Intro

Discover what PPO stands for in health insurance, including Preferred Provider Organization benefits, network providers, and out-of-pocket costs, to make informed decisions about your healthcare coverage options.

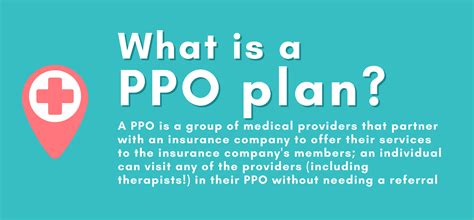

The term "PPO" is widely used in various contexts, but its meaning can vary depending on the industry or field. In general, PPO stands for "Preferred Provider Organization." This term is commonly used in the healthcare industry to describe a type of health insurance plan. However, PPO can also stand for other phrases, such as "Pay Per Opportunity" or "Pulse Position Operator," depending on the context.

In the healthcare industry, a Preferred Provider Organization (PPO) is a type of health insurance plan that allows policyholders to receive medical care from a network of preferred providers. These providers have agreed to offer discounted services to the insurance company's policyholders. PPO plans are known for their flexibility, as they allow policyholders to seek care from both in-network and out-of-network providers. However, seeking care from out-of-network providers typically results in higher out-of-pocket costs for the policyholder.

The importance of understanding what PPO stands for cannot be overstated, especially in the context of healthcare. With the rising costs of medical care, having a comprehensive health insurance plan is crucial for individuals and families. A PPO plan can provide policyholders with access to a wide range of healthcare services, including preventive care, diagnostic tests, and treatments. Moreover, PPO plans often offer additional benefits, such as prescription drug coverage and mental health services.

In recent years, the demand for PPO plans has increased significantly, driven by the need for flexible and affordable healthcare options. As the healthcare landscape continues to evolve, it is essential to stay informed about the different types of health insurance plans available, including PPO plans. By understanding what PPO stands for and how these plans work, individuals can make informed decisions about their healthcare needs and choose the best plan for themselves and their families.

Understanding PPO Plans

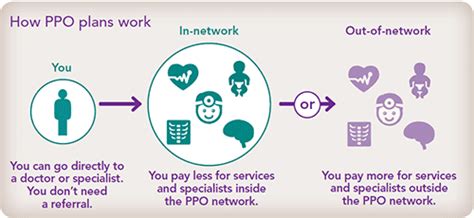

PPO plans are designed to provide policyholders with a range of benefits, including access to a network of preferred providers, flexible coverage options, and cost-sharing arrangements. One of the key features of PPO plans is the ability to seek care from both in-network and out-of-network providers. In-network providers have agreed to offer discounted services to the insurance company's policyholders, while out-of-network providers may charge higher rates.

To illustrate the benefits of PPO plans, consider the following example. Suppose an individual has a PPO plan with a deductible of $1,000 and a coinsurance rate of 20%. If the individual seeks care from an in-network provider, the provider may charge $100 for a routine check-up. The insurance company would pay $80, and the individual would pay $20. However, if the individual seeks care from an out-of-network provider, the provider may charge $150 for the same service. The insurance company would pay $120, and the individual would pay $30.

Key Features of PPO Plans

Some of the key features of PPO plans include: * Access to a network of preferred providers * Flexible coverage options * Cost-sharing arrangements, such as deductibles and coinsurance * Out-of-network coverage options * Prescription drug coverage * Mental health servicesHow PPO Plans Work

PPO plans work by allowing policyholders to seek care from a network of preferred providers. These providers have agreed to offer discounted services to the insurance company's policyholders. When a policyholder seeks care from an in-network provider, the provider submits a claim to the insurance company, which pays a portion of the bill. The policyholder is responsible for paying any applicable deductibles, coinsurance, or copays.

To illustrate how PPO plans work, consider the following example. Suppose an individual has a PPO plan with a deductible of $1,000 and a coinsurance rate of 20%. If the individual seeks care from an in-network provider, the provider may charge $500 for a procedure. The insurance company would pay $400, and the individual would pay $100.

