Intro

Discover 5 expert tips to buy the perfect health plan, ensuring comprehensive medical coverage, affordable premiums, and stress-free claims, with insights on policy benefits, network providers, and deductible options.

Purchasing a health plan can be a daunting task, especially with the numerous options available in the market. It's essential to make an informed decision to ensure you and your loved ones receive the best possible care when needed. With the rising costs of medical expenses, having a suitable health plan can provide financial protection and peace of mind. In this article, we will delve into the world of health plans, exploring the key factors to consider when buying one, and provide valuable tips to help you make the right choice.

The importance of having a health plan cannot be overstated. Medical emergencies can arise at any time, and without adequate coverage, you may find yourself facing significant financial burdens. Moreover, a health plan can help you maintain your overall well-being by providing access to preventive care, diagnostic tests, and specialist consultations. As you navigate the complex landscape of health insurance, it's crucial to stay informed and up-to-date on the latest developments and trends.

When buying a health plan, there are several factors to consider, including your age, health status, income, and personal preferences. You should also think about the type of coverage you need, whether it's individual, family, or group insurance. With so many options available, it's easy to feel overwhelmed. However, by breaking down the process into manageable steps and seeking professional advice when needed, you can find a health plan that meets your unique requirements and budget.

Understanding Health Plan Options

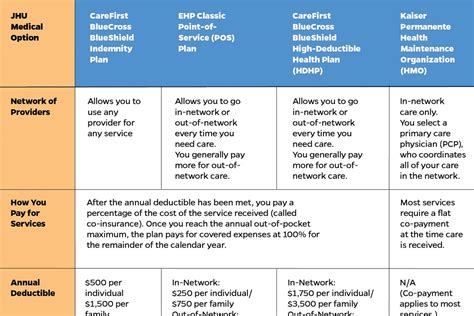

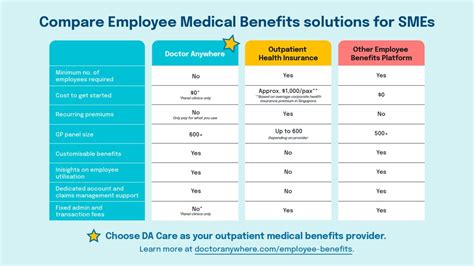

Understanding the different types of health plans is vital to making an informed decision. The most common types include Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), and Point of Service (POS) plans. Each type has its advantages and disadvantages, and some may be more suitable to your needs than others. For instance, HMOs often have lower premiums but may limit your choice of healthcare providers. On the other hand, PPOs offer more flexibility in terms of provider selection but may come with higher costs.

Key Factors to Consider

When evaluating health plan options, there are several key factors to consider. These include the premium costs, deductible amounts, copayment and coinsurance rates, and the out-of-pocket maximum. You should also look at the plan's network of healthcare providers, including primary care physicians, specialists, and hospitals. Additionally, consider the plan's coverage for prescription medications, mental health services, and alternative therapies.Evaluating Health Plan Benefits

Evaluating the benefits of a health plan is crucial to determining its value and suitability. Look for plans that offer comprehensive coverage, including preventive care, diagnostic tests, and treatment for chronic conditions. Some plans may also provide additional benefits, such as dental and vision coverage, fitness programs, and wellness incentives. When assessing the benefits, consider your individual needs and priorities. For example, if you have a family history of certain medical conditions, you may want to prioritize plans that offer specialized care and treatment options.

Comparing Health Plan Costs

Comparing the costs of different health plans is essential to finding a affordable option. Start by calculating your total out-of-pocket costs, including premiums, deductibles, copayments, and coinsurance. You should also consider the plan's maximum out-of-pocket limit, which can help protect you from unexpected medical expenses. Additionally, look at the plan's premium costs, including any discounts or subsidies you may be eligible for. By carefully evaluating the costs and benefits, you can make an informed decision that meets your budget and healthcare needs.Choosing the Right Health Plan

Choosing the right health plan requires careful consideration and research. Start by identifying your priorities, including the type of coverage you need, your budget, and your healthcare preferences. You should also evaluate the plan's network of providers, including the quality and accessibility of care. Additionally, consider the plan's customer service and support, including the availability of online resources and phone support.

Seeking Professional Advice

Seeking professional advice can be invaluable when buying a health plan. Insurance brokers and agents can provide expert guidance and help you navigate the complex process. They can also assist with plan selection, enrollment, and claims processing. When working with a broker or agent, be sure to ask questions and seek clarification on any aspects of the plan you don't understand.5 Tips for Buying a Health Plan

Here are 5 tips for buying a health plan:

- Start by researching and comparing different health plans, including their costs, benefits, and provider networks.

- Evaluate your healthcare needs and priorities, including any pre-existing conditions or ongoing treatments.

- Consider working with an insurance broker or agent to get expert guidance and support.

- Carefully review the plan's terms and conditions, including any exclusions or limitations.

- Don't hesitate to ask questions or seek clarification on any aspects of the plan you don't understand.

Common Mistakes to Avoid

When buying a health plan, there are several common mistakes to avoid. These include: * Not carefully evaluating the plan's network of providers and coverage options. * Failing to consider your individual healthcare needs and priorities. * Not comparing costs and benefits across different plans. * Not seeking professional advice or guidance. * Not carefully reviewing the plan's terms and conditions.Health Plan Enrollment and Claims Processing

Once you've selected a health plan, the next step is to enroll and begin using your coverage. This typically involves completing an application, providing required documentation, and paying your premiums. When submitting claims, be sure to follow the plan's procedures and guidelines, including any required paperwork or documentation. You should also keep track of your claims and expenses, including any out-of-pocket costs or reimbursements.

Managing Your Health Plan

Managing your health plan requires ongoing attention and maintenance. This includes staying up-to-date on your plan's terms and conditions, including any changes to coverage or benefits. You should also keep track of your premiums, deductibles, and out-of-pocket expenses, including any payments or reimbursements. Additionally, consider taking advantage of any wellness programs or incentives offered by your plan, including fitness classes, health screenings, or disease management programs.Conclusion and Next Steps

In conclusion, buying a health plan requires careful consideration and research. By understanding your options, evaluating the benefits and costs, and seeking professional advice, you can find a plan that meets your unique needs and budget. Remember to stay informed and up-to-date on your plan's terms and conditions, and don't hesitate to ask questions or seek clarification on any aspects of the plan you don't understand.

We hope this article has provided you with valuable insights and tips for buying a health plan. If you have any further questions or comments, please don't hesitate to share them below. You can also share this article with friends and family who may be looking for guidance on buying a health plan.

What is the most important factor to consider when buying a health plan?

+The most important factor to consider when buying a health plan is your individual healthcare needs and priorities, including any pre-existing conditions or ongoing treatments.

How do I choose the right health plan for my family?

+To choose the right health plan for your family, consider factors such as the type of coverage you need, your budget, and your healthcare preferences. You should also evaluate the plan's network of providers, including the quality and accessibility of care.

What is the difference between an HMO and a PPO health plan?

+An HMO (Health Maintenance Organization) plan typically has lower premiums but may limit your choice of healthcare providers. A PPO (Preferred Provider Organization) plan offers more flexibility in terms of provider selection but may come with higher costs.