordable health insurance and quality medical care.