Intro

Master Medicare enrollment with 5 expert tips, covering eligibility, deadlines, and plan selection, to ensure seamless healthcare coverage and avoid penalties, utilizing Medicare Advantage, Supplement, and Part D plans effectively.

Medicare enrollment can be a daunting task, especially for those who are new to the program. With various plans, deadlines, and requirements to consider, it's essential to approach the enrollment process with a clear understanding of what's involved. In this article, we'll delve into the world of Medicare enrollment, exploring the ins and outs of the program and providing valuable tips to help you make informed decisions about your healthcare coverage.

As people age, their healthcare needs often become more complex, and having the right insurance coverage is crucial. Medicare is a federal health insurance program designed for individuals 65 and older, as well as certain younger people with disabilities. The program offers a range of benefits, including hospital insurance, medical insurance, and prescription drug coverage. However, navigating the Medicare enrollment process can be overwhelming, especially with the numerous plans and options available.

The importance of understanding Medicare enrollment cannot be overstated. Failing to enroll on time or choosing the wrong plan can result in gaps in coverage, financial penalties, and even delayed access to necessary medical care. Moreover, the Medicare landscape is constantly evolving, with changes to plans, premiums, and benefits occurring regularly. Staying informed and up-to-date on the latest developments is essential to ensuring that you receive the best possible coverage for your needs.

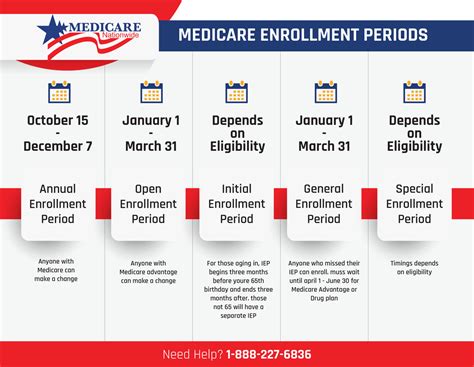

Understanding Medicare Enrollment Periods

To navigate the Medicare enrollment process successfully, it's crucial to understand the different enrollment periods. The Initial Enrollment Period (IEP) is the first time you can enroll in Medicare, and it typically begins three months before your 65th birthday and ends three months after. The Annual Election Period (AEP), also known as Open Enrollment, takes place from October 15 to December 7 each year, allowing you to change your Medicare coverage or switch plans. Additionally, there are Special Enrollment Periods (SEPs) for individuals who experience certain life events, such as moving to a new area or losing employer coverage.

Key Enrollment Periods to Keep in Mind

- Initial Enrollment Period (IEP): Begins three months before your 65th birthday and ends three months after

- Annual Election Period (AEP): Takes place from October 15 to December 7 each year

- Special Enrollment Periods (SEPs): Available for individuals who experience certain life events, such as moving or losing employer coverage

Medicare Enrollment Tips

When it comes to Medicare enrollment, having the right strategy can make all the difference. Here are five valuable tips to help you navigate the process:

- Start Early: Don't wait until the last minute to enroll in Medicare. Begin researching plans and options well in advance to ensure you're prepared for the enrollment period.

- Understand Your Options: Medicare offers a range of plans, including Original Medicare, Medicare Advantage, and Medicare Supplement Insurance. Take the time to understand the differences between each plan and choose the one that best fits your needs.

- Consider Your Health Needs: When selecting a Medicare plan, think about your health needs and preferences. Do you have a chronic condition that requires frequent doctor visits? Do you take prescription medications? Choose a plan that aligns with your healthcare requirements.

- Review and Compare Plans: Each year, Medicare plans change, and new options become available. Take the time to review and compare plans during the Annual Election Period to ensure you're getting the best coverage for your needs.

- Seek Professional Guidance: Medicare enrollment can be complex, and it's easy to feel overwhelmed. Consider seeking guidance from a licensed insurance agent or broker who can help you navigate the process and choose the right plan for your needs.

Additional Tips for a Smooth Enrollment Process

- Keep track of important deadlines and enrollment periods

- Gather necessary documents, such as your Social Security number and identification

- Be prepared to provide detailed information about your health and medical history

- Don't hesitate to ask questions or seek clarification if you're unsure about any aspect of the enrollment process

Medicare Plan Options

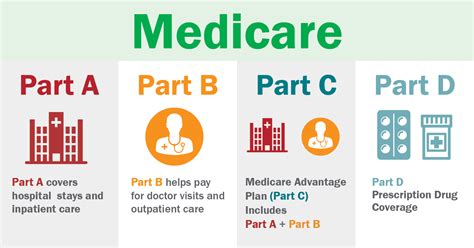

Medicare offers a range of plan options to suit different needs and preferences. Here are some of the most common types of Medicare plans:

- Original Medicare: This plan includes Part A (hospital insurance) and Part B (medical insurance) and is administered by the federal government.

