Intro

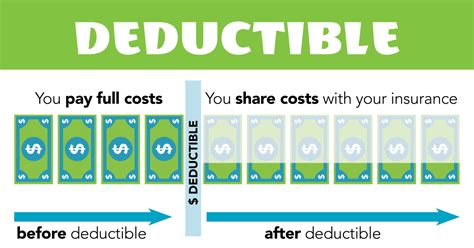

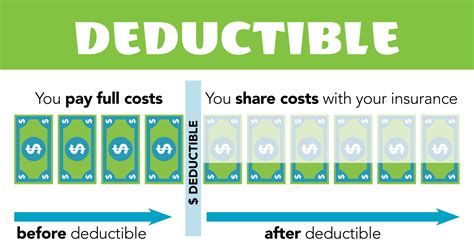

The concept of a deductible is a crucial aspect of insurance policies, and understanding how it works can help individuals and businesses make informed decisions about their coverage. In essence, a deductible is the amount of money that an insured party must pay out of pocket before their insurance provider starts to pay for a claim. This amount can vary widely depending on the type of insurance policy, the provider, and the specific terms of the agreement.

The importance of deductibles cannot be overstated, as they play a significant role in determining the overall cost of an insurance policy. A higher deductible typically means lower premiums, as the insured party is taking on more of the financial risk. On the other hand, a lower deductible usually results in higher premiums, as the insurance provider is assuming more of the risk. This trade-off is a key consideration for anyone purchasing an insurance policy, as it can have a significant impact on their finances.

As individuals and businesses navigate the complex world of insurance, it is essential to have a thorough understanding of deductibles and how they work. This knowledge can help policyholders make informed decisions about their coverage, avoid unexpected expenses, and ensure that they have adequate protection in place. Whether it's health insurance, auto insurance, or homeowners insurance, the concept of a deductible is a critical component of the policy, and understanding its implications is vital for making the most of the coverage.

Understanding Deductibles

To truly grasp the concept of deductibles, it's essential to explore the different types of deductibles that exist. For instance, a flat deductible is a fixed amount that must be paid for each claim, while a percentage-based deductible is a percentage of the total claim amount. Additionally, some policies may have a cumulative deductible, which is the total amount that must be paid over a specified period. Understanding these different types of deductibles can help policyholders better navigate their insurance coverage and make informed decisions about their financial obligations.

Types of Deductibles

There are several types of deductibles, each with its own unique characteristics and implications. Some of the most common types of deductibles include: * Flat deductible: A fixed amount that must be paid for each claim * Percentage-based deductible: A percentage of the total claim amount * Cumulative deductible: The total amount that must be paid over a specified period * Aggregate deductible: The total amount that must be paid for all claims made during a policy periodHow Deductibles Work

The process of how deductibles work is relatively straightforward. When a policyholder makes a claim, they must pay the deductible amount before the insurance provider starts to pay. For example, if the deductible is $1,000 and the claim amount is $10,000, the policyholder must pay the first $1,000, and the insurance provider will pay the remaining $9,000. This process can vary depending on the type of policy and the specific terms of the agreement, but the basic principle remains the same.

Example of Deductibles

To illustrate how deductibles work, consider the following example: * Policyholder has a health insurance policy with a $1,000 deductible * Policyholder incurs medical expenses totaling $10,000 * Policyholder must pay the first $1,000 (deductible) * Insurance provider pays the remaining $9,000Benefits of Deductibles

Deductibles offer several benefits to both policyholders and insurance providers. One of the primary advantages is that deductibles help to reduce the number of small claims made by policyholders. By requiring policyholders to pay a certain amount out of pocket, deductibles encourage them to think carefully before making a claim, which can help to reduce the overall cost of the policy. Additionally, deductibles can help to prevent fraudulent claims, as policyholders are less likely to make false claims if they have to pay a portion of the costs themselves.

Advantages of Deductibles

Some of the key advantages of deductibles include: * Reduced number of small claims * Lower premiums * Increased policyholder responsibility * Reduced risk of fraudulent claimsDisadvantages of Deductibles

While deductibles offer several benefits, there are also some potential drawbacks to consider. One of the primary disadvantages is that deductibles can be a financial burden for policyholders, particularly if they are not prepared to pay the deductible amount. Additionally, deductibles can create a barrier to access for individuals who cannot afford to pay the deductible, which can lead to delayed or foregone medical care.

Drawbacks of Deductibles

Some of the key disadvantages of deductibles include: * Financial burden for policyholders * Barrier to access for individuals who cannot afford the deductible * Potential for delayed or foregone medical careStrategies for Managing Deductibles

To manage deductibles effectively, policyholders can use several strategies. One approach is to set aside a portion of their income each month to cover the deductible amount. Another strategy is to consider a policy with a lower deductible, although this may result in higher premiums. Additionally, policyholders can explore alternative payment options, such as payment plans or financing, to help cover the deductible amount.

Tips for Managing Deductibles

Some tips for managing deductibles include: * Set aside a portion of income each month to cover the deductible amount * Consider a policy with a lower deductible * Explore alternative payment options, such as payment plans or financingConclusion and Next Steps

In conclusion, deductibles are a critical component of insurance policies, and understanding how they work is essential for making informed decisions about coverage. By grasping the concept of deductibles and exploring the different types, benefits, and drawbacks, policyholders can better navigate their insurance coverage and make the most of their policy. To take the next step, policyholders can review their current policy, explore alternative options, and develop a strategy for managing their deductible.

We invite you to share your thoughts and experiences with deductibles in the comments below. Have you had to pay a deductible recently? How did you manage the cost? Share your story and help others understand the importance of deductibles in insurance policies.

What is a deductible in insurance?

+A deductible is the amount of money that an insured party must pay out of pocket before their insurance provider starts to pay for a claim.

How do deductibles work?

+When a policyholder makes a claim, they must pay the deductible amount before the insurance provider starts to pay. The insurance provider then pays the remaining amount of the claim.

What are the benefits of deductibles?

+Deductibles offer several benefits, including reduced premiums, increased policyholder responsibility, and reduced risk of fraudulent claims.