Intro

Explore Cigna Health Insurance Plans, offering flexible medical coverage with preventive care, dental, and vision options, providing individuals and families with affordable, comprehensive health insurance solutions and personalized wellness programs.

The importance of having a reliable health insurance plan cannot be overstated. With the rising costs of medical care, it's essential to have a plan that provides comprehensive coverage and protects your financial well-being. Cigna is one of the most well-established and reputable health insurance providers in the industry, offering a wide range of plans to suit different needs and budgets. In this article, we'll delve into the world of Cigna health insurance plans, exploring their benefits, features, and what sets them apart from other providers.

Cigna has been a trusted name in the health insurance industry for over 200 years, with a global presence in over 200 countries. Their plans are designed to provide flexibility, affordability, and access to quality healthcare services. Whether you're an individual, family, or employer, Cigna has a range of options to choose from, including medical, dental, and vision plans. With a strong network of healthcare professionals and state-of-the-art technology, Cigna is dedicated to providing exceptional customer service and support.

From preventive care to chronic condition management, Cigna's health insurance plans are designed to promote overall well-being and provide peace of mind. With a focus on preventive care, Cigna's plans encourage policyholders to take proactive steps in maintaining their health, reducing the risk of costly medical procedures down the line. Additionally, Cigna's plans often include innovative features such as telehealth services, health coaching, and wellness programs, which can help policyholders manage their health more effectively.

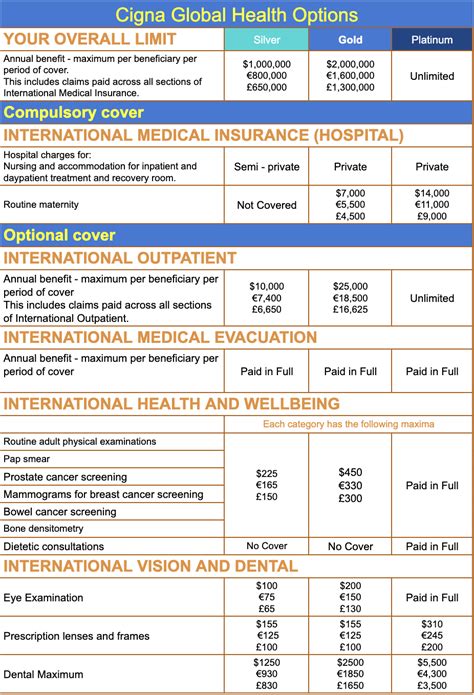

Cigna Health Insurance Plan Options

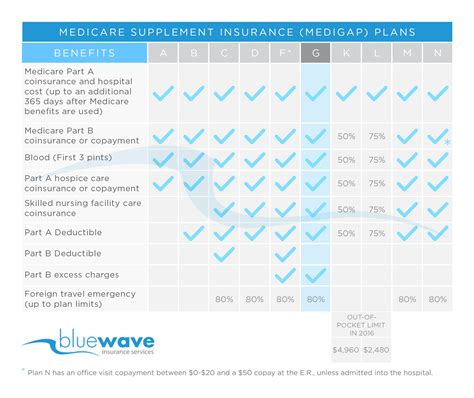

Cigna offers a diverse range of health insurance plans to cater to different needs and preferences. Their plans can be broadly categorized into individual and family plans, group plans, and Medicare plans. Individual and family plans are designed for those who are not covered by an employer-sponsored plan, while group plans are tailored for businesses and organizations. Medicare plans, on the other hand, are designed for seniors and individuals with disabilities who are eligible for Medicare.

Individual and Family Plans

Cigna's individual and family plans provide comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications. These plans often include additional benefits such as dental and vision coverage, as well as access to wellness programs and health coaching. Policyholders can choose from a range of deductible and copayment options, allowing them to tailor their plan to their budget and healthcare needs.Group Plans

Cigna's group plans are designed for businesses and organizations, providing employees with access to quality healthcare services. These plans can be customized to meet the specific needs of the organization, including options for medical, dental, and vision coverage. Group plans often include features such as employee wellness programs, health coaching, and disease management services, which can help promote a healthier and more productive workforce.Medicare Plans

Cigna's Medicare plans are designed for seniors and individuals with disabilities who are eligible for Medicare. These plans provide comprehensive coverage for medical expenses, including hospital stays, doctor visits, and prescription medications. Cigna's Medicare plans often include additional benefits such as dental and vision coverage, as well as access to wellness programs and health coaching.Benefits of Cigna Health Insurance Plans

Cigna health insurance plans offer a range of benefits that set them apart from other providers. Some of the key benefits include:

- Comprehensive coverage: Cigna's plans provide comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

- Flexible plan options: Cigna offers a range of plan options to suit different needs and budgets, including individual and family plans, group plans, and Medicare plans.

- Access to quality healthcare: Cigna has a strong network of healthcare professionals, providing policyholders with access to quality healthcare services.

- Innovative features: Cigna's plans often include innovative features such as telehealth services, health coaching, and wellness programs, which can help policyholders manage their health more effectively.

- Customer support: Cigna is dedicated to providing exceptional customer service and support, including 24/7 phone support and online resources.

