Intro

Streamline your finances with secure pay online bill payment options, offering convenient digital transactions, easy payment tracking, and automatic bill reminders.

The advent of technology has revolutionized the way we conduct our daily transactions, and one of the most significant benefits is the ability to pay online bill payments. Gone are the days of standing in long queues, writing checks, or worrying about late payment fees. With online bill payment, individuals can now manage their finances with ease, convenience, and speed. The importance of online bill payment cannot be overstated, as it has become an essential tool for individuals and businesses alike. In this article, we will delve into the world of online bill payment, exploring its benefits, working mechanisms, and steps to ensure a seamless payment experience.

The rise of online bill payment has been driven by the increasing demand for convenience, flexibility, and security. With the proliferation of smartphones, laptops, and tablets, individuals can now access their accounts, view their bills, and make payments from anywhere, at any time. This has not only saved time but also reduced the likelihood of late payments, which can result in additional fees and damage to one's credit score. Moreover, online bill payment has also reduced the need for physical documentation, minimizing the risk of lost or stolen bills, and reducing the environmental impact of paper waste.

The benefits of online bill payment are numerous, and it is essential to understand how this system works. At its core, online bill payment involves the transfer of funds from an individual's account to the biller's account, using a secure online platform. This platform can be accessed through a website, mobile app, or online banking system, and typically requires the individual to register for an account, link their payment method, and set up their biller information. Once this is done, the individual can view their bills, schedule payments, and receive notifications and reminders to ensure timely payments.

Benefits of Online Bill Payment

The benefits of online bill payment are numerous, and some of the most significant advantages include convenience, speed, and security. With online bill payment, individuals can manage their finances from anywhere, at any time, eliminating the need for physical visits to the bank or biller's office. This not only saves time but also reduces the risk of late payments, which can result in additional fees and damage to one's credit score. Moreover, online bill payment also provides a secure and reliable way to make payments, using encryption and other security measures to protect sensitive information.

Some of the key benefits of online bill payment include:

- Convenience: Online bill payment allows individuals to manage their finances from anywhere, at any time, eliminating the need for physical visits to the bank or biller's office.

- Speed: Online bill payment enables individuals to make payments quickly and efficiently, reducing the risk of late payments and associated fees.

- Security: Online bill payment provides a secure and reliable way to make payments, using encryption and other security measures to protect sensitive information.

- Flexibility: Online bill payment allows individuals to schedule payments in advance, set up recurring payments, and receive notifications and reminders to ensure timely payments.

- Environmentally friendly: Online bill payment reduces the need for physical documentation, minimizing the risk of lost or stolen bills, and reducing the environmental impact of paper waste.

How Online Bill Payment Works

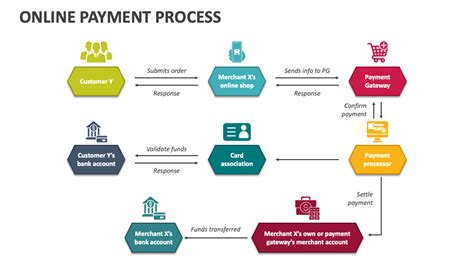

The online bill payment process typically involves several steps, including registration, linking payment methods, setting up biller information, and scheduling payments. Here's a step-by-step guide to the online bill payment process:

- Registration: Individuals must register for an account with the online bill payment platform, providing personal and financial information to verify their identity.

- Linking payment methods: Individuals must link their payment methods, such as credit cards, debit cards, or bank accounts, to their online bill payment account.

- Setting up biller information: Individuals must set up their biller information, including the biller's name, account number, and payment amount.

- Scheduling payments: Individuals can schedule payments in advance, set up recurring payments, and receive notifications and reminders to ensure timely payments.

- Payment processing: The online bill payment platform processes the payment, transferring funds from the individual's account to the biller's account.

Types of Online Bill Payment

There are several types of online bill payment, including: * Credit card payments: Individuals can make payments using their credit cards, earning rewards and accumulating points. * Debit card payments: Individuals can make payments using their debit cards, drawing funds directly from their checking accounts. * Bank transfer payments: Individuals can make payments using bank transfers, transferring funds from their bank accounts to the biller's account. * Electronic funds transfer (EFT) payments: Individuals can make payments using EFT, transferring funds electronically from their bank accounts to the biller's account.Security Measures for Online Bill Payment

The security of online bill payment is a top priority, and several measures are in place to protect sensitive information. Some of the key security measures include:

- Encryption: Online bill payment platforms use encryption to protect sensitive information, such as credit card numbers and bank account details.

- Firewalls: Online bill payment platforms use firewalls to prevent unauthorized access to their systems and protect against cyber threats.

- Secure sockets layer (SSL) certificates: Online bill payment platforms use SSL certificates to verify their identity and ensure a secure connection.

- Two-factor authentication: Online bill payment platforms use two-factor authentication to verify the identity of individuals, adding an extra layer of security to the payment process.

Best Practices for Online Bill Payment

To ensure a seamless and secure online bill payment experience, individuals should follow best practices, including: * Using strong passwords and keeping them confidential * Monitoring account activity regularly * Verifying the identity of the biller and the online bill payment platform * Keeping software and browsers up to date * Avoiding public computers and public Wi-Fi networksConclusion and Future of Online Bill Payment

In conclusion, online bill payment has revolutionized the way we manage our finances, providing a convenient, secure, and reliable way to make payments. As technology continues to evolve, we can expect to see even more innovative solutions, such as mobile payments, contactless payments, and blockchain-based payments. To stay ahead of the curve, individuals must stay informed about the latest developments and best practices in online bill payment, ensuring a seamless and secure payment experience.

We invite you to share your thoughts and experiences with online bill payment in the comments below. Have you encountered any challenges or benefits with online bill payment? What do you think is the future of online bill payment? Share this article with your friends and family to help them understand the importance of online bill payment and how to make the most of it.

What is online bill payment?

+Online bill payment is a service that allows individuals to pay their bills online, using a secure platform to transfer funds from their account to the biller's account.

How does online bill payment work?

+Online bill payment works by allowing individuals to register for an account, link their payment methods, set up biller information, and schedule payments, which are then processed electronically.

Is online bill payment secure?

+Yes, online bill payment is secure, using encryption, firewalls, and other security measures to protect sensitive information and prevent unauthorized access.

What are the benefits of online bill payment?

+The benefits of online bill payment include convenience, speed, security, flexibility, and environmental benefits, making it a preferred method for managing finances.

Can I use online bill payment for all my bills?

+Most bills can be paid online, but it's essential to check with the biller to confirm their online payment options and any associated fees.