Intro

Discover the average medical insurance price and explore factors influencing healthcare costs, including premiums, deductibles, and copays, to make informed decisions about your medical coverage options.

The cost of medical insurance is a significant concern for many individuals and families around the world. With the rising costs of healthcare, it's essential to have adequate coverage to protect against unexpected medical expenses. The average medical insurance price can vary greatly depending on several factors, including age, location, health status, and the type of coverage chosen. In this article, we'll delve into the world of medical insurance, exploring the factors that affect pricing, the different types of coverage available, and what you can expect to pay.

The importance of medical insurance cannot be overstated. Without adequate coverage, a single medical emergency can lead to financial ruin. According to a recent study, medical bills are the leading cause of bankruptcy in the United States. With the average cost of a hospital stay ranging from $10,000 to $20,000 per day, it's clear that medical insurance is not a luxury, but a necessity. As we navigate the complex world of medical insurance, it's crucial to understand the factors that affect pricing and how to choose the right coverage for your needs.

The cost of medical insurance is influenced by a multitude of factors, including age, health status, and location. Older adults and those with pre-existing medical conditions can expect to pay higher premiums. Additionally, the cost of living in your area can significantly impact the price of medical insurance. For example, cities with high costs of living, such as New York or San Francisco, tend to have higher medical insurance premiums. As we explore the world of medical insurance, it's essential to consider these factors and how they affect the average medical insurance price.

Average Medical Insurance Price Overview

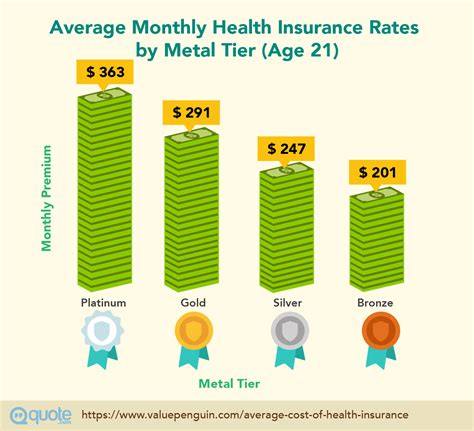

The average medical insurance price can vary greatly depending on the type of coverage chosen. Individual plans, which cover a single person, tend to be less expensive than family plans, which cover multiple individuals. Additionally, the level of coverage chosen can significantly impact the price. For example, catastrophic plans, which provide minimal coverage, tend to be less expensive than comprehensive plans, which provide more extensive coverage. According to recent data, the average monthly premium for an individual plan is around $400, while the average monthly premium for a family plan is around $1,200.

Factors Affecting Medical Insurance Prices

Several factors can affect the price of medical insurance, including:

- Age: Older adults tend to pay higher premiums due to the increased risk of health problems.

- Health status: Individuals with pre-existing medical conditions may pay higher premiums or be denied coverage.

- Location: The cost of living in your area can significantly impact the price of medical insurance.

- Type of coverage: The level of coverage chosen can impact the price, with catastrophic plans tend to be less expensive than comprehensive plans.

- Deductible: Plans with higher deductibles tend to have lower premiums, while plans with lower deductibles tend to have higher premiums.

Types of Medical Insurance Coverage

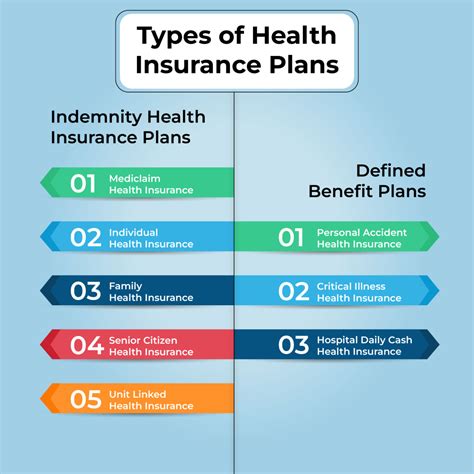

There are several types of medical insurance coverage available, including:

- Individual plans: These plans cover a single person and tend to be less expensive than family plans.

- Family plans: These plans cover multiple individuals and tend to be more expensive than individual plans.