Telehealth Services

Cigna's telehealth services allow policyholders to access healthcare services remotely, using phone or video conferencing. This can be particularly useful for policyholders who live in rural areas or have mobility issues, providing them with greater flexibility and convenience.Health Coaching

Cigna's health coaching services provide policyholders with personalized support and guidance, helping them to manage their health more effectively. Health coaches can help policyholders set health goals, develop healthy habits, and manage chronic conditions.Wellness Programs

Cigna's wellness programs are designed to promote overall well-being and prevent illness. These programs often include features such as fitness classes, nutrition counseling, and stress management techniques, which can help policyholders maintain a healthy lifestyle.Cigna Health Insurance Plan Costs

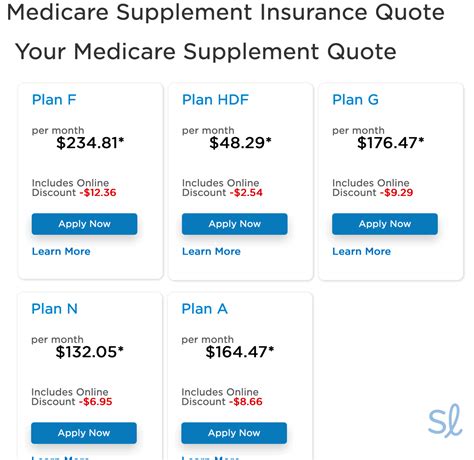

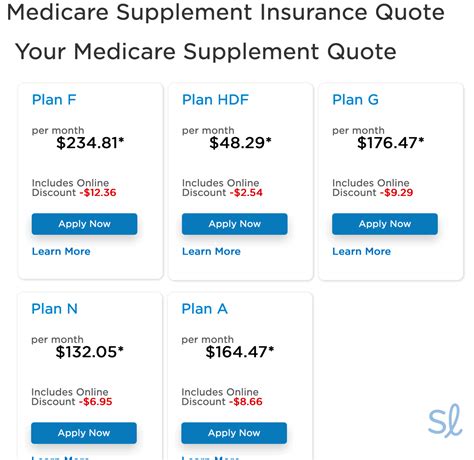

The cost of Cigna health insurance plans can vary depending on a range of factors, including the type of plan, deductible, and copayment options. Policyholders can expect to pay a monthly premium, which can range from a few hundred to several thousand dollars per month.

- Monthly premiums: The monthly premium is the amount policyholders pay each month to maintain their coverage.

- Deductibles: The deductible is the amount policyholders must pay out-of-pocket before their coverage kicks in.

- Copayments: The copayment is the amount policyholders must pay for each healthcare service, such as doctor visits or prescription medications.

- Coinsurance: The coinsurance is the percentage of healthcare costs that policyholders must pay after meeting their deductible.

Factors Affecting Plan Costs

The cost of Cigna health insurance plans can be affected by a range of factors, including:- Age: Older policyholders may pay higher premiums due to their increased health risks.

- Location: Policyholders living in areas with higher healthcare costs may pay higher premiums.

- Health status: Policyholders with pre-existing medical conditions may pay higher premiums or face higher out-of-pocket costs.

- Plan type: The type of plan chosen can affect the cost, with more comprehensive plans typically costing more.

Cigna Health Insurance Plan Enrollment

Enrolling in a Cigna health insurance plan is a straightforward process, with policyholders able to apply online, by phone, or through a licensed agent. To enroll, policyholders will need to provide some basic information, including:

- Personal details: Policyholders will need to provide their name, address, and contact information.

- Health information: Policyholders may need to provide information about their health status, including any pre-existing medical conditions.

- Plan selection: Policyholders will need to choose a plan that meets their needs and budget.

Open Enrollment Period

The open enrollment period is the time of year when policyholders can enroll in a new plan or make changes to their existing plan. This period typically runs from November to December, although it may vary depending on the state or employer.Special Enrollment Period

Policyholders may be eligible for a special enrollment period if they experience a qualifying life event, such as losing their job, getting married, or having a baby. This allows them to enroll in a new plan or make changes to their existing plan outside of the open enrollment period.What is the difference between a deductible and a copayment?

+A deductible is the amount policyholders must pay out-of-pocket before their coverage kicks in, while a copayment is the amount policyholders must pay for each healthcare service.

Can I enroll in a Cigna health insurance plan at any time?

+No, policyholders can typically only enroll in a Cigna health insurance plan during the open enrollment period or if they experience a qualifying life event.

Do Cigna health insurance plans cover pre-existing medical conditions?

+Yes, Cigna health insurance plans typically cover pre-existing medical conditions, although policyholders may face higher premiums or out-of-pocket costs.

In conclusion, Cigna health insurance plans offer a range of benefits and features that make them an attractive option for individuals, families, and employers. With comprehensive coverage, flexible plan options, and innovative features such as telehealth services and health coaching, Cigna is dedicated to providing exceptional customer service and support. Whether you're looking for individual and family plans, group plans, or Medicare plans, Cigna has a range of options to suit different needs and budgets. We invite you to share your thoughts and experiences with Cigna health insurance plans in the comments below, and to explore our website for more information on how to enroll in a plan that's right for you.