Intro

Unlock expert 5 HMO tips for landlords, including HMO licensing, tenant management, and property optimization, to maximize rental yields and compliance with HMO regulations and laws.

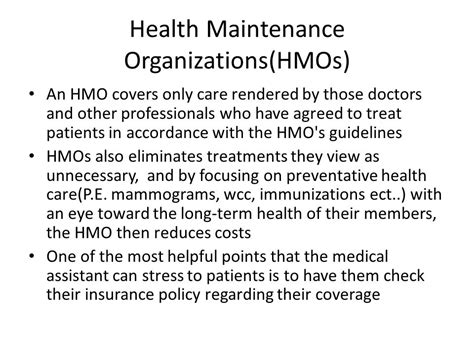

The world of health maintenance organizations (HMOs) can be complex and overwhelming, especially for those who are new to the concept. With so many options available, it's essential to understand the ins and outs of HMOs to make informed decisions about your healthcare. In this article, we'll delve into the world of HMOs, exploring their benefits, drawbacks, and providing valuable tips to help you navigate the system.

Health maintenance organizations have been around for decades, offering an alternative to traditional health insurance plans. By providing a range of healthcare services for a fixed fee, HMOs aim to promote preventive care, reduce costs, and improve health outcomes. However, with the numerous options available, it's crucial to choose the right HMO plan that suits your needs and budget. In the following sections, we'll discuss the key aspects of HMOs, including their advantages, disadvantages, and provide practical tips to help you make the most of your HMO plan.

Understanding HMOs

Benefits of HMOs

The benefits of HMOs are numerous, including lower premiums, reduced out-of-pocket costs, and a focus on preventive care. By emphasizing preventive care, HMOs aim to reduce the likelihood of costly medical interventions down the line. Additionally, HMOs often provide members with access to a range of health and wellness programs, such as fitness classes, nutrition counseling, and stress management workshops. These programs can help members adopt healthy habits, manage chronic conditions, and improve their overall well-being.Choosing the Right HMO Plan

HMO Tips and Tricks

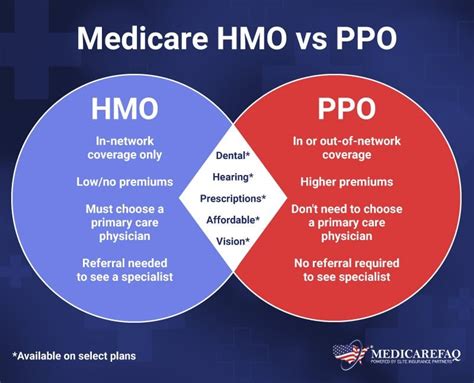

To make the most of your HMO plan, here are some valuable tips and tricks to keep in mind: * Always choose a primary care physician (PCP) who is a good fit for your needs and preferences. * Take advantage of preventive care services, such as annual check-ups, screenings, and vaccinations. * Keep track of your out-of-pocket costs and ensure you're not exceeding your plan's maximum out-of-pocket limit. * Don't be afraid to ask questions or seek a second opinion if you're unsure about a diagnosis or treatment plan.HMO vs. PPO: What's the Difference?

PPO Benefits and Drawbacks

PPOs offer several benefits, including greater flexibility in terms of provider choice and out-of-network care. However, this flexibility often comes at a cost, with PPOs typically having higher premiums and out-of-pocket costs compared to HMOs. Additionally, PPOs may have more complex billing and reimbursement processes, which can be confusing for members.HMOs and Preventive Care

The Importance of Preventive Care

Preventive care is essential for maintaining good health and reducing the risk of chronic diseases. By catching health problems early, members can avoid costly medical interventions and improve their overall quality of life. Additionally, preventive care can help members adopt healthy habits, manage chronic conditions, and reduce their risk of developing certain diseases.HMOs and Chronic Condition Management

Benefits of Chronic Condition Management

The benefits of chronic condition management are numerous, including improved health outcomes, reduced hospitalizations, and enhanced quality of life. By providing members with access to specialized care and support, HMOs can help members manage their conditions, reduce their risk of complications, and improve their overall well-being.HMOs and Mental Health

Importance of Mental Health Support

Mental health support is essential for maintaining good mental health and reducing the risk of mental health conditions. By providing members with access to mental health services, HMOs can help members manage stress, anxiety, and other mental health concerns, improving their overall quality of life.HMOs and Customer Service

Tips for Getting the Most Out of Your HMO

To get the most out of your HMO plan, here are some valuable tips to keep in mind: * Always read and understand your plan's benefits and limitations. * Keep track of your out-of-pocket costs and ensure you're not exceeding your plan's maximum out-of-pocket limit. * Don't be afraid to ask questions or seek a second opinion if you're unsure about a diagnosis or treatment plan. * Take advantage of preventive care services and health and wellness programs.What is an HMO, and how does it work?

+An HMO, or health maintenance organization, is a type of health insurance plan that provides a range of healthcare services for a fixed fee. HMOs typically require members to choose a primary care physician (PCP) from their network, who will then coordinate their care and refer them to specialists as needed.

What are the benefits of an HMO plan?

+The benefits of an HMO plan include lower premiums, reduced out-of-pocket costs, and a focus on preventive care. HMOs often provide members with access to a range of health and wellness programs, such as fitness classes, nutrition counseling, and stress management workshops.

How do I choose the right HMO plan for my needs?

+To choose the right HMO plan, research the plan's network of providers, review the plan's coverage and benefits, and compare the plan's premiums, deductibles, and out-of-pocket costs. Consider your individual needs and preferences, such as the need for specialized care or access to certain healthcare providers.

In conclusion, navigating the world of HMOs can be complex, but by understanding the benefits, drawbacks, and tips outlined in this article, you can make informed decisions about your healthcare. Remember to always choose a plan that meets your needs and budget, and don't be afraid to ask questions or seek a second opinion if you're unsure about a diagnosis or treatment plan. By taking control of your healthcare and making the most of your HMO plan, you can improve your overall health and well-being, and reduce your risk of costly medical interventions down the line. We invite you to share your thoughts and experiences with HMOs in the comments below, and encourage you to share this article with others who may benefit from this valuable information.