- Group plans: These plans are offered through employers and tend to be less expensive than individual or family plans.

- Catastrophic plans: These plans provide minimal coverage and tend to be less expensive than comprehensive plans.

- Comprehensive plans: These plans provide extensive coverage and tend to be more expensive than catastrophic plans.

How to Choose the Right Medical Insurance Coverage

Choosing the right medical insurance coverage can be a daunting task, but there are several steps you can take to ensure you find the right plan for your needs. First, consider your budget and how much you can afford to pay each month. Next, think about your health status and any pre-existing medical conditions you may have. Finally, research different plans and compare prices to find the best option for your needs. It's also essential to read reviews and ask for referrals from friends or family members who have experience with medical insurance.

Medical Insurance Price Comparison

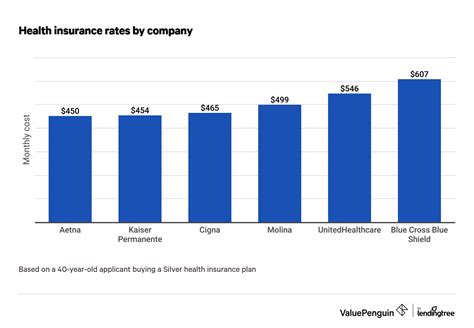

Comparing medical insurance prices can be a challenging task, but there are several tools and resources available to help. Online marketplaces, such as eHealth or GetInsured, allow you to compare prices and plans from different insurance providers. Additionally, many insurance companies offer free quotes and consultations to help you find the right plan for your needs. When comparing prices, be sure to consider the level of coverage, deductible, and out-of-pocket costs.

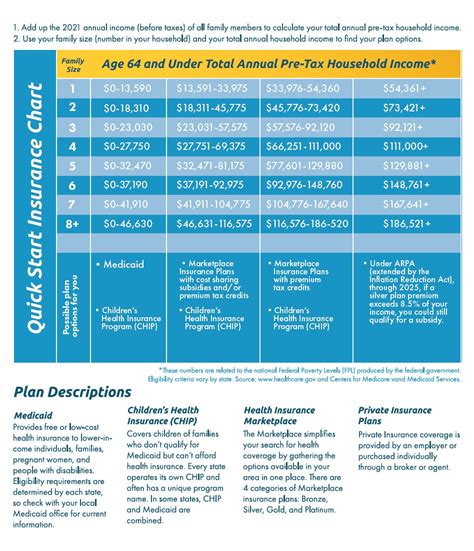

Medical Insurance Discounts and Subsidies

There are several discounts and subsidies available to help make medical insurance more affordable. For example, the Affordable Care Act (ACA) provides subsidies to individuals and families who meet certain income requirements. Additionally, many insurance companies offer discounts for students, military personnel, and individuals who participate in wellness programs. When shopping for medical insurance, be sure to ask about any available discounts or subsidies.

Medical Insurance FAQs

Here are some frequently asked questions about medical insurance:

- What is the average cost of medical insurance?

- How do I choose the right medical insurance coverage?

- What are the different types of medical insurance coverage?

- How do I compare medical insurance prices?

- What discounts and subsidies are available for medical insurance?

What is the average cost of medical insurance?

+The average cost of medical insurance varies depending on several factors, including age, health status, and location. However, the average monthly premium for an individual plan is around $400, while the average monthly premium for a family plan is around $1,200.

How do I choose the right medical insurance coverage?

+Choosing the right medical insurance coverage involves considering your budget, health status, and needs. You should research different plans, compare prices, and read reviews to find the best option for your needs.

What are the different types of medical insurance coverage?

+There are several types of medical insurance coverage, including individual plans, family plans, group plans, catastrophic plans, and comprehensive plans. Each type of coverage has its own unique features and benefits.

In conclusion, the average medical insurance price can vary greatly depending on several factors, including age, health status, and location. By understanding the different types of coverage available and how to choose the right plan for your needs, you can ensure you have adequate protection against unexpected medical expenses. Remember to compare prices, consider discounts and subsidies, and read reviews to find the best option for your needs. We hope this article has provided you with valuable insights and information to help you navigate the complex world of medical insurance. If you have any further questions or comments, please don't hesitate to share them with us.