- Medicare Advantage: These plans, also known as Part C, are offered by private insurance companies and combine Part A and Part B coverage with additional benefits, such as dental, vision, and hearing coverage.

- Medicare Supplement Insurance: These plans, also known as Medigap, help fill gaps in Original Medicare coverage, such as copayments, coinsurance, and deductibles.

- Medicare Part D: This plan provides prescription drug coverage and is available as a standalone plan or as part of a Medicare Advantage plan.

Key Differences Between Medicare Plans

- Network Providers: Medicare Advantage plans often have a network of providers, while Original Medicare allows you to see any doctor who accepts Medicare.

- Out-of-Pocket Costs: Medicare Advantage plans may have lower out-of-pocket costs, but they can also have more restrictive provider networks.

- Additional Benefits: Medicare Advantage plans often offer additional benefits, such as dental, vision, and hearing coverage, which may not be available with Original Medicare.

Common Medicare Enrollment Mistakes

While Medicare enrollment can be complex, there are common mistakes to avoid. Here are some of the most frequent errors people make during the enrollment process:

- Missing Enrollment Deadlines: Failing to enroll during the Initial Enrollment Period or missing the Annual Election Period can result in gaps in coverage and financial penalties.

- Choosing the Wrong Plan: Selecting a plan that doesn't meet your health needs or preferences can lead to dissatisfaction and increased out-of-pocket costs.

- Not Reviewing Plan Changes: Failing to review and compare plans during the Annual Election Period can result in missed opportunities to improve your coverage or reduce costs.

How to Avoid Common Enrollment Mistakes

- Create a Calendar: Keep track of important deadlines and enrollment periods to ensure you don't miss critical dates.

- Seek Professional Guidance: Consider working with a licensed insurance agent or broker to help you navigate the enrollment process and choose the right plan.

- Take Your Time: Don't rush through the enrollment process. Take the time to carefully review and compare plans to ensure you're making an informed decision.

Medicare Enrollment Resources

Navigating the Medicare enrollment process can be challenging, but there are resources available to help. Here are some valuable tools and resources to consider:

- Medicare.gov: The official Medicare website offers a wealth of information on Medicare plans, enrollment periods, and benefits.

- State Health Insurance Assistance Programs (SHIPs): These programs provide free, unbiased counseling and assistance with Medicare enrollment and benefits.

- Licensed Insurance Agents or Brokers: Working with a licensed professional can help you navigate the enrollment process and choose the right plan for your needs.

Additional Resources for Medicare Enrollment

- Medicare & You Handbook: This annual handbook provides detailed information on Medicare plans, benefits, and enrollment periods.

- Medicare Enrollment Hotline: The Medicare hotline (1-800-MEDICARE) offers assistance with enrollment, benefits, and claims.

- Local Medicare Offices: Many communities have local Medicare offices that offer in-person assistance with enrollment and benefits.

Conclusion and Next Steps

Medicare enrollment is a critical process that requires careful planning and attention to detail. By understanding the different enrollment periods, plan options, and resources available, you can make informed decisions about your healthcare coverage. Remember to start early, review and compare plans, and seek professional guidance when needed. With the right strategy and support, you can navigate the Medicare enrollment process with confidence and ensure you receive the best possible coverage for your needs.

Now that you've learned more about Medicare enrollment, take the next step by sharing this article with friends and family who may be approaching Medicare eligibility. Leave a comment below with your thoughts on Medicare enrollment, and don't hesitate to reach out if you have any questions or need further guidance.

What is the Initial Enrollment Period for Medicare?

+The Initial Enrollment Period (IEP) is the first time you can enroll in Medicare, and it typically begins three months before your 65th birthday and ends three months after.

Can I change my Medicare plan during the year?

+Generally, you can only change your Medicare plan during the Annual Election Period (AEP), which takes place from October 15 to December 7 each year. However, you may be eligible for a Special Enrollment Period (SEP) if you experience certain life events, such as moving to a new area or losing employer coverage.

What is the difference between Original Medicare and Medicare Advantage?

+Original Medicare is administered by the federal government and includes Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plans, on the other hand, are offered by private insurance companies and combine Part A and Part B coverage with additional benefits, such as dental, vision, and hearing coverage.