Intro

Explore flexible service payment plan options, including installment plans, deferred payments, and financing solutions, to manage expenses and budget effectively with convenient payment methods.

The way businesses and individuals manage their finances has undergone significant changes over the years, with a notable shift towards flexibility and convenience. One aspect that has seen considerable evolution is the service payment plan options available to customers. With the rise of digital technologies and changing consumer behaviors, companies are now offering a wide range of payment plans to cater to diverse needs and preferences. Understanding these options is crucial for both businesses and consumers, as it can significantly impact financial management, customer satisfaction, and ultimately, the bottom line.

In today's fast-paced, technology-driven world, consumers expect ease, flexibility, and transparency in their financial transactions. Service providers, whether in the realm of utilities, telecommunications, healthcare, or finance, must adapt to these expectations by offering varied and accommodating payment plans. This not only enhances customer experience but also plays a critical role in building trust and loyalty. For instance, a utility company that offers flexible payment plans can help its customers manage their bills more effectively, reducing the likelihood of late payments and associated penalties.

The importance of service payment plan options extends beyond customer satisfaction to encompass financial planning and stability. For businesses, offering the right payment plans can lead to improved cash flow, reduced bad debt, and enhanced financial forecasting. It also allows companies to differentiate themselves in a competitive market, leveraging their payment flexibility as a unique selling point. On the consumer side, flexible payment plans can help individuals and families better manage their budgets, avoid debt traps, and make informed financial decisions. This is particularly significant in sectors like healthcare, where unexpected expenses can be a significant burden without a manageable payment plan in place.

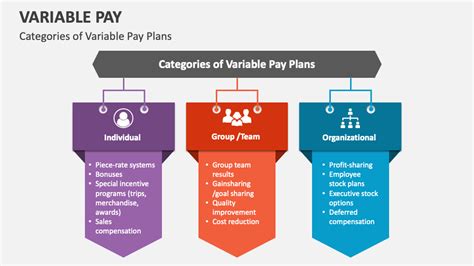

Types of Service Payment Plans

There are several types of service payment plans that businesses can offer, each catering to different customer needs and preferences. Understanding these types is essential for tailoring services to meet customer demands effectively.

Fixed Payment Plans

Fixed payment plans involve a fixed amount being paid at regular intervals. This type of plan is common in subscription services, such as streaming platforms or software services, where the cost is the same every month. Fixed plans provide predictability for both the customer and the service provider, making them ideal for budgeting and financial forecasting.

Variable Payment Plans

Deferred Payment Plans

Deferred payment plans allow customers to delay their payments for a specified period. This type of plan is particularly useful in situations where customers may face temporary financial difficulties. For example, a healthcare provider might offer a deferred payment plan for a patient who cannot pay their medical bills immediately.

Benefits of Flexible Service Payment Plans

Flexible service payment plans offer numerous benefits for both businesses and customers. Some of the key advantages include:

- Improved Customer Satisfaction: Flexible payment plans can significantly enhance customer experience by providing options that fit their financial situations and preferences.

- Increased Loyalty: By offering flexible payment options, businesses can build trust and loyalty with their customers, leading to long-term relationships.

- Better Financial Management: Flexible plans can help customers manage their finances more effectively, reducing the risk of missed payments and associated penalties.

- Competitive Advantage: Businesses that offer flexible payment plans can differentiate themselves in the market, attracting customers who value payment flexibility.

Implementing Effective Payment Plans

- Conduct Market Research: Understand what customers are looking for in terms of payment flexibility and what competitors are offering.

- Analyze Customer Data: Use customer data to identify patterns and preferences that can inform payment plan options.

- Offer Clear Communication: Ensure that payment plans and their terms are clearly communicated to customers to avoid confusion and mistrust.

- Provide Multiple Options: Offer a range of payment plans to cater to different customer segments and preferences.

Challenges and Considerations

While flexible service payment plans offer numerous benefits, there are also challenges and considerations that businesses must address. These include:

- Administrative Complexity: Managing multiple payment plans can add complexity to administrative processes, requiring additional resources and systems.

- Risk of Non-Payment: Flexible payment plans can increase the risk of non-payment, particularly if customers are allowed to defer payments without a clear plan for repayment.

- Regulatory Compliance: Businesses must ensure that their payment plans comply with relevant regulations and laws, such as consumer protection laws.

Best Practices for Managing Payment Plans

- Regular Communication: Keep customers informed about their payment plans, including reminders and updates on any changes.

- Clear Terms and Conditions: Ensure that the terms and conditions of payment plans are clear, transparent, and easily accessible to customers.

- Flexible Adjustments: Be willing to adjust payment plans if customers experience financial difficulties, offering support and alternatives where possible.

Future of Service Payment Plans

The future of service payment plans is likely to be shaped by technological advancements, changing consumer behaviors, and evolving regulatory landscapes. Some trends that are expected to influence the development of payment plans include:

- Digital Payments: The adoption of digital payment methods, such as mobile wallets and contactless payments, is expected to continue growing, offering more convenience and flexibility to customers.

- Personalization: With the help of data analytics and AI, businesses will be able to offer more personalized payment plans that cater to individual customer preferences and financial situations.

- Sustainability: There will be a greater emphasis on sustainable payment practices, with businesses and customers alike looking for options that reduce environmental impact and support social responsibility.

Preparing for the Future

- Investing in Technology: Adopting cutting-edge technologies that enable flexible, secure, and efficient payment processing.

- Customer Feedback: Continuously gathering customer feedback to understand evolving needs and preferences.

- Regulatory Compliance: Staying ahead of regulatory changes and ensuring that payment plans comply with emerging standards and laws.

What are the benefits of flexible service payment plans for customers?

+Flexible service payment plans offer customers the ability to manage their finances more effectively, reduce the risk of missed payments, and enjoy greater convenience and flexibility in their payment options.

How can businesses implement effective payment plans?

+Businesses can implement effective payment plans by conducting market research, analyzing customer data, offering clear communication, and providing multiple payment options that cater to different customer segments and preferences.

What trends are expected to shape the future of service payment plans?

+The future of service payment plans is expected to be shaped by trends such as the adoption of digital payments, personalization through data analytics and AI, and a greater emphasis on sustainability and social responsibility.

As the financial landscape continues to evolve, the importance of flexible and customer-centric service payment plans will only continue to grow. By understanding the benefits, challenges, and future trends in payment plans, businesses can position themselves for success, build stronger relationships with their customers, and navigate the complexities of the modern financial ecosystem with confidence and agility. Whether you're a business looking to enhance your payment options or a customer seeking more flexibility in your financial dealings, embracing the potential of service payment plans is a step towards a more sustainable, efficient, and customer-friendly financial future. We invite you to share your thoughts on the evolving landscape of service payment plans, how they have impacted your business or personal finances, and what innovations you hope to see in the future. Your insights and experiences are invaluable in shaping the conversation around financial flexibility and customer-centric services.