Steps to Using a PPO Plan

Some of the steps to using a PPO plan include: 1. Choosing a primary care physician from the network of preferred providers 2. Scheduling appointments with in-network providers 3. Paying applicable deductibles, coinsurance, or copays 4. Submitting claims to the insurance company for reimbursement 5. Seeking care from out-of-network providers, if necessaryBenefits of PPO Plans

PPO plans offer a range of benefits, including access to a network of preferred providers, flexible coverage options, and cost-sharing arrangements. Some of the benefits of PPO plans include:

- Lower out-of-pocket costs for in-network care

- Flexible coverage options, including out-of-network coverage

- Access to a wide range of healthcare services, including preventive care and diagnostic tests

- Prescription drug coverage and mental health services

- Ability to seek care from specialists without a referral

Advantages of PPO Plans

Some of the advantages of PPO plans include: * Flexibility in choosing healthcare providers * Lower out-of-pocket costs for in-network care * Access to a wide range of healthcare services * Prescription drug coverage and mental health services * Ability to seek care from specialists without a referralDisadvantages of PPO Plans

While PPO plans offer a range of benefits, they also have some disadvantages. Some of the disadvantages of PPO plans include:

- Higher premiums compared to other types of health insurance plans

- Out-of-pocket costs for out-of-network care

- Limited coverage for certain services or procedures

- Complex billing and reimbursement processes

- Potential for surprise medical bills

Drawbacks of PPO Plans

Some of the drawbacks of PPO plans include: * Higher premiums compared to other types of health insurance plans * Out-of-pocket costs for out-of-network care * Limited coverage for certain services or procedures * Complex billing and reimbursement processes * Potential for surprise medical billsComparison of PPO Plans

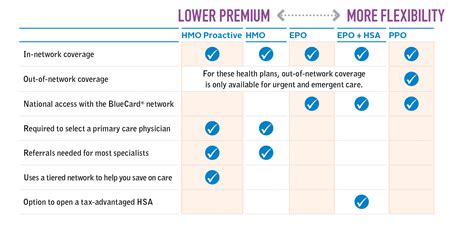

PPO plans can be compared to other types of health insurance plans, such as HMO (Health Maintenance Organization) plans and POS (Point of Service) plans. Some of the key differences between these plans include:

- Network of providers: PPO plans have a larger network of providers compared to HMO plans

- Out-of-pocket costs: PPO plans typically have higher out-of-pocket costs compared to HMO plans

- Coverage options: PPO plans offer more flexible coverage options compared to HMO plans

- Premiums: PPO plans typically have higher premiums compared to HMO plans

Types of Health Insurance Plans

Some of the types of health insurance plans include: 1. PPO (Preferred Provider Organization) plans 2. HMO (Health Maintenance Organization) plans 3. POS (Point of Service) plans 4. EPO (Exclusive Provider Organization) plans 5. HDHP (High-Deductible Health Plan) plansFAQs

What does PPO stand for?

+PPO stands for Preferred Provider Organization, a type of health insurance plan that allows policyholders to receive medical care from a network of preferred providers.

How do PPO plans work?

+PPO plans work by allowing policyholders to seek care from a network of preferred providers, who have agreed to offer discounted services to the insurance company's policyholders.

What are the benefits of PPO plans?

+The benefits of PPO plans include access to a network of preferred providers, flexible coverage options, and cost-sharing arrangements, as well as lower out-of-pocket costs for in-network care and access to a wide range of healthcare services.

In conclusion, understanding what PPO stands for is essential for individuals and families who are seeking comprehensive and flexible health insurance options. By knowing how PPO plans work, policyholders can make informed decisions about their healthcare needs and choose the best plan for themselves and their families. We encourage readers to share their experiences with PPO plans and ask questions in the comments section below. Additionally, we invite readers to explore other articles on our website to learn more about health insurance and healthcare-related topics.