Intro

Compare HMO vs PPO health insurance plans with 5 expert tips, exploring network coverage, out-of-pocket costs, and provider flexibility to make informed decisions about managed care, copays, and deductibles.

When it comes to choosing a health insurance plan, two of the most popular options are Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans. Both types of plans have their advantages and disadvantages, and it's essential to understand the differences between them to make an informed decision. In this article, we'll delve into the world of HMO and PPO plans, exploring their benefits, drawbacks, and key features.

The importance of selecting the right health insurance plan cannot be overstated. With the rising costs of medical care, having adequate coverage can be the difference between financial stability and bankruptcy. Moreover, the right plan can provide peace of mind, knowing that you and your loved ones are protected in case of unexpected medical expenses. As we navigate the complexities of HMO and PPO plans, we'll examine the factors that can help you make a decision that suits your needs and budget.

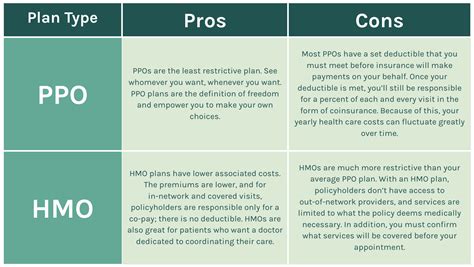

As we explore the world of HMO and PPO plans, it's crucial to consider the trade-offs between cost, flexibility, and coverage. HMO plans, for instance, often offer lower premiums but may limit your access to certain healthcare providers. On the other hand, PPO plans provide more flexibility in terms of provider choice but may come with higher premiums and out-of-pocket costs. By understanding these trade-offs, you can make an informed decision that balances your healthcare needs with your financial situation.

Understanding HMO Plans

One of the key benefits of HMO plans is their cost-effectiveness. By limiting your access to a specific network of providers, HMO plans can negotiate lower rates with these providers, resulting in lower premiums for you. Additionally, HMO plans often have lower out-of-pocket costs, such as copays and deductibles, making them a more affordable option for many individuals and families.

Benefits of HMO Plans

Some of the benefits of HMO plans include: * Lower premiums compared to PPO plans * Lower out-of-pocket costs, such as copays and deductibles * Coordinate care through a primary care physician (PCP) * Often include preventive care services, such as routine check-ups and screeningsUnderstanding PPO Plans

One of the primary advantages of PPO plans is their flexibility. If you have a preferred healthcare provider who is not part of an HMO network, a PPO plan can provide you with the freedom to continue seeing that provider. Additionally, PPO plans often have a larger network of providers, giving you more options for specialized care.

Benefits of PPO Plans

Some of the benefits of PPO plans include: * More flexibility in terms of provider choice * Can receive care from any healthcare provider, both in-network and out-of-network * Often have a larger network of providers * May be a better option for those who need specialized careComparing HMO and PPO Plans

Another key difference between HMO and PPO plans is their cost structure. HMO plans often have lower premiums but may have higher out-of-pocket costs for out-of-network care. PPO plans, while more expensive in terms of premiums, may offer more comprehensive coverage for out-of-network care.

Key Differences Between HMO and PPO Plans

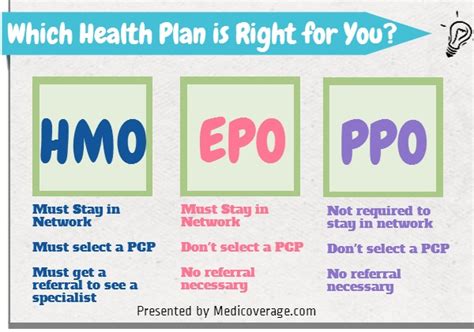

Some of the key differences between HMO and PPO plans include: * Network structure: HMO plans have a more restrictive network, while PPO plans have a more flexible network * Cost structure: HMO plans often have lower premiums but may have higher out-of-pocket costs for out-of-network care * Provider choice: PPO plans offer more flexibility in terms of provider choice * Referrals: HMO plans often require a referral from a PCP to see a specialist, while PPO plans do notChoosing the Right Plan for Your Needs

It's essential to carefully evaluate your healthcare needs and budget before making a decision. Consider factors such as your family's medical history, your current health status, and your anticipated healthcare expenses. Additionally, think about your personal preferences, such as your willingness to pay more for flexibility in provider choice.

Factors to Consider When Choosing a Plan

Some of the factors to consider when choosing a plan include: * Healthcare needs: Consider your family's medical history, your current health status, and your anticipated healthcare expenses * Budget: Evaluate your ability to pay premiums, out-of-pocket costs, and other expenses * Personal preferences: Think about your willingness to pay more for flexibility in provider choice * Network structure: Consider the importance of having a flexible network of providers5 HMO vs PPO Tips

By following these tips, you can make an informed decision that balances your healthcare needs with your financial situation.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is their network structure. HMO plans have a more restrictive network, requiring you to receive care from specific providers, while PPO plans have a more flexible network, allowing you to choose your own healthcare providers.

Which plan is more affordable, HMO or PPO?

+HMO plans are often more affordable than PPO plans, with lower premiums and out-of-pocket costs. However, PPO plans may offer more comprehensive coverage for out-of-network care.

Can I see any doctor I want with a PPO plan?

+With a PPO plan, you can see any doctor you want, both in-network and out-of-network. However, you'll typically pay more for out-of-network care.

Do HMO plans cover out-of-network care?

+HMO plans usually don't cover out-of-network care, except in emergency situations. If you need to see a specialist or receive care from a provider outside of your network, you may need to pay out-of-pocket or switch to a PPO plan.

How do I choose the right plan for my needs?

+To choose the right plan, evaluate your healthcare needs, budget, and personal preferences. Consider factors such as your family's medical history, your current health status, and your anticipated healthcare expenses. Additionally, research provider networks, compare plan features, and read reviews from current policyholders.

In conclusion, choosing the right health insurance plan is a crucial decision that can have a significant impact on your financial and physical well-being. By understanding the differences between HMO and PPO plans, evaluating your healthcare needs and budget, and considering your personal preferences, you can make an informed decision that balances your healthcare needs with your financial situation. Remember to research provider networks, compare plan features, and read reviews from current policyholders to ensure you're making the best choice for your unique situation.