Intro

Discover how High-Deductible Health Plans (HDHPs) work, offering affordable premiums, lower costs, and tax benefits, while balancing deductible amounts, out-of-pocket expenses, and network providers for optimal healthcare coverage and savings.

The world of health insurance can be complex and overwhelming, with numerous options and plans to choose from. One type of plan that has gained popularity in recent years is the High-Deductible Health Plan (HDHP). HDHPs are designed to provide affordable health insurance coverage while promoting consumerism and personal responsibility in healthcare decision-making. In this article, we will delve into the world of HDHPs, exploring how they work, their benefits, and what to expect from these plans.

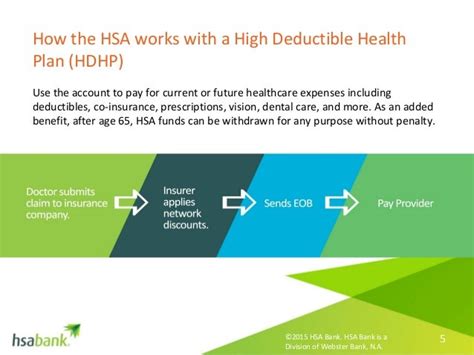

HDHPs are often paired with Health Savings Accounts (HSAs), which allow individuals to set aside pre-tax dollars to pay for qualified medical expenses. This combination can provide a powerful tool for managing healthcare costs and building savings over time. However, HDHPs can be confusing, especially for those who are new to the world of health insurance. To help clarify the process, we will break down the key components of HDHPs and explore how they work in practice.

As we navigate the complexities of HDHPs, it's essential to understand the context in which they operate. The Affordable Care Act (ACA) has played a significant role in shaping the health insurance landscape, and HDHPs have emerged as a popular option for individuals and families seeking affordable coverage. By examining the inner workings of HDHPs, we can gain a deeper understanding of how these plans can help individuals and families manage their healthcare costs and make informed decisions about their care.

What is a High-Deductible Health Plan?

Key Components of HDHPs

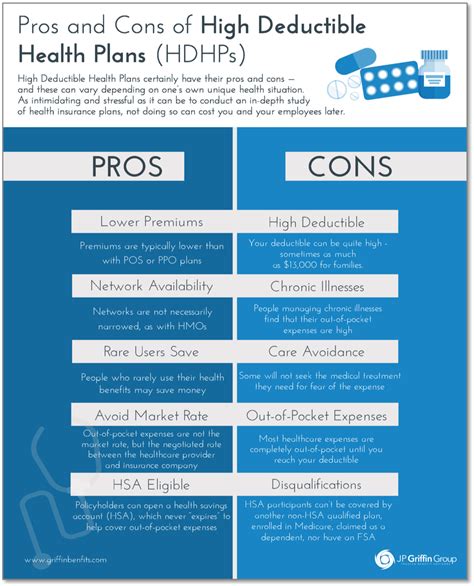

To understand how HDHPs work, it's essential to familiarize yourself with the key components of these plans. These components include: * High deductibles: HDHPs require individuals to pay a higher deductible before the insurance company begins to pay its share of medical expenses. * Lower premiums: In exchange for the higher deductible, HDHPs typically offer lower monthly premiums. * Health Savings Accounts (HSAs): HDHPs are often paired with HSAs, which allow individuals to set aside pre-tax dollars to pay for qualified medical expenses. * Out-of-pocket maximums: HDHPs have out-of-pocket maximums, which limit the amount individuals must pay for medical expenses in a given year.How Do HDHPs Work?

Once the deductible is met, the insurance company begins to pay its share of medical expenses. The amount the insurance company pays varies depending on the specific plan, but it's typically a percentage of the medical expenses. For example, an HDHP might pay 80% of medical expenses after the deductible is met, leaving the individual to pay the remaining 20%.

Benefits of HDHPs

HDHPs offer several benefits, including: * Lower premiums: HDHPs typically offer lower monthly premiums, making them an attractive option for individuals and families who are looking for affordable health insurance coverage. * Health Savings Accounts (HSAs): HDHPs are often paired with HSAs, which allow individuals to set aside pre-tax dollars to pay for qualified medical expenses. * Increased consumerism: HDHPs promote consumerism and personal responsibility in healthcare decision-making, as individuals are more likely to shop around for medical services and compare prices. * Tax benefits: Contributions to HSAs are tax-deductible, and the funds in the account grow tax-free.5 Ways HDHPs Work

Real-World Examples

To illustrate how HDHPs work in practice, let's consider a few real-world examples: * **Example 1**: John has an HDHP with a $2,000 deductible and a $5,000 out-of-pocket maximum. He pays the first $2,000 of medical expenses out-of-pocket and then the insurance company pays 80% of the remaining expenses. If John's total medical expenses for the year are $10,000, he will pay the first $2,000 (deductible) and then 20% of the remaining $8,000 (co-insurance), for a total of $3,600. * **Example 2**: Sarah has an HDHP with a $1,500 deductible and a $3,000 out-of-pocket maximum. She pays the first $1,500 of medical expenses out-of-pocket and then the insurance company pays 80% of the remaining expenses. If Sarah's total medical expenses for the year are $6,000, she will pay the first $1,500 (deductible) and then 20% of the remaining $4,500 (co-insurance), for a total of $2,700.Advantages and Disadvantages of HDHPs

Who Are HDHPs Best For?

HDHPs are best for individuals and families who: * Are relatively healthy and don't expect to incur significant medical expenses * Want to lower their monthly premiums * Are willing to take on more financial responsibility for their healthcare costs * Want to promote consumerism and personal responsibility in healthcare decision-makingConclusion and Next Steps

We invite you to share your thoughts and experiences with HDHPs in the comments below. Have you had a positive or negative experience with an HDHP? What do you think are the most significant advantages and disadvantages of these plans? Your feedback and insights can help others make informed decisions about their healthcare coverage.

What is a High-Deductible Health Plan?

+A High-Deductible Health Plan (HDHP) is a type of health insurance plan that requires individuals to pay a higher deductible before the insurance company begins to pay its share of medical expenses.

How do HDHPs work?

+HDHPs work by requiring individuals to pay a higher deductible before the insurance company begins to pay its share of medical expenses. Once the deductible is met, the insurance company pays a percentage of the medical expenses, and the individual pays the remaining percentage.

What are the benefits of HDHPs?

+HDHPs offer several benefits, including lower premiums, Health Savings Accounts (HSAs), and increased consumerism. They also promote personal responsibility in healthcare decision-making and can help individuals save money on their healthcare